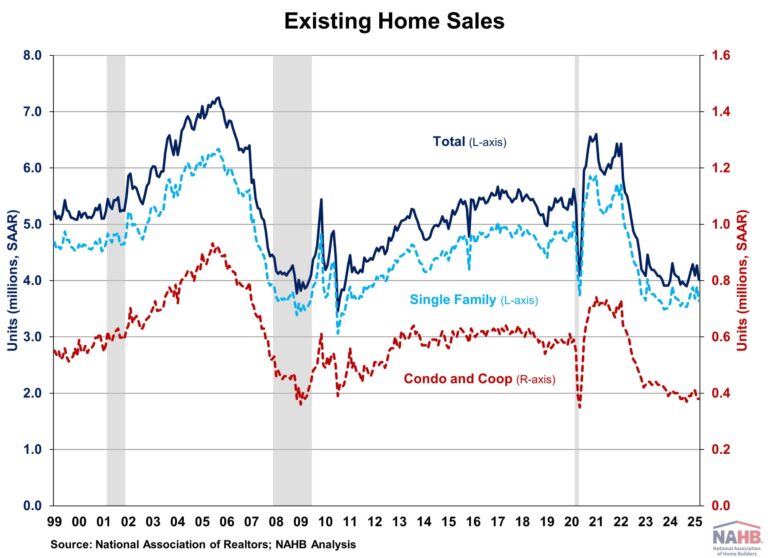

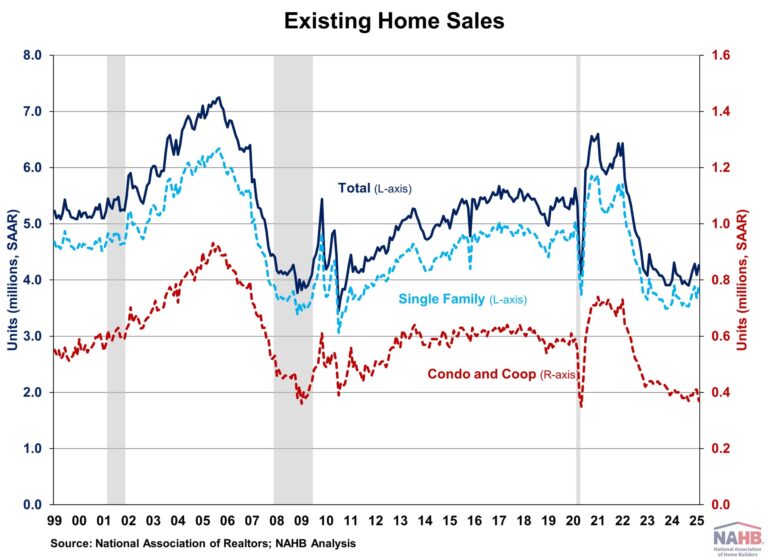

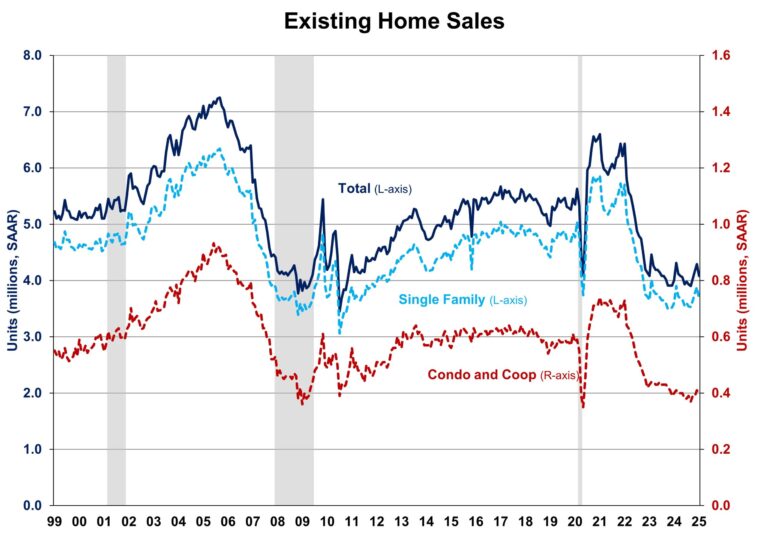

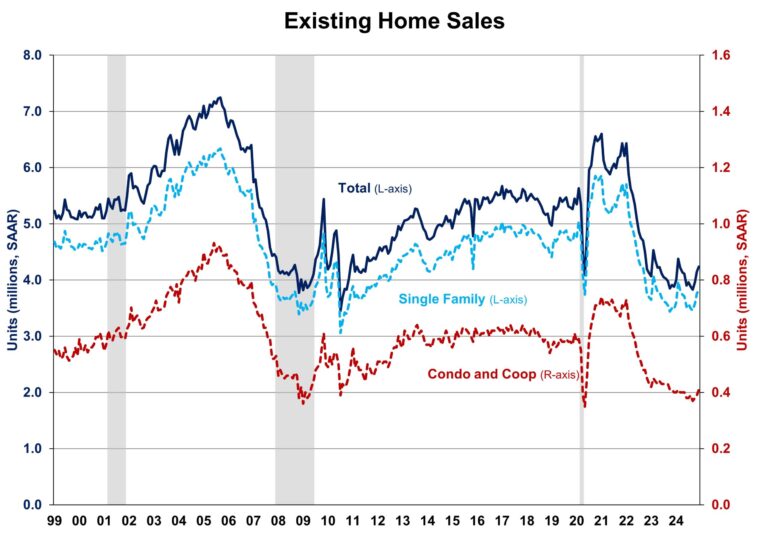

Existing home sales declined in March, according to the National Association of Realtors (NAR), as affordability challenges continued to weigh on the market. For the first time, the median home price surpassed $400,000 for the month of March, underscoring the ongoing pressure on prospective buyers. While mortgage rates have eased slightly, persistent economic uncertainty may continue to limit buyer activity in the near term.

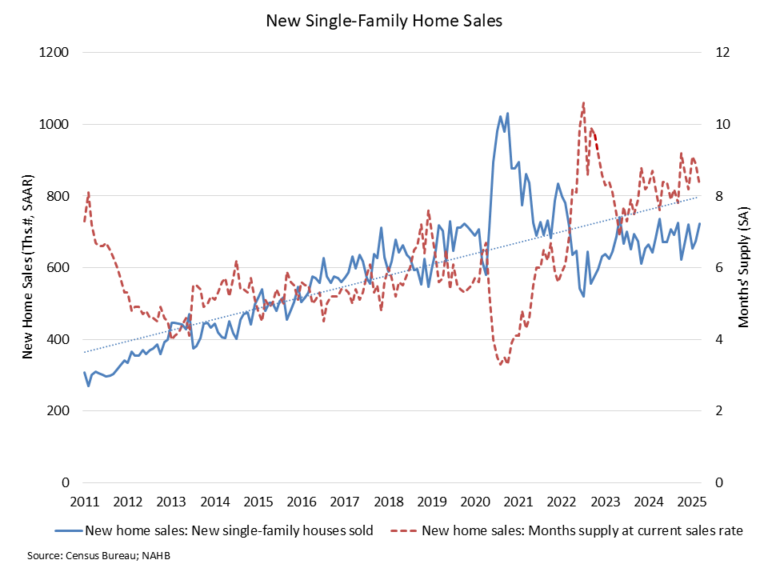

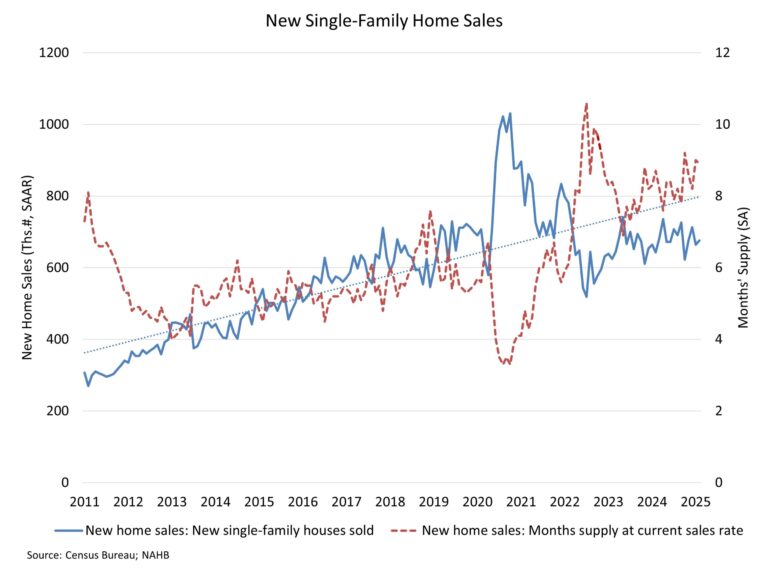

While existing home inventory improves and the Fed continues lowering rates, the market faces headwinds as mortgage rates are expected to stay above 6% for longer due to an anticipated slower easing pace in 2025. These prolonged rates may continue to discourage homeowners from trading existing mortgages for new ones with higher rates, keeping supply tight and prices elevated. As such, sales are likely to remain limited in the coming months due to elevated mortgage rates and home prices.

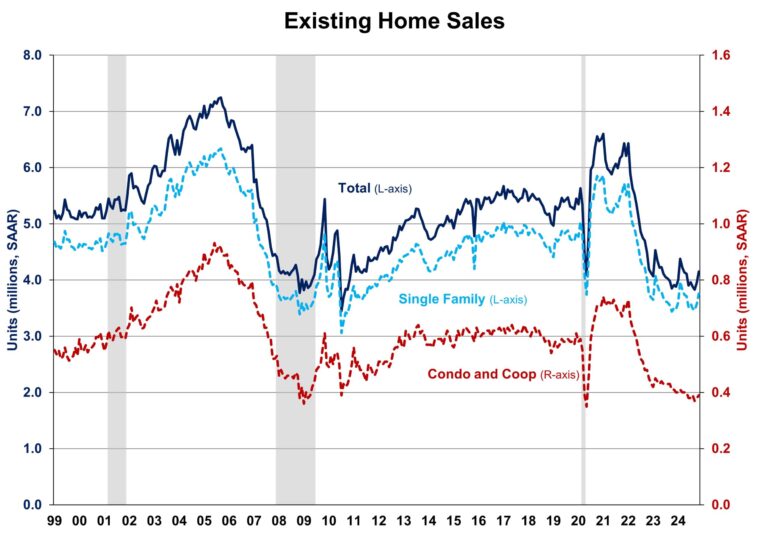

Total existing home sales, including single-family homes, townhomes, condominiums, and co-ops, declined 5.9% to a seasonally adjusted annual rate of 4.02 million in March. On a year-over-year basis, sales were 2.4% lower than a year ago.

The share of first-time buyers rose to 32% in March, up from 31% in February and unchanged from March 2024.

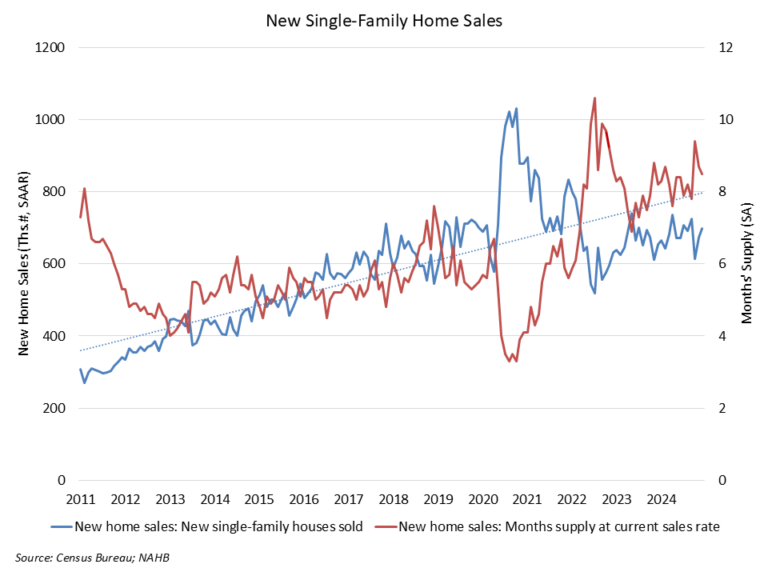

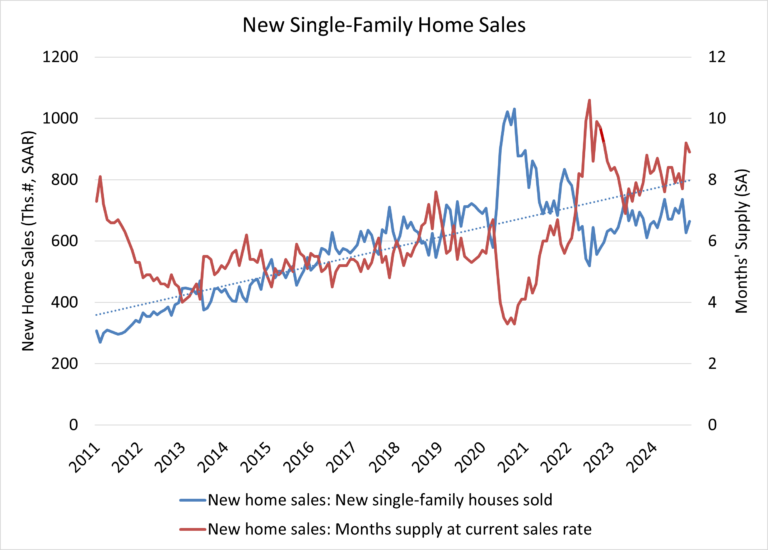

The existing home inventory level was 1.33 million units in March, up 8.1% from February and 19.8% from a year ago. At the current sales rate, March unsold inventory sits at a 4.0-months’ supply, up from 3.5 months in February and 3.2 months in March 2024. This inventory level remains low compared to balanced market conditions (4.5 to 6 months’ supply) and illustrates the long-run need for more home construction.

Homes stayed on the market for an average of 36 days in March, down from 42 days in February but up from 33 days in March 2024.

The March all-cash sales share was 26% of transactions, down from 32% in February and 28% a year ago.

The March median sales price of all existing homes was $403,700, up 2.7% from last year. This marked the 21st consecutive month of year-over-year increases. The median condominium/co-op price in March was up 1.5% from a year ago at $363,000. This rate of price growth will slow as inventory increases.

In March, existing home sales declined across all four major U.S. regions. The West experienced the steepest drop, with sales falling 9.4%, followed by the South (-5.7%), the Midwest (-5.0%), and the Northeast (-2.0%). On a year-over-year basis, sales rose slightly in the West by 1.3%, declined in the South and Midwest by 4.2% and 3.1% respectively, and remained unchanged in the Northeast.

The Pending Home Sales Index (PHSI) is a forward-looking indicator based on signed contracts. The PHSI fell from 70.6 to an all-time low of 67.3 in February. This decline suggests elevated home prices and higher mortgage rates continue to constrain affordability. On a year-over-year basis, pending sales were 9.9% lower than a year ago, per National Association of Realtors data.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .