NAHB estimates that $184 billion worth of goods were used in the construction of both new multifamily and single-family housing in 2023. Additionally, we estimate that $13 billon of those goods were imported from outside of the U.S. These figures lead to 7% of all goods used in new residential construction originating from a foreign nation. This data come from the BEA input-output accounts, which reveals important details of numerous industries across the U.S. detailing what products they produce, use and import in the economy. The latest tables are from 2017 and the data is adjusted to 2023 dollar value.

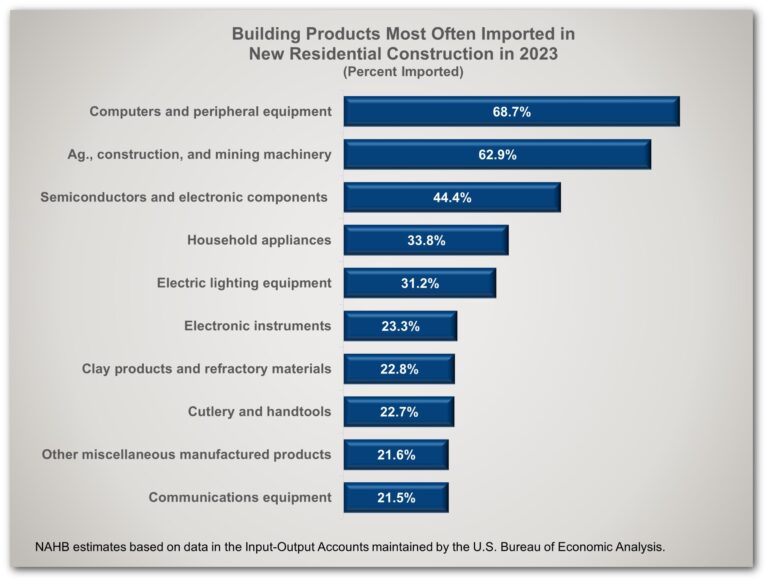

Import use varies significantly by type of building product. Shown above are the ten most import reliant products that are used in new residential construction. These products are defined by North American Industry Classification System (NAICS).

The U.S Census Bureau reports data on international trade of goods by NAICS definitions. With this, we can locate which nations are responsible for importing products used in residential construction into the U.S. Using the commodities that are used in residential construction, a significant share comes from China, at 27%. Mexico was the second most important nation with around 11% followed by Canada at 8%. Shown below are the countries with the 10 highest shares along with the remaining 27% from countries outside the top 10.

Tariff Impact

During the election campaign, President Trump promised the enactment of a tariff plan ranging from 10%-20% on imported goods, with 60% tariffs on imports from China. A tariff is essentially a tax on an imported good, meaning the importer pays an additional tax for importing such an item from another country. For example, say a business in the United States needed to purchase a $100 worth of screws from China. With a 60% tariff, the business would then need to pay an additional $60 to the U.S. Government to receive the screws. The exporter in China would still receive the $100 from the business and not pay the added tariff costs. The tariff cost falls on the importer, who would absorb the higher costs through lower profit margins or raising their own prices for consumers.

Without additional detail for these tariff proposals, it is difficult to estimate the impact of these tariffs. Using our best estimate, a 10% tariff on all imports with a 60% tariff on imports directly from China would result in a $3.2 billion increase in the cost of imported building materials used in residential construction. By product, the largest increase in cost would be for household appliances, where 54% of imports come from China, this tariff adds $670 million for these imported products. Additionally, a 20% tariff coupled with 60% imports from China would result in $4.2 billion in added cost of imported residential building products.

From Canada, the U.S. imports a significant amount of wood related products. In 2023, 70% of sawmill and wood product imports came from Canada. Many of these wood products from Canada are already subject to tariffs, with the current rate at 14.5%. Total imports of sawmill and wood products from Canada in 2023 was $5.8 billion. The highest valued import from Canada was nonferrous metals, totaling $17.6 billion in 2023.

Turning to Mexico, 71% of lime and gypsum products imported in 2023 originated from Mexico. While this share is particularly high, the total value of imports in 2023 of lime and gypsum was only $456 million. The highest valued import from Mexico at $28.6 billion in 2023 was computer equipment, where imports from Mexico made up 23% of total imports of computer equipment in 2023.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .