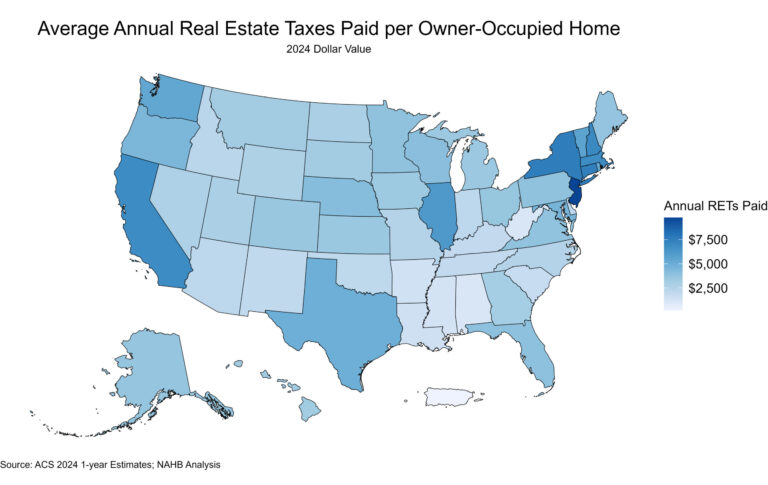

Nationally, across the 87 million owner-occupied homes in the U.S., the average amount of annual real estate taxes paid in 2024 was $4,271, according to NAHB analysis of the 2024 American Community Survey. Homeowners in New Jersey continued to pay the highest real estate taxes, paying an average of $9,767, $2,194 more than the next closest state, New York, at $7,573. On the other end of the distribution, homeowners in West Virginia paid the lowest average amount of real estate taxes at $1,044. The map below shows the geographic variation of average annual real estate taxes (RETs) paid.

The 2024 data indicate that there is no state where real estate taxes paid were on average less than $1,000, the first time in the ACS data. There continues to be noticeable differences in the average amount of taxes paid based on geographic location. States in the Northeast, where home values tend to be higher, pay more on average in real estate taxes compared to states in other parts of the nation.

Average Effective Property Tax Rates

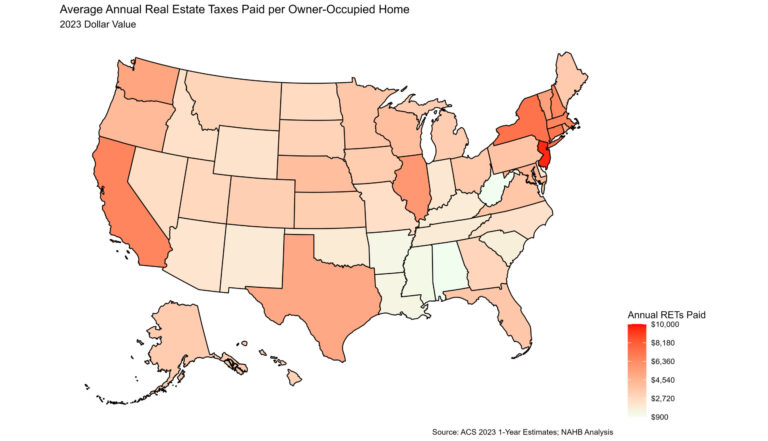

While average annual real estate taxes paid is important, it provides an incomplete picture. Property values vary across states, which explains some, if not most, of the variation across the nation in average annual real estate taxes. To control for property values and create a more informative state-by-state analysis, NAHB calculates the average effective property tax rates by dividing aggregate real estate taxes paid by aggregate value of owner-occupied housing within each state. For example, the aggregate real estate taxes paid across the U.S. was $370.0 billion with an aggregate value of owner-occupied real estate totaling $41.7 trillion in 2024. Using these two amounts, the average effective property tax rate nationally was $8.88 ($370.0 billion/$41.7 trillion) per $1,000 in home value. This effective rate can be expressed as a percentage of home value or as a dollar amount taxed per $1,000 of a home’s value. The map below displays the effective rate by state.

Illinois, for the second consecutive year, had the highest effective property tax rate at $17.93 per $1,000 of home value. Hawaii continued to have the lowest effective property tax rate at $3.08 per $1,000 of home value. Hawaii also had the highest average home value, at $1.05 million in 2024. Notably, the average effective property tax rate tends to be higher in the Northeast, in addition to the presence of higher home values.

This article was originally published by a eyeonhousing.org . Read the Original article here. .