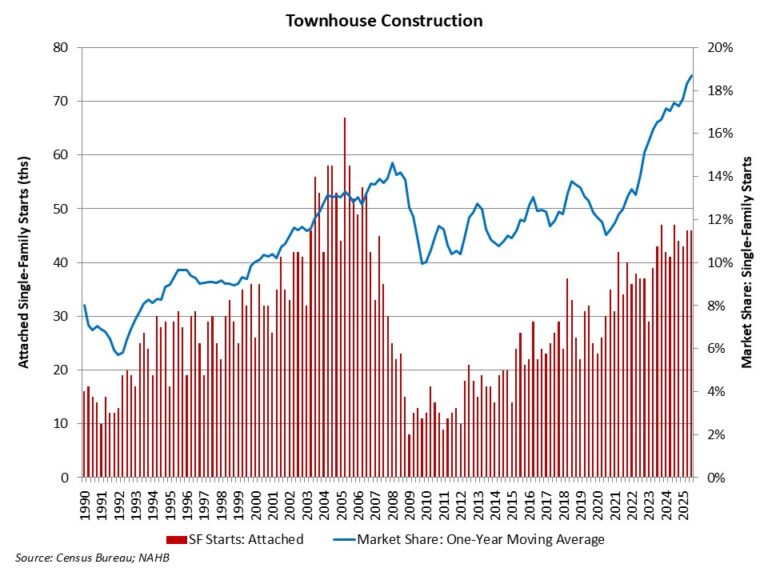

Townhouse construction gained single-family construction market share during the third quarter of 2025.

According to NAHB analysis of the most recent Census data of Starts and Completions by Purpose and Design, during the third quarter of 2025, single-family attached starts totaled 46,000. Over the last four quarters, townhouse construction starts totaled a strong 179,000 homes, which is 1% higher than the prior four-quarter period (177,000). Townhouses made almost 20% all of single-family housing starts for the third quarter of the year.

Using a one-year moving average, the market share of newly-built townhouses stood at 18.7% of all single-family starts for the third quarter. With gains over the last year, the four-quarter moving average market share is the highest on record, for data going back to 1985.

Prior to the current cycle, the peak market share of the last two decades for townhouse construction was set during the first quarter of 2008, when the percentage reached 14.6% on a one-year moving average basis. This high point was set after a fairly consistent increase in the share beginning in the early 1990s.

The long-run prospects for townhouse construction are positive given growing numbers of homebuyers looking for medium-density residential neighborhoods, such as urban villages that offer walkable environments and other amenities. Where it can be zoned, it can be built.

This article was originally published by a eyeonhousing.org . Read the Original article here. .

Patricia Butler, interior designer at Patricia Butler Interiors in Kentucky, is guided by the words of two design visionaries. “First, ‘Fashion fades, only style remains the same,’ which is a quote from Coco Chanel. It reminds me to be true to myself,” Butler says.

“The second is, ‘Buy the best and you will only cry once,’ from interior designer Miles Redd. I love this one for its practicality.

“Years ago, I saw two torchieres that I desperately wanted but were just outside my budget,” Butler says. “So I purchased two from an online discount company. When they arrived, I was terribly disappointed in the quality. I tried to return them, but the return would have cost more than what I had paid. Eventually, after waiting and saving, I purchased the original torchieres. Moral of the story: It is better on your pocketbook to wait and save for the real deal.”