Key takeaways

The current housing market is causing many prospective buyers to wait for better conditions, but there’s no guarantee that it will improve considerably anytime soon.

If your credit score is strong, your employment is stable and you have enough savings to cover a down payment and closing costs, buying now might still be smart.

If your personal finances are not ideal at the moment, or if home values in your area are on the decline, it might be better to wait.

Buy now, or wait? That’s the question prospective homeowners have been struggling to answer in today’s housing market. Home prices have been skyrocketing recently, and the Federal Reserve’s work to tame inflation sent mortgage rates soaring, too.

The combination has led many would-be buyers to pick the “wait” side of the equation. The median sale price of an existing home in the U.S. hit its second all-time-high of the year in June 2024 — an astonishing $426,900 — according to the National Association of Realtors (NAR). And, according to the Fannie Mae Home Purchase Sentiment Index released in July 2024, 81 percent of consumers believe it’s a bad time to buy a house.

However, after being at a constant disadvantage for the past few years, things have actually started to look a bit better for buyers in some respects. For example, days-on-market figures are up, giving buyers more time to make an informed decision. NAR data shows that homes typically spent 22 days on the market before selling in June, up from 18 days a year ago. And available housing inventory, while still on the low side, is rising — up a healthy 23.4 percent year-over-year, per NAR.

June’s National Housing Report from RE/MAX, one of the biggest real estate brokerages in the country, also reported a sharp uptick in new listings, up 38.1 percent from June 2023. “It’s good to see inventory levels rising, as more listings represent more options for buyers,” said RE/MAX president Amy Lessinger in the report. However, she continued, “it’s evident that buyers are sensitive to interest rates, highlighting the need for lower rates to stimulate significant growth in market activity.”

So, is it a good time to buy a home? Or is it better to wait on the sidelines, in the hopes that either prices or rates see a significant drop soon? And are there still concerns about a possible recession? Here are some key considerations to help determine the way forward.

Is now a good time to buy a house?

Mortgage rates have backed off from the 8 percent highs hit in October, but they’re still close to 7 percent. And home prices are sky-high as well: June data showed the highest median price NAR has ever recorded, reflecting 12 consecutive months of year-over-year increases. Together, these factors might dissuade you from buying right now, and that’s understandable.

No matter which way the real estate market is leaning, though, buying now means you can start building equity immediately. It also means avoiding the potential for additional mortgage rate increases later: Rising rates can spell serious trouble for your monthly budget, and they also result in paying more in interest over the life of the loan.

“If a buyer finds a property they would like to call home, they should not delay,” says Stacey Froelich, a broker with Compass in New York City. “You cannot time the market, and a home should be a long-term investment.”

“Remember, you ‘marry the house and date the rate,’” Melissa Cohn, regional vice president of William Raveis Mortgage in Connecticut, recently told her newsletter subscribers. To put it another way, if you find the right place, buy now — you can always refinance later.

In general, if you can answer yes to these three questions, now is a good time to buy.

Do you have excellent credit? Anytime you’re borrowing money, start by checking your credit score. The best deals on mortgages will be available to those with the best scores — in fact, the median credit score for mortgage borrowers in the first quarter of 2024 was a very high 770, according to the Federal Reserve Bank of New York. If you have demonstrated that you are a low-risk borrower with a history of on-time payments, you’ll be in line for the lowest mortgage rates a lender offers.

Have you saved enough for a down payment? In addition to paying your bills on time, you should be sitting on a sizable chunk of change for a down payment. The more you can pay upfront, the less you’ll have to borrow (and so the less interest you’ll have to pay). Make sure you’ll have plenty left over, too: Lenders like to see additional cash reserves that can provide a cushion if something unexpected happens.

Are you planning to stay in the home for a while? Beyond the purchase price, buying a home comes with closing costs that can run thousands more. So, to justify those one-time transaction costs, it’s wise to be reasonably certain that you won’t move again anytime soon — or that you’ll be financially stable enough to hold on to the property and rent it out. Selling a home very soon after buying can have serious tax implications.

Should I buy a house now or wait?

Ultimately, the decision of when to buy a home is up to you. Life goes on, whether the timing is perfect or not. If you’re anxious to become a homeowner, you’ve met the criteria above and you’re financially stable, go ahead and start house-hunting.

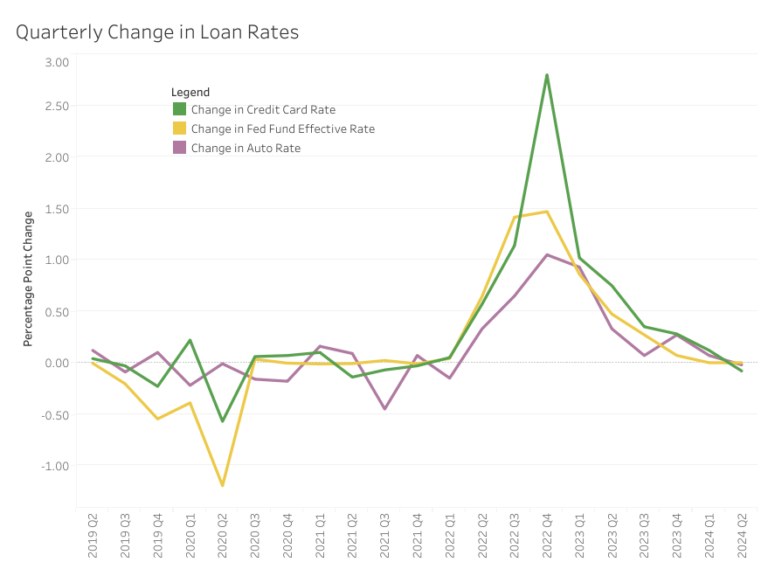

If you’re holding out for lower mortgage rates, a bit of patience might be in order. They have been volatile lately, topping 8 percent in October 2023 before falling back below 7 percent, then rising back above it, and lately just a hair under 7 percent again. That’s more than a full percentage point swing in just a few months.

While 1 percent might not sound like much, it can make a big difference in how much house you can afford over the long run. For example, Bankrate’s mortgage calculator shows that if you buy a $350,000 home with a 20 percent down payment, the monthly payment for principal and interest on a 30-year loan with a 7 percent interest rate is $1,862. The same loan at 8 percent brings those monthly payments up to $2,054 — $192 higher every month. That’s more than $2,300 each year, or $69,000 over the life of the loan.

Of course, it’s impossible to predict where rates will land eventually. But here are three instances in which it might make more sense to wait out the market for at least a while:

If home values in your area are dropping: The country’s overall median home price may have hit a record high in June, but some individual areas have still seen price declines. Take Austin, Texas, for example: Redfin data shows that the median price in Austin in June 2022 was $616,444. A year later, that figure was down to $600,000 even, and by June 2024, it had fallen to $564,000. Such declines may not be done yet, so it could pay to be patient for a bit longer.

If inventory in your area is increasing: When there are more properties on the market to choose from, buyers enjoy more bargaining power. Since many buyers have been sitting on the sidelines due to the interest rate environment, many areas have seen a jump in inventory. Even so, according to NAR, the country overall had 4.1 months worth of housing supply in June — an improvement over recent months, but still too low to meet demand.

If your personal finances could use some love: The biggest reason to wait is if your current financial situation is not ideal. For example, if you are expecting a sizable commission check or bonus, an inheritance or some other windfall that would make a big difference in your down payment, waiting until it arrives makes sense. And if your credit score is low, waiting is also smart. Take some time to improve your credit and pay down your debt so you can qualify for better loan terms.

Analyze your local market carefully

Deciding whether to buy a house now or wait depends a lot on where you want to call home. Regardless of national headlines, real estate is a local game and can vary greatly from one market to another, even within the same state.

Consider this June Redfin data from North Carolina’s Research Triangle cities of Raleigh and Chapel Hill, only about 30 miles away from each other: Raleigh homes cost a median of $450,000 and spend about 16 days on the market before selling. But in nearby Chapel Hill, the median home costs a much higher $667,500 and sells in less than half the time (just 6 days). That’s a notable difference.

In today’s homebuying market, it’s more important than ever to find a real estate agent who really knows your local area — down to your specific neighborhood — and can help you successfully navigate its unique quirks.

What if there’s a recession?

The odds of a recession within the next 12 months now stand at 32 percent, according to Bankrate’s most recent survey. And as you might imagine, recessions are a risky time to buy a home. If you lose your job, for example, a lender will be much less likely to approve your loan application.

Even if a recession doesn’t affect you directly, if your area is hard-hit, that could have a serious effect on the local real estate market. Fewer people with the means to buy means a lower chance of homes selling, which could keep homeowners from listing and decrease your options as a buyer.

There are some potential upsides to buying a home during a recession, though, if you’re financially able to do so. Notably, there will be less competition, which could help you find a great property that you otherwise couldn’t.

Next steps

Trying to buy a house right now might feel overwhelming, but waiting too long can present challenges as well. Review your finances in detail, and think about how much you’re able to pay upfront as a down payment. Be sure to take the pulse of the town in which you’re hoping to live. Then, talk with an experienced local real estate agent to figure out whether you should buy now or wait until the market is a bit more friendly to your bank account.

FAQs

Is now a good time to buy a house?

We’re in a volatile time for real estate. Prices are at record highs, mortgage rates reached 20-year highs last year, and some economic experts still believe we are heading for a recession. A high-interest-rate climate gives you less buying power, so buyers who opt to wait for lower rates may find themselves able to afford a higher-priced house, due to the lower mortgage payments. But there’s no guarantee that rates will actually go down. Ultimately, whether it’s a good time to buy depends on your personal circumstances. If you need to move now, then go for it: Shop around for the best deal possible, and remember, you can always refinance down the line if rates do decrease.

Can I buy and sell a house at the same time?

Yes — lots of people buy a new house while selling their old one at the same time. However, it does create some additional challenges, especially if you’re showing your home while still living in it. It’s important to work with an expert real estate agent who can help you find the right buyer and the right listings to look at. You’ll also want to stay close with your loan officer, to make sure the complexities of putting the proceeds from your sale toward your new down payment are as smooth as possible.

Is the housing market going to crash?

Housing experts do not think so. While there is certainly some economic uncertainty swirling right now, most experts believe that the housing market will not crash. Home prices may decline in some areas, but it won’t be catastrophic — think of it as more of a soft landing.