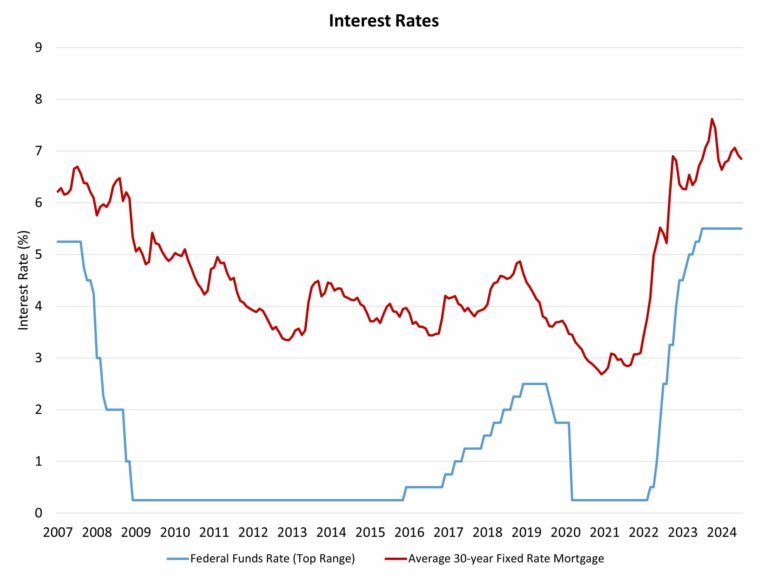

The Federal Reserve’s monetary policy committee once again held constant the federal funds rate at a top target of 5.5% at the conclusion of its July meeting. In its statement, the Federal Open Market Committee (FOMC) noted:

“Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have moderated, and the unemployment rate has moved up but remains low. Inflation has eased over the past year but remains somewhat elevated. In recent months, there has been some further progress toward the Committee’s 2 percent inflation objective.“

Compared to the Fed’s June commentary, the current statement upgraded “modest further progress” from last month to “some further progress” with respect to achieving the central bank’s 2% inflation target. This change in wording moves the Fed closer to reducing interest rates. Importantly, the July policy statement also noted:

“The Committee judges that the risks to achieving its employment and inflation goals continue to move into better balance.”

This text, previewed by various Federal Reserve officials in recent weeks, makes it clear that the Fed has now moved from a primary policy focus of reducing inflation to balancing the goals of both price stability and maximum employment. Raising the goal of maximum employment up with inflation means that the Fed is now in position to lower the fed funds rate. However, the FOMC’s statement also noted (consistent with its commentary in May and June):

The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.

This wording is a reminder that the Fed remains data-dependent. Thus, while a reduction for the federal funds rate is in view, the timing will be data-dependent on forthcoming inflation and labor market estimates. Also keep in mind, inflation does not need to be reduced to a 2% growth rate for the Fed to cut. Rather, it just needs to be on the path to reaching that goal (likely in late 2025 or early 2026).

When will the Fed cut? If the incoming inflation yield no upside surprises, a rate cut in September now appears possible, if not likely. However, the NAHB forecast remains for rate cuts to begin in December. This is a conservative outlook given the upside surprise to inflation at the start of the year and the possibility of a disappointing inflation report before the Fed’s September meeting. Fed officials have repeatedly warned that they would prefer to cut somewhat too late, rather than move too early and undermine long-term inflation expectations and central bank credibility. Nonetheless, a rate cut before the end of the calendar year seems all but certain.

This eventual easing of interest rates is coming later than most forecasters expected a year ago. This is due to an uptick in inflation at the start of 2024 and ongoing elevated measures of shelter inflation, which can only be tamed in the long-run by increases in housing supply.

Given the focus on inflation and shelter costs, higher interest rates are ironically preventing more construction by increasing the cost and limiting the availability of builder and developer loans necessary to construct new housing. With more than half of the overall gains for consumer inflation due to shelter over the last year, increasing attainable housing supply is a key anti-inflationary strategy, one that is complicated by higher short-term rates, which increase builder financing costs and hinder home construction activity. For these reasons, policy action in other areas, such as zoning reform and streamlining permitting, can be important ways for other elements of the government to fight inflation.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .