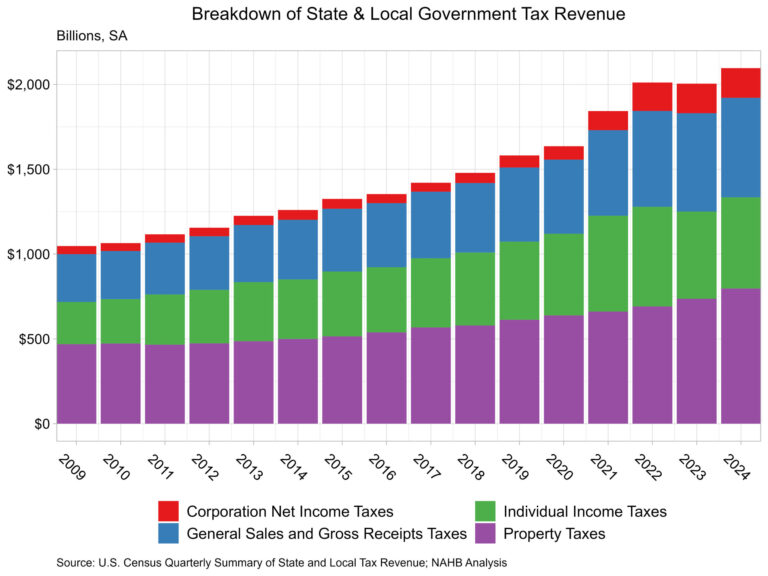

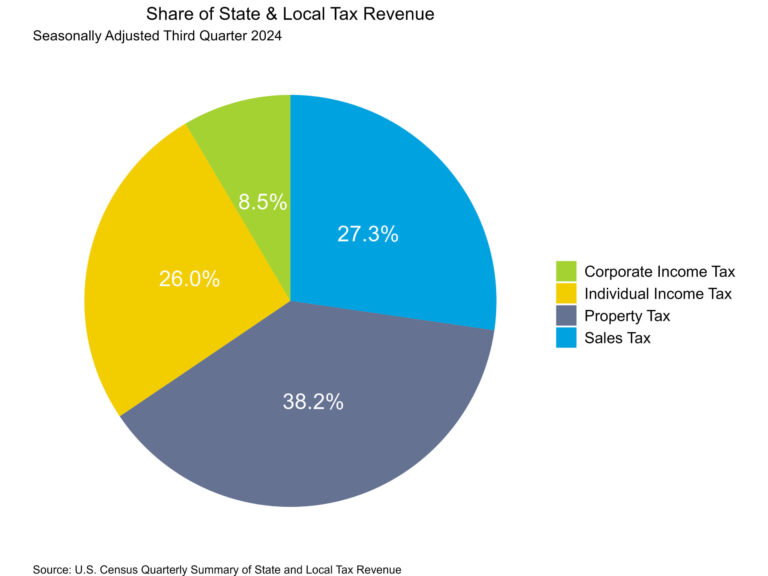

Property tax revenue collected by state and local governments reached a new high in 2024 and continued to make up a bulk of tax revenue. Total tax revenue for state and local governments also reached a high after falling in 2023, driven by higher revenue across all sources. In 2024, tax revenue totaled $2.095 trillion, up 4.6% from $2.004 trillion in 2023.

According to the Census Bureau’s Quarterly Summary of State and Local Taxes, state and local property tax revenue totaled $797.0 billion (38.0%), up 8.2% from the prior year. Individual income tax totaled $537.4 billion (25.6%), up 4.7% over the year. Corporate income tax totaled $174.5 billion (8.3%), up 0.2% and general sales tax revenue was up 1.2% to $587.0 billion (28.0%) in 2024.

State Level Detail

Separating out this summary to just the state level, property taxes accounted for only 1.6% of state tax revenue in 2024, totaling $24.3 billion. State tax revenue is mostly comprised of individual income tax and general sales tax, with individual income tax reaching $490.7 billion (32.9%) and general sales tax at $470.0 billion (31.5%) in 2024.

Additionally, the state where government tax revenue was most reliant on property tax was Vermont, where approximately 27.7% of the state’s tax revenue was from property tax. Seventeen states did not collect any tax revenue in the form of property tax. This means that for property tax within a state, all collections essentially remain at the local government level.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .