Profitability for single-family home builders reached the highest levels in more than a decade in 2023. Industrywide profit benchmarks are important because they allow companies to compare their financial performance against the entire industry. Doing so can guide resource allocation, budgeting, and target setting for costs and expense lines. More broadly, understanding industry benchmarks can lead to an improved business strategy and to higher financial results.

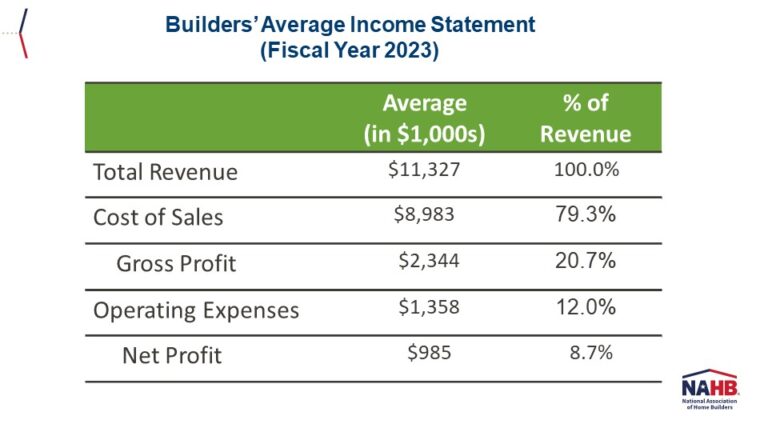

On average, builders reported $11.3 million in total revenue for fiscal year 2023. Of that, about $9.0 million (79.3%) was spent on cost of sales (i.e., land, direct and indirect construction costs), which translates into an average gross profit margin of 20.7%. Operating expenses (i.e., finance, S&M, G&A, and owner’s compensation) cost builders an average of $1.4 million (12.0% of revenue), leaving them with an average net profit margin of 8.7%. This post summarizes the results from NAHB’s most recent edition of the Builders’ Cost of Doing Business Study.

Based on historical survey data (performed every three years), the 20.7% average gross profit margin in 2023 was the highest registered since 2006 (20.8%). As a point of reference, builders’ gross margin sank to a record low of 14.4% in 2008 (i.e., during the housing recession), but bounced back steadily through 2017 (19.0%). The onset of COVID-19 in 2020 increased costs, causing builders’ average gross margin to drop (18.2%) for the first time since 2008.

The 8.7% average net profit margin for fiscal year 2023 is the highest in this survey’s recent history, exceeding the 7.7% reported in 2006. However, increased use of financial incentives, such as mortgage rate buydowns, and cuts in home prices are likely to have caused this margin to shrink in 2024.

The Cost of Doing Business Study also tracks builders’ balance sheets. On average, builders reported $7.2 million in total assets on their 2023 balance sheets. Of that, $4.5 million (62%) was financed by liabilities (either short- or long-term) and the other $2.7 million (38%) by equity builders held in their companies.

Historical data show the average $7.2 million in total assets in 2023 was 23% lower than in 2020 ($9.4 million), and builders’ lowest asset level since 2010 ($6.2 million). But perhaps more important than fluctuations in the size of their balance sheets, the data reveal a long-term decline in builders’ reliance on debt to finance their operations: in 2006, 74% of their assets were backed up by debt; by 2020, the share was down 10 points to 64%; and by 2023, it dropped to a record low of 62%. Logically, the latter means builders are using more of their own capital to run their companies, as illustrated by their equity share rising from 26% of assets in 2006 to 38% in 2023.

The NAHB Economics team will conduct a Cost of Doing Business Study for residential remodelers in the spring of 2025. If that is your firm’s primary activity, please consider participating in this confidential survey. We simply can’t produce benchmarks without your input. To participate, please complete this form. A summary of the most recent profitability benchmarks for residential remodelers is available in this blog post.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .