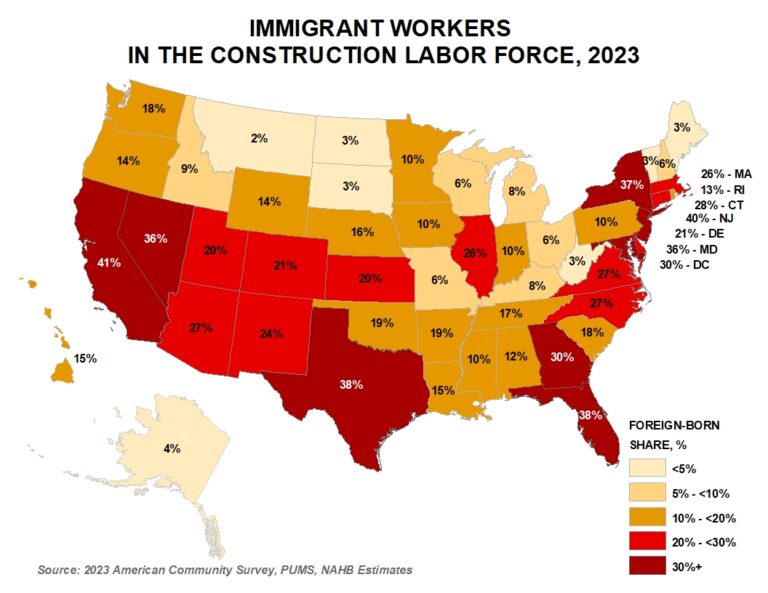

As reported in a previous post, immigrants make up one in four workers in the construction industry. The share of immigrants is significantly higher (32.5%) among construction tradesmen. In some states, reliance on foreign-born labor is particularly evident, with immigrants comprising over 40% of the construction workforce in California and New Jersey, and 38% – in Texas and Florida.

According to the government’s system for classifying occupations, the construction industry employs workers in about 390 occupations. Out of these, only 28 are construction trades, yet they account for almost two thirds of the construction labor force. The other one-third of workers are in finance, sales, administration and other off-site activities.

The concentration of immigrants is particularly high in construction trades essential for home building, such as plasterers and stucco masons, drywall/ceiling tile installers (61%), roofers (52%), painters (51%), carpet/floor/tile installers (45%).

The two most prevalent construction occupations, laborers and carpenters, account for over a quarter of the construction labor force. A third of all carpenters and 42% of construction laborers are of foreign-born origin. These trades require less formal education but consistently register some of the highest labor shortages in the NAHB/Wells Fargo Housing Market Index (HMI) and NAHB Remodeling Market Index (RMI) surveys.

In the latest February 2024 HMI Survey, 65% of builders reported some or serious shortage of workers performing finished carpentry. Looking at other tradesmen directly employed by builders, the shortages of bricklayers and masons are similarly acute, despite a high presence of immigrant workers in these trades.

Labor shortages are also high among electricians, plumbers and HVAC technicians, with over half of surveyed builders reporting shortages of these craftsmen. In contrast, these trades demand longer formal training, often require professional licenses and attract fewer immigrants.

More than half (53%) of the three million immigrant construction workers reside in the four most populous states in the U.S. – California, Texas, Florida, and New York. California and Texas have over half a million foreign-born construction workers each. Combined, these two states account for over a third (35%) of all immigrant construction workers. Florida and New York combined account for an additional 18%.

These are not only the most populous states in the U.S., but as traditional gateway states, they are also particularly reliant on foreign-born construction labor. Immigrants comprise 41% of the construction workforce in California. In Florida and Texas, 38% of the construction labor force is foreign-born. In New York, 37% of construction industry workers come from abroad.

The reliance on foreign-born labor continues to spread outside of these traditional immigrant magnets. This is evident in states like New Jersey, that registered the second highest share of immigrant workers, 40%, in 2023, closely following California. Nevada and Maryland, where immigrants (as of 2023) account for over a third of the construction labor force (36%) also illustrate spreading reliance on immigrant labor.

In Georgia, Connecticut, North Carolina, Virginia, Arizona, Massachusetts, and Illinois, more than a quarter of construction workers are foreign-born. At the other end of the spectrum, seven states – Montana, North and South Dakota, Vermont, Maine, West Virginia, and Alaska – have share of immigrant workers of less than 5%.

Because immigrant workers are disproportionately concentrated within the construction trades, immigrant presence among craftsmen is higher than their overall representation in the industry across all states. In California and DC, immigrant workers account for more than half of all tradesmen in construction. In New Jersey and Texas, these shares are similarly high at 49%. In Maryland, Nevada, Florida, New York and Georgia, between 40% and 47% of craftsmen are foreign-born.

While most states draw the majority of immigrant foreign-born workers from the Americas, Hawaii relies more heavily on Asian immigrants. European immigrants are a significant source of construction labor in New York, New Jersey and Illinois.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .