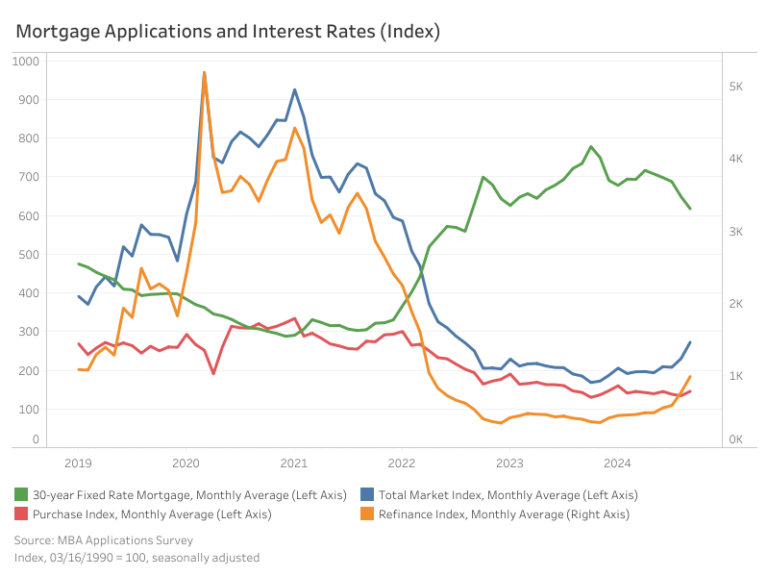

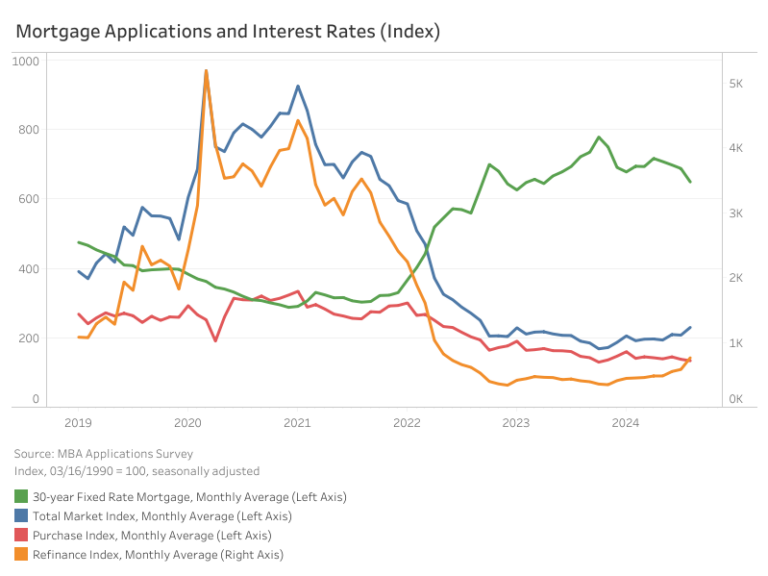

The Market Composite Index, a measure of mortgage loan application volume by the Mortgage Bankers Association’s (MBA) weekly survey, rose 18.4% month-over-month on a seasonally adjusted (SA) basis, driven primarily by a surge in refinancing activity. Compared to September 2023, the index increased by 47%. The Market Composite Index which includes the Purchase and Refinance Indices saw monthly gains, rising by 8.6% and 29%, respectively. Year-over-year, the Purchase Index showed a modest increase of 1.9%, while the Refinance Index jumped 149.9%.

The average 30-year fixed mortgage rate continued its downward trajectory for the fifth consecutive month, with September seeing a decline of 31 basis points (bps), bringing the rate to 6.18%. This is 117 bps lower than the same time last year.

Loan sizes also saw growth across the board. The average loan size for the total market (including purchases and refinances) was $400,450 on a non-seasonally adjusted (NSA) basis, an increase of 5.1% from August. Purchase loans grew by 3% to an average of $439,600, while refinance loans jumped by 11.6% to $363,825. Adjustable-rate mortgages (ARMs) saw an 8.2% increase in average loan size, rising from $1.1 million to $1.2 million.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .