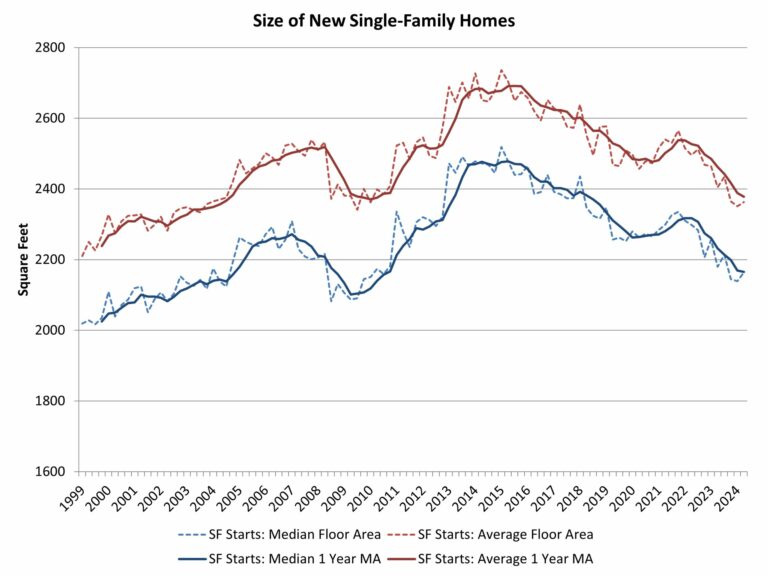

An expected impact of the virus crisis was a need for more residential space, as people use homes for more purposes including work. Home size correspondingly increased in 2021 as interest rates reached historic lows. However, as interest rates increased in 2022 and 2023, and housing affordability worsened, the demand for home size has trended lower.

According to second quarter 2024 data from the Census Quarterly Starts and Completions by Purpose and Design and NAHB analysis, median single-family square floor area edged up to 2,164 square feet, just off the lowest reading since the second half of 2009. Average (mean) square footage for new single-family homes registered at 2,363 square feet.

Since Great Recession lows (and on a one-year moving average basis), the average size of a new single-family home is now effectively flat at 2,387 square feet, while the median size is about 3% higher at 2,165 square feet.

Home size rose from 2009 to 2015 as entry-level new construction lost market share. Home size declined between 2016 and 2020 as more starter homes were developed. After a brief increase during the post-COVID building boom, home size trended lower due to declining affordability conditions. As interest rates decline, new home size could level off and increase in the quarters ahead.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .