In this episode, Miller will tell you everything you need to know about co-living—including how to pick your market, analyze properties, and convert unused square footage into rentable space. He’ll also provide some potentially property-saving tips, like how to reduce turnover and keep renters living in harmony!

Ashley:

If you’re looking to maximize your cashflow in today’s real estate market, a returning guest has proven that house hacking and co-living are not just trends. They are real strategies that deliver serious returns. Today, he’s breaking down exactly how you can find, manage, and scale this unique investment approach from the ground up.

Tony:

That’s right. Last time that Miller was on the show, he gave us a snapshot of his co-living success. He quit his W2 to scale his real estate portfolio, and today he’s kind of pulling back the curtain on his entire process from market selection to tenant management and so much more. So if you’ve been curious about co-living, but you weren’t sure where to start, this is the episode you’ve been waiting for.

Ashley:

Even if co-living isn’t your preferred strategy, Miller has so many universal tips on analyzing markets and managing tenants that you won’t want to miss his expertise here. This is the Real Estate Rookie podcast, and I am Ashley Care.

Tony:

And I’m Tony j Robinson and Miller McSwain, welcome back to the Real Estate Rookie podcast.

Miller:

Yeah, thanks for the invite back. This is a second time, so not a two timer. I think that’s kind of a bad thing, but we’ll just say it’s like I’m a second timer. Maybe that sounds a little better. So yeah, thanks for the invite back guys.

Ashley:

Okay, Miller, so it’s been about 4, 5, 6 months since you’ve last been on the show. How has your co-living portfolio evolved?

Miller:

Yeah, so we actually haven’t bought anything in the last three or four months. Instead, we’ve been focusing on optimizing what we have. Not to say that you can’t buy them now, we just wanted to take a little bit of breathing room to get everything that we have totally up to speed. So we are still trying to buy, in fact, we’re under contract on one right now, but we just really tightened up our requirements. Two, give us some breathing room to work on what we currently have. So it’s like, yeah, if a fantastic deal does fall on our lap, let’s work on it. But in the meantime, what we’re doing is looking at the properties that we purchased previously, especially earlier on in our co-living journey, and we’re looking at spaces that we can optimize and increase the income on the properties that we currently have. So that’s the very first property that we bought. There is an extra family room that we never touched because we never considered converting the extra space to a bedroom. So we’re doing things like that now. Some garages that are attached that are extra 500 square feet. We’re working on doing some conversions like that right now.

Ashley:

So Miller, you’ve also been pretty busy with a special project for BiggerPockets. Can you tell us about that?

Miller:

Yeah, so last time I was on, I said I was writing a co-living book. I’m happy to say I’ve written the co-living book now and it is coming out with BiggerPockets. I think it’ll be out when this episode drops. So if anyone is interested in getting this high cashflow that we’ll be talking about today, you can go to co-living book.com and we actually have a 25% off deal there that’ll redirect you to the BiggerPockets bookstore. So super excited for people to get it in their hands.

Ashley:

Yeah, congratulations Miller. Thank you.

Tony:

So Miller, some might say that co-living is one of the hottest new trends of 2025, and I know Ashley and I have talked about it a lot on this podcast as well since interviewing you and some other guests. So what do you make of co-living kind of having its moment right now and why do you think it’s a strategy that so many people are starting to get excited about?

Miller:

You’re right, it is definitely the hot one right now. Short-term rentals, we super hot for a while and then midterm and then now. So a lot of strategies go through this really hot phase. I think whenever I think about strategies, I think about three things whenever you’re considering which strategy to commit to. So there’s a lot of things that you could think about, but I think about regulations and then I think about supply and demand. So regulations tell you, does the state or the city even allow you to do this? If they do, how easy do they make it or how hard do they make it? And then the supply and demand kind of tells you how profitable is this strategy? Is it even worth pursuing? Even if the city lets you do it, is it worth doing? So if I kind of compare co-living to short-term rentals, I think it would be a really good example.

So as far as the regulations go, short-term rentals in 2015, you could do short-term rentals in cities and vacation markets and rural areas, whatever. The city didn’t know anything bad or good about it. It was just like, yeah, you’re allowed to do it. No regulations against it. Over time, we’ve seen that it still works super well in vacation markets. It’s still a phenomenal strategy for the Smokies and what Tony talks about in Joshua Tree and all that. Still super favorable regulation wise, but in cities it’s a little bit of a different story. So in places like Denver, and I dunno, there’s Texas markets and all sorts of markets are starting to come out with or already have regulations that do limit it short-term rentals within the city. And the reason for that is just that the short-term rental strategy does convert housing that was meant for long-term families that live in the city, two housing for tourists and great, that can produce cashflow and everything, but that does drive up costs for the locals.

So that’s just kind of the thinking behind that. Regulation, again, works great in vacation markets, but on the other side with co-living when you think about regulations, things are actually swinging the other way. There’s more and more favorable regulations because it does provide cheaper housing for locals. So whenever you elect a mayor or you elect a governor or whatever, the people who are voting probably want cheaper housing. So that’s why it’s leaning more favorably on the regulation front. So then if we dive into supply, so I guess I’ll say a little bit of a negative on regulations for STR and cities and a little bit of a positive for co-living in cities.

Tony:

Let me ask real quick before we go to supply on the regulation piece, because I agree, I think the regulatory landscape in the short term rental industry has changed significantly. And there are a lot of folks I think who have gotten themselves in the hot water by not really understanding the regulations before they buy something. So if I want to pursue the co-living strategy, I guess what should I be looking for from a regulatory standpoint to know that this city actually supports or is encouraging of this co-living strategy?

Miller:

Yeah, very, very good question. So the biggest thing that you want to look for, so what you can find is that cities or states could have regulations that say you can only have a single family house is considered five unrelated people or less, or three unrelated people or less, or eight unrelated people or less. So that’s usually the potentially limiting regulation. Some cities will have that and then some won’t have a regulation against it at all, but you’ll definitely want to check to see if it does. And so there are cities that are not favorable. So I don’t want to say every city is, I’m just saying it’s trending towards doing that. But for example, a lot of people are getting cracked down on pretty hard in Fort Worth, Texas who are doing co-living and it was against the regulations there, but they’re like, ah, the city doesn’t actually enforce it, so we’ll go for it.

Well, it turned out not to be a good idea in Fort Worth, and there’s a Florida market that I’m thinking of that’s the same way, but there’s states like Washington State, Oregon State Colorado that have passed statewide legislation preventing cities from setting those sort of regulations. And then there’s other cities and states that just don’t have them. So Houston doesn’t have any regulations against that, but that’s the sort of law that you would want to look up and it’s really hard to Google. So unfortunately, you probably have to email the zoning office, the planning office to get your answer

Ashley:

And definitely get it in writing too if you are going to contact them directly. So it’s not a phone call and later on you have to say, well, this person that I talked to, but you have no evidence of that if it becomes a problem. So I guess at Miller, a follow up to that is short-term rentals. There was no regulation in a lot of areas and then there was regulation. Do you think that’s something to be aware of with co-living that you should be aware of how regulation can change that if this does become such a saturated strategy and become more popular that you could be at risk of that?

Miller:

I mean, yeah, sure, it’s good to be aware of, but I don’t foresee more regulations being put on it that are anti co-living, right? So with short-term rentals, it’s not like there were rules against it and then people took them away. It’s like, no, no rules were put in place to prevent it. So that could be a possibility. But when you do break down the supply and then specifically the demand, there is a lot of demand for this strategy. And like I said, it serves a different purpose. You’re trying to lower housing costs for locals in particular. I think what makes it very defendable legislatively and regulatory is just that it does provide that lower cost of housing versus doing the opposite and just making investors money. It’s a win-win if you’re in an HOA. Yeah, I see that being very, very likely if you’re buying in an HOA and yeah, it doesn’t have good parking, and so all of a sudden you’re parking in front of the other people’s houses and all that, yeah, they’re going to get mad and they’re going to put new regulations in place and that’s not great. So you do have to be careful where you buy, but I think that’s harder and harder to do at the city when you have a mayor that’s serving some NIMBY people, but then also some people who need the affordable housing and then people in the middle who care about either way, it gets much harder for them to put such regulations in place that make things more expensive the larger you go up. So at the H OA level, I think that definitely could happen.

Tony:

So regulations are big, and I think that’s one thing to look for as rookies are thinking about what market to go into. But I guess Miller, what other kind of key indicators should we be looking at to evaluate a market’s worthiness when it comes to co-living?

Miller:

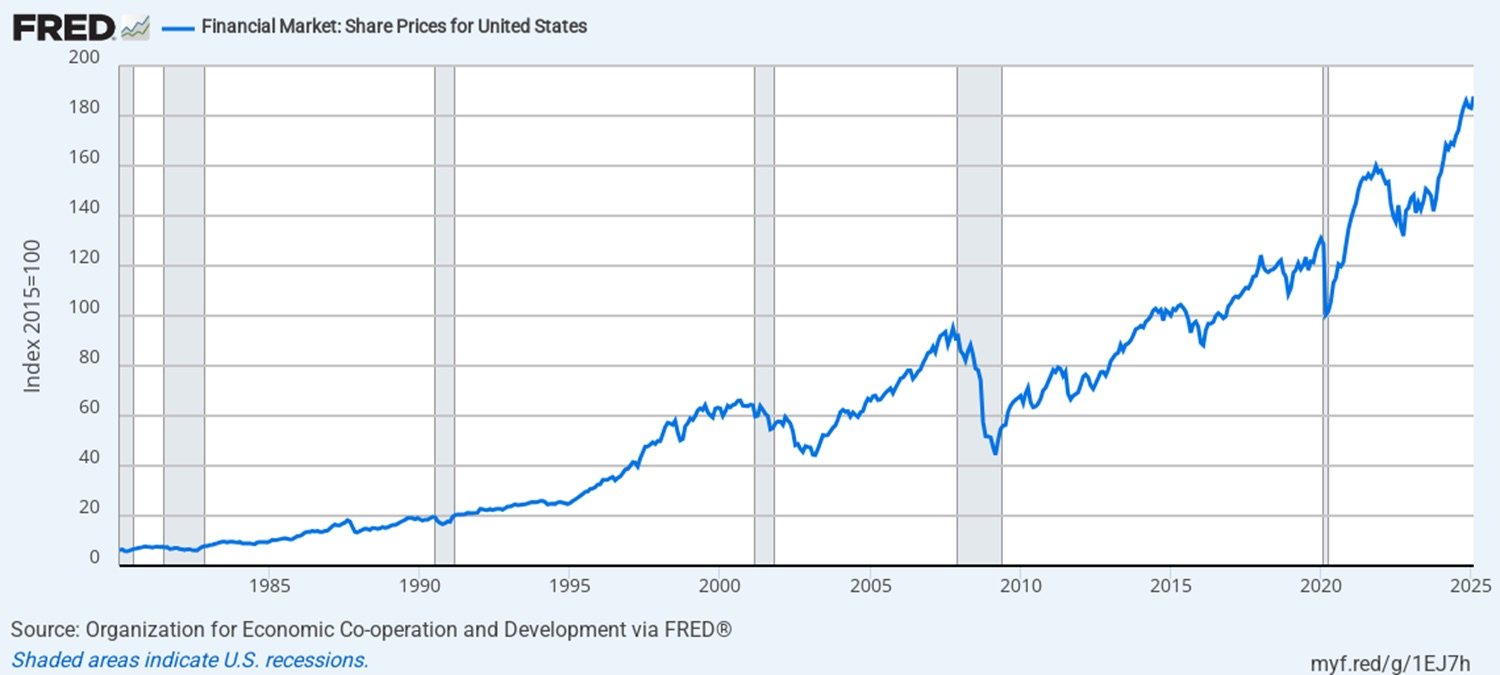

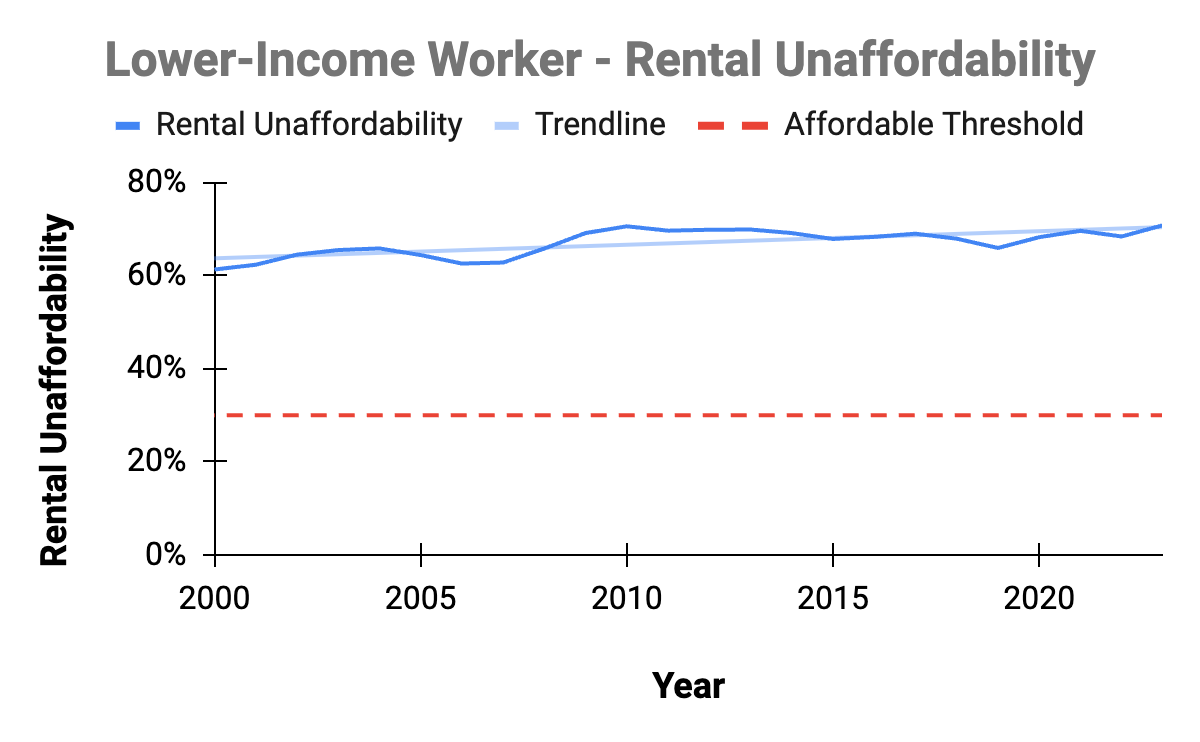

Yeah, so a big one is demand for the room rentals. The best way that I’ve found to infer estimate what the demand is in the city is looking at the rental unaffordability there. So if there’s people in the market that don’t make a lot of income and their rentals are also expensive at the same time, so it’s like, Hey, I don’t make a lot and I have to spend a lot of what I make on the rental, then all of a sudden there’s a huge opportunity to come in and provide something that’s cheaper so that they can get their financial house more in order so they have more money to save or do whatever they want to do with it. But it’s not all going towards housing anymore. So that’s an awesome indicator that you can look at piece of data and the way that you would get that is look up the studio rents in a market, so you can do that on apartments.com. That’s a super easy place to do that. And then you can look up the salary for an individual in an area, and I usually go to pay scale for that. So whenever you divide those two, it’s like the more, the higher that is, it means the more unaffordable it is for the typical renter there. So there’s likely more demand for the rooms

Tony:

As a follow-up to. Do you see that this strategy works better in major metros? I’m in Los Angeles, one of the most unaffordable places to live, or New York City. Does it work better in a city like that, or is it better in maybe a smaller suburban or even rural town?

Miller:

Yeah, great. Great question. So yeah, I think there could be more demand in the Los Angeles or whatever because of how expensive the rents are in comparison to the income. But the other thing that you have to take into consideration is how expensive are the houses? So I’m sure there it’s extremely expensive versus if you’re looking in a town with 450,000 median purchase price, maybe there’s a little bit less demand there, but maybe the house is like a third, a fourth, a fifth, a sixth of the cost. So another good indicator or a piece of data that you can look at is the room rent to price ratio. So that’s another one that you should consider. So if you’ve heard of the 1% rule, right? That’s essentially what does this property rent for as a long-term rental and then divided by how much does this property cost?

So you can essentially do that with room rentals, with co-living properties, but instead you’re just dividing the room rent in that market by the purchase price. So the higher that is, the more bang for your buck. So if you have those two pieces of data, you can kind of weigh them however you want to, but can give you a good picture of whether this would be a good co-living market or not. One other piece of data that you can look at that I really like is population growth. So you can look at historical appreciation and historical rent growth and all of that, but it’s a little bit dangerous because if you see that a market has grown by 10% per year in property value, that sounds cool. It’s like, oh, I would love to get in and also reap this 10% per year increase, but it may have already gotten all of that appreciation and maybe now you’re just stuck at the top of the market and it goes down or it just doesn’t continue to go up.

So instead, what I like to look at is population growth. I think it predicts, it infers what property values and what rents could do in the future. If you have a certain number of properties for sale in a market and now more and more people are moving there, all of a sudden the people who are selling the properties can jack up the price because so many people want them in the same idea on the rental side. So the higher the population growth, the higher you could expect property values and rents to go up in the future. So that’s another one to throw in there that could really make an awesome just investing market in general.

Ashley:

We have to take a quick break, and Miller has shown us how to identify some markets, but how do you find the right property once you’ve chosen your location? So up next, he reveals his exact criteria for selecting properties that convert successfully to co-living spaces. But first, a quick message from our sponsors.

Tony:

Alright guys, welcome back. So we’ve seen how Miller is identifying markets for the co-living tragedy, but I just want to dive into Miller, how exactly you’re fine in these deals. That make sense. So I guess what kind of specific features do you look for in a property that would make it ideal for co-living? I guess are there certain things to look for now that you didn’t quite know of when you first started?

Miller:

Yeah, there’s a lot of ’em. I think the very first thing I would say is you need a really good real estate agent that knows about co-living, right? So in a perfect world, if you could find a co-living specific agent, they’re going to help you so much with this.

Tony:

No, I know that there’s agents who specialize in house hacking, but are there agents who like, hey, all we do is help agents or investors with co-living?

Miller:

Yes. Yeah, there’s definitely starting to be. So I think if you’re in a city with 400,000 people or more than I have been able to find co-living specific agents there, just like there’s rental agents and yeah, like you said, house hacking and all that. If you’re in a market smaller than that, it is less likely to find someone super specialized in it right now because the strategy is in its infancy and it’s modern infancy anyway. It’s existed for a long time, but it’s become more popular now. So if you are in a larger city, like I said, 400,000 or more, you could probably find someone, I would check out BiggerPockets forums and search Houston co-living, Denver co-living, whatever, and maybe you find some posts about it. Maybe you message the people who made the posts and ask who they used as their agent. You could look in the BP rookie Facebook group, you could DM me. I know agents all over the country that do specifically. So first I would definitely try to find one of those. They’re going to know the areas that are best for co-living. They’re going to know about these features that we’re about to talk about. But if you can’t find one, then maybe just the next best thing is a cashflow strategy agent. So someone who’s done short-term rentals or done midterm rentals, again, they’re really different, but at least they’re kind of the aligned in this cashflow thinking. It’s probably the closest you could get.

Ashley:

You can also go to biggerpockets.com/agent, and when you’re matched with an agent from your area, let them know that you’re looking to do co-living. And one way you can ask them to see if they actually are specialized in co-living is asking them how many people have they helped purchase a home for co-living? So they actually have to give you a number instead of just asking them, have you helped people do co-living before? Then they just say, yeah, oh yes I have. And maybe it was just one person, but you ask it that way. They have to, if somebody really has done a lot of co-living deals, they’ll be able to say, oh yeah, I did 10 just last year helping someone. So great way to phrase that.

Miller:

And you can definitely ask. So first off, everyone will say that they’ve done it. They’re like, oh yeah, of course, because they’re salespeople, right? But if you’ve read the book or listened to this podcast or whatever, you can ask questions to kind of figure it out. So you could ask them about these features. So parking is a big one. So you could ask them about parking like, oh, how many parking spots do you usually see your clients buy for co-living? Or what do the remodels usually look like for co-living? And if they say something about, oh yeah, building a room in the unfinished basement, the extra family room, converting that to a bedroom, then okay, they do at least know what they’re talking about a little bit. But I will say when you do have this agent and you start digging down into specific properties that you’re looking at, the first and quickest thing to look at is parking, right?

You can hop on Google Maps, turn it onto the satellite view, or hop down on the little yellow man doing the street view. And you definitely do want to have a lot of parking because exactly what we mentioned earlier, you don’t want to make the neighbors mad. Technically, it might be okay, it might be allowed to park wherever in front of other people’s houses, but we’re definitely not trying to give the strategy a bad stigma and induce any regulations with the HOAs or even at the city level or whatever. So you do want to look for ample parking. So that’s things like corner lots. That’s things like we have some that are just really wide, like wedge shaped lots. So there’s just a ton of front street parking. It could be, we’ve seen some with driveways that go into the backyard and then there’s a parking pad back there. There’s a lot of different ways that you could find parking, but it’s not a house sandwiched in by five other houses on every side of the street and you just have a two car garage that’s not going to cut it.

Ashley:

Miller, I’m curious, have you ever gotten rid of the backyard to create more parking and added just a big huge parking lot in the back?

Miller:

You totally could. We have. Not all of ours have had good parking from the start, but yeah, I mean, if deals to get tighter and tighter and tighter, you get more creative. So it’s like, yeah, if the side yard is big enough to add a driveway through the fence and then you build a parking pad, cool. I have heard of people graveling the front yards, maybe it just depends on the market. That would be something that would definitely make my neighbors mad. Depends on the neighborhood and everything, but definitely keep the neighborhood in mind while you’re at it.

Ashley:

So what are some of the other things we should have in our buy box when going after a co-living property?

Miller:

So once you’ve identified whether parking works or not, now you can dive in and look at a few other things. So you can look at things like property square footage. The bigger the property, the better. If you think about a, let’s just say a 1500 square foot house that’s three bedrooms. Let’s say you have a kitchen, you have a living room, and then you have three bedrooms, and that’s probably it. Now, any additional square footage you add beyond that. So let’s say that instead you find a 2,500 square foot house that’s five bedrooms. Okay, well, every piece of additional square footage for the most part goes to building bedroom type area. So you just get much more efficient with the floor plan. The more square footage, the more opportunity there is to add bedroom. Once you’ve looked at the square footage, notice that I didn’t say anything about filtering on bedroom count.

So you’re probably not going to find a six bedroom house in a market, or maybe you could, but you’re probably not going to find a seven, you’re probably not going to find an eight. The highest that we have right now is eight, right? You’re not going to find those. So we’ve bought properties that are huge, 3000 square feet, 3,300 square feet, but only have three bedrooms. So it’s really great because no one else wants to buy that, by the way. No family wants to buy a 3000 square foot house with only three rooms. They probably have three, four kids. They need more rooms than that. So you’re able to kind of negotiate on them. And then once you buy it, we finish the basement, we turn the dining room, we turn them whatever, the game room, the theater. So I would not filter on bedroom count. That’s where your expertise as a co-living investor comes in and you’re able to do things that other investors or homeowners don’t.

Ashley:

Miller, I guess on that point of the bedroom count, converting rooms to bedrooms. What is actually, is there a permit process you’re following to that When you go to resell it, it’s now an eight bedroom. Do you have to put a closet in each one? What are the things that you’re actually doing to convert them to bedrooms?

Miller:

That’s where it gets kind of weird, right? Because it’s like, okay, if I’m buying this giant house, like I said, 3000, 3,300 square feet and I’m making it eight bedrooms when I go to sell, who’s going to want to buy this? Right? That looks great and it produces a lot of cashflow, but who’s going to want to buy this thing? So it’s up to you as the investor, but I will say if you’re doing a permanent modification, like a permanent addition, we’ve done things like extend a balcony on the interior to add 200 square foot of living space that we’ve turned into a bedroom. We’ve done things like, yeah, finished basements, these sort of permanent additions you probably do want to have in that listing when you go to sell it in 10 years, like, oh yeah, now there’s an extra 200 square feet. Now there’s an extra thousand square feet in the basement and it went from a four bedroom or a three bedroom to a five bedroom, that looks great. Whenever you go to sell, there are some more temporary modifications that you do though of course, I’ll say, you should always do everything to code no matter what. Things should be safe, things should be clean and all of that. So this isn’t necessarily advice, but there are more temporary modifications, like adding a door to an office. Okay, now it’s a bedroom

Ashley:

Or a dining room, when do you really need a dining room?

Miller:

So for those sort of things, maybe it’s up to you on those. Yeah.

Ashley:

Okay. So we’ve went through a couple things. Is there anything else that we need to really consider for our buy box

Miller:

As far as building a bedroom goes? You asked about what do you need in a bedroom? So it varies by city, it varies by state, but generally you’re going to want a closet like you said, and the other big requirement is having two forms of egress. So this is along those lines of safety. If there was a fire in the house, which you could totally build bedrooms without the proper egress, but if you do this at scale, eventually there’s just going to be a fire. If you have 20 properties, one of ’em is going to catch on fire one day and you do not want to be stuck holding the bag. So you definitely want to make things safe. So usually you need two forms of egress. One of them has to be to the exterior, so the door to enter the room, right? That’s one form. That’s great. The other form needs to have some exterior access. So that would be things like a window, like a door even that goes to the exterior. If you converted a garage and there’s another door that goes straight to the backyard, that could potentially count. So make sure you have the closet, make sure you have the two forms of egress and make sure you have the appropriate electrical outlets and lighting, and it’s not super small. Things like that.

Ashley:

So Tony, I know what you’re thinking. You were going to turn your walk-in closet, rinse it out, but that won’t pass. It’s a legal bedroom.

Tony:

So from a renovation standpoint, Miller, are there any other, I guess, priorities that you started to focus on? Because I mean, you’ve been doing this for a while now, so I’m sure maybe there were things you weren’t doing initially that you’re like, Hey, we’re going to do this every single time now. But just from a renovation standpoint, how have priorities kind of changed for you?

Miller:

Yeah, they’ve changed a lot. So in the beginning, our very first house act, so I should say this is a fantastic house hacking strategy. Whenever you’re house hacking, you’re buying a property and you’re just renting it, renting pieces of it out in some way, you’re making money on it somehow. You could short term part of it, you could midterm part of it, or you could rent out the rooms. This is co-living is fantastic for house hacking. Whenever we bought our first house hack, it was a flip. It had just been flipped and we’re moving into it now, and we didn’t do anything to it. It was like, yeah, it’s a five bedroom house and it broke even whenever we left, it would break even, and that’s all we knew how to do. It’s like, oh, if it breaks even that’s a good investment. That’s what we were kind of hearing at the time.

Since then, now we cashflow a lot enough to where we can actually replace our incomes and do all of that, and that’s because we did start getting creative with those floor plans. So the biggest recent tools in our tool belt beyond the simple ones, like the dining rooms that we’ve been talking about, is the garage conversion. That’s the big one. We have multiple houses with three car garages. Seriously, like 600, 500, 600 square feet just sitting there for cars. And now whenever we convert these, we’re not taking away parking still. You can park in the driveway, so where three people would’ve parked in the garage, you’re just now parking outside, but you can add a lot of square footage and add two rooms easily in something like a two three car garage.

Ashley:

I mean, I guess you could also charge for parking in the garage too, like charge extra if you want the premium parking spot, I guess. But then I guess you have to worry about people parking in the garage door so you can’t get back out or storage too if you don’t have it in your budget to actually renovate the garage. There are other things you can do too to make money off of it.

Miller:

Originally, that is how we utilize the garage. So like I said, we’ve just been optimizing recently. So previously we could rent each garage space for a hundred and let’s say a hundred dollars a month. So three car garage, $300 a month. Awesome. That’s great. Instead, if the house supports it, if there’s enough bathrooms, we’re not trying to just cram for no reason. It’s like, oh, if we could reasonably fit three more people and the bathroom still makes sense and the kitchen’s not overloaded with people, then all of a sudden if we had two rooms, let’s say now we’re making an extra 1400 a month instead of 300 a month. So it really adds a lot to your cashflow if you invest into it.

Ashley:

There’s something else I want to add that I recently came across with. I was talking to the guy from the health department that comes and does the septic and water testing on property. So I’m assuming most of your properties probably have public sewer, not dealing with a septic, but just in case there is someone who is considering a property that has a septic is that most septics are built to only support so many bedrooms by the bedroom count. So if you have a septic that only supports a three bedroom, but you’re going to convert the basement into have a fourth or fifth bedroom, whatever that may be, when actually go to sell the property, you will have a problem that you’re selling it as a four bedroom house, but your septic only supports three bedrooms. And so he said that what a lot of people do is they’ll list the property as a three bedroom with an office or with Aden, and then the people come and see the house and like, oh, I could actually use this as a bedroom. But just something to be careful of too is make sure your utilities will support the bedroom count too.

Miller:

Should your contractor know about that or should you talk to the city to know about that? How do you know if there’s an issue with the utilities?

Ashley:

Yeah, so I would call whoever does the septic and the septic inspections in your area, and when you purchase a house, there should always be, at least in New York, you always have to have the septic inspected anyways, so before you’re even closing on the house, you would find that information out.

Tony:

Miller, one final question on the renovation side. So do you leave any communal space aside from the kitchen? Is there typically still a living room or what communal space do you typically leave?

Miller:

Yeah, so we definitely do. So I would define co-living as community living, and I would say that that is a room rental strategy with built-in community, and that’s very difficult to do if you don’t have any community space. Definitely, we always keep a living room and we have porches outside, whatever, so people could hang out outside if they wanted to. But yeah, definitely have the community space inside. We’ve started adding on some new community features and amenities. Things like the newest one that we’re trying out is bowling night. So super cheap for us to pay for. It’s like message the house, Hey, anybody want to go do bowling on Friday? And I don’t even, it’s like five or 10 bucks a person or whatever, but that just gets ’em out of the house. So you could even do this if you didn’t have community space, but I think it’s great if you also have the community space.

So there’s little things like that to really help everyone form those relationships, but it really helps on the management side it sounds like, oh, well, doing these community events would be a drag on management. It’s like, oh, now I got to schedule these things and whatever. It cuts down on the issues that we experienced by so much ever since we started doing this huge drop in inner tenant conflict because just now they know each other and they can chat about issues themselves. They’re not texting me about the guy next door who’s loud. They know that guy now they’ve talked to him, they can just go knock on his door and speak to him directly. So it’s helped out a lot on the management front.

Ashley:

Miller, the last piece on this, is there any little thing that isn’t super expensive or requires a whole house remodel or anything like that that is unique that you found that your renters would actually really enjoy as an amenity? So for example, having three fridges where each person gets half of a fridge instead of just one little tiny shelf. Is there any little things like that that somebody can do that a tenant would appreciate and actually want to live there because of those little things?

Miller:

Yeah, this isn’t necessarily on the remodel side, but just on the experience side, I would say a really easy thing to do is to provide the shared supplies for the house. So we provide toilet paper, trash bags, paper towels, and so for example, whenever we do rent raises or anything like that, in that email I include, Hey, don’t forget, no one else does this anywhere else you go, you’re going to paying an extra, you’re going to be paying for your toilet paper and paying for this and fighting with your roommates about it. So that’s been an easy one where I think people immediately see the value as soon as they move in, they’re like, whoa, this is way better than any dorm I’ve lived in. This is a different beast just because we provide those things that cost us $50 a month maybe nothing crazy.

Tony:

So we talked a little bit about the renovation side, but I guess the thing that comes to mind next is actually running the numbers, and you touched on this a little bit earlier, but I guess how is the strategy for analyzing a co-living property different than a traditional long-term rental, and where have you found to go to get the best data to know what you can actually charge?

Miller:

So it is similar to running the numbers for a traditional long-term rental. So close in fact that you can use, I use the BiggerPockets calculator. I think that’s a fantastic tool. It’ll make sure that you don’t forget any of your inputs. Whenever you go through that page, it’s going to remind you, Hey, what are repairs and maintenance? Hey, what is CapEx? Hey, all of these things. But the difference is you’re still going to have your down payment. You’re still going to have certain things, but the unique things about co-living are one, the rents are going to be different. You need to know what a room RINs for. One quick way that you can find that this is sort of a plug, it’s my thing, but if you go to co-living pro.io/rent calculator, we have it is essentially a rentometer or BiggerPockets rent estimator, but specifically for rooms, you can go there and punch in your city and is it a room with a private bath room with a shared bath?

And we have a lot of data at this point, so there’s some estimates that we can give you. Otherwise you can go on Zillow, Facebook, marketplace and comp to other rooms that are listed. So that’ll be different. Your rents will be different. Then there’s some unique expenses that you’ll have. So you will be paying for utilities. You’re not going to do that with the long-term rental. So you need to talk to the utility companies, figure out what that’s going to cost. Or if you live in the market, you probably know what it’s going to cost. You need to include that. You’ll probably have a cleaner that helps, again, a ton. On the management side, we pay a little bit for it. 80, a hundred bucks a month is what we’re paying, but huge on the management side reduces the headaches. If you do the shared supplies include that lawn care, basically anything that tenants would pay for in a long-term rental, you should probably be paying for in a co-living rental yourself, and you make so much more income than it’s totally worth it.

Ashley:

So it’s very similar. Then if you had the property as a short-term rental, you’re paying for a lot of those same things. So Miller, tell us, give us an example of a property of how good is the cashflow?

Miller:

The most recent one that we bought, I guess I’ll use because it wasn’t the higher interest rate environment. Like I said, we haven’t bought anything in three or four or five months. So the last one that we bought was probably more similar to what you could buy today since we’re still at what, 7% or something like that. So this one was at 7.5% interest I think. And even with that, it’s an eight bedroom house now. I think we bought it as four or five. And so we added, the basement was finished, but it was just totally open. I think they called it a flex space or a game room or something like that. But anyway, totally untapped space. So we put up three walls total, I think to make three rooms and that was it. So it was a super easy remodel, cost us 12 grand, 15 grand, nothing extraordinary.

A house hacker could put probably 20 grand down on this property and then spend an extra 10 or whatever building these rooms. And with that, we produce 2000 a month in cashflow. I would say to be on the more conservative side. Now that is a 25% down type situation. So for rookies who are house hacking and you’re living there, I will say your cashflow would be lower. I don’t know exactly what it would be on this, but it would be over zero. You’re probably like 500 to a thousand by the time that you move out. But your cash on cash return would probably be stupid high. Ours is 12%, but if you put only put 5% down, you’re probably at way higher than that. Right, 50%. Something stupid.

Tony:

Two quick follow up question on that, Miller, what market is that property in

Miller:

Colorado Springs? So it’s very median priced market. I think this one costs 500, and that’s pretty close to the median for the country. I think like 4 50, 4 60.

Tony:

And how long did your renovation take to take it from a four bedroom to an eight bedroom or five to an eight?

Miller:

This was my big learning lesson. The smaller the remodel, the better. By far. This one was probably six weeks, four to six weeks, and we had just come off of doing two much larger remodels where we went from the three to the eight, which doesn’t necessarily mean that it’s a much bigger remodel, but it was just the way in which the property was laid out. It was a lot of work and it took three months and that really sucked cashflow, right? For three months. Not having that much occupancy was pretty tough.

Tony:

I guess last question, right? So how long does it take post rehab typically for you to fill all of your bedrooms? Do you have a waiting list, people just knocking on the door while you’re doing renovation, or is it kind of like a lease up process where it takes a couple of months to get all those rooms filled?

Miller:

Yeah, great question. That definitely is a disadvantage of co-living is that pros and cons. It’s like you have a lot of income streams, you have redundant income streams. You have, let’s say eight people. One loses their job, one leaves in the middle of the night, whatever. Okay, it sucks a little bit. Second one leaves, okay, still sucks, but you’re probably still positive cashflow by the time three or four of them leave. Okay, maybe now you’re digging into reserve. But the flip side of that, the con is that you do have to get all of those filled up in the beginning. So that is the toughest part of co-living, I would say depends on the market and how much demand there is. The market that I’m in, I didn’t know all of this about market selection that I talked about today. Whenever we first purchased, we don’t have the most demand that there are cities with way more demand than we have, honestly. So we probably move slower than certain markets, but we can usually lease up about a room a week with no issue pretty naturally without pushing anything too hard. So eight bedroom house probably takes us about eight weeks or two months to get it totally filled up. I would say

Ashley:

We have to take a quick break, but when we come back with Miller, I want to find out how long a tenant actually stays in the property and how often is he having to fill vacancies. We’ll be right back. Okay. Welcome back from our short break. So Miller, you told us once you’ve got the property, it can take a week or so to get somebody in there, but how long on average are people actually staying? Are they signing one year leases? What does that look?

Miller:

Yeah, I will say that once you get the property filled up, now, even if it takes a week to find someone, that’s not such a big deal because you probably got a 30 day notice or a 60 day notice. So you can probably get someone in there without so much lag. So that is a benefit there. But as far as how often they stay, what’s the turnover and all that? We’ve been seeing that our average is like 10 months. So on the leasing side, we’ll let anyone sign ’em anywhere from a one month to a 12 month, and we just kind of adjust the pricing depending on how long they end up staying. So most people will pick a six month or a 12 month or a 12 month and is leaning towards the 12. But one thing that we’ve done recently to really help our retention is that previously, whenever their lease would expire, we would automatically turn month to month.

Super easy, super easy on the paperwork. That was cool. It was great that we started that way. I didn’t have all the time to look at all the paperwork and everything. Since what we do now is okay, a few months out or two months out from their lease expiration, we’ll now send them options. So it’s like, okay, you could continue months to month, it will be a little bit more expensive. You have more flexibility to move whenever you want. That puts us at a little bit of a disadvantage. So that is an option that they have or resign at six or resign at 12 months and the pricing varies there. So I’ve been very surprised at what we found. We found that almost everyone signs a 12 month just to get that $20 a month discount or whatever it is, instead of 800, it’s now seven 80 total win-win, right? It’s like, okay, we make $200 less over the year, but all of a sudden we’re not going to have a vacancy. And if the room sits vacant for one week, that’s 200, $300 gone. So reduces management headache and extends the stay and probably is better for the cashflow overall even though there’s a little bit of a dip in income.

Tony:

Last question. I think the one challenge that a lot of folks have when it comes to co-living is kind of just the idea of eight people being together. And you’ve already touched a little bit on, Hey, I’m going to buy all of your consumables, I’m going to pay for the utilities, we’re going to assign parking spaces. What have you found or what have you found to be like the holy grail of making sure that there’s harmony amongst all of these random people that you’re putting into a house together?

Miller:

Two holy grails, one is screening. Make sure that you screen well. That’s probably one of the biggest questions I get whenever people are looking to join the household. And I usually know that they’re a good applicant if they ask this, but they’re like, Hey, how do you, we know that everyone in the household is good. How do you maintain the quality? And so it is because we definitely screen well. So part of that is talking to rental references. That’s a huge piece. If they have personal references, you can require those, or I dunno if you can technically require them or not, but you can definitely request those and talk to them depending on the state. So you want to get an idea from the rental references, how they’ve behaved, because a lot of these people have been in room rentals before, so you can get a good idea from that.

Also, whenever they come to tour, we have the current residents tour them around, so there’s an immediate vibe check there. If it doesn’t fit well, then I hope the person excludes themself because you want it to be a good vibe in the house. If they don’t exclude themself, the person who gave the tour will probably tell us that it didn’t go well. So we’ll get an idea from that. So that’s one big thing. And then the second one I would say is the community piece. So I think that that is overlooked, even if you do keep the living room and that’s all you do. I think that that’s not enough because that is what we did at first. We kept the living room. We’re like, Hey guys, go hang out. And just that initial connection was never made. So no one ever hung out, ever. No one ever talked. They would say, Hey, in the hallway and that’s it. We found that we really do have to provide that just initial spark just a little bit. Here’s dinner, here’s bowling. And then it takes off from there and does is self-sufficient after that, but we have to provide that spark is what we found.

Ashley:

Well, Miller, thank you so much for joining us today. Can you let everyone know where they can reach out to you and find more information?

Miller:

If anyone has questions, feel free to DM me on Instagram. Just Miller McSwain, it’s my name. But yeah, and if anyone’s interested in the book, like I said, co-living book.com, 25% off there and you can pick it up from the BP Bookstore.

Ashley:

And congratulations again on writing your book. I can’t wait to read it. Thank you guys so much for joining us today. I’m Ashley. And he’s Tony. And we’ll see you on the next episode of Real Estate Ricky.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!