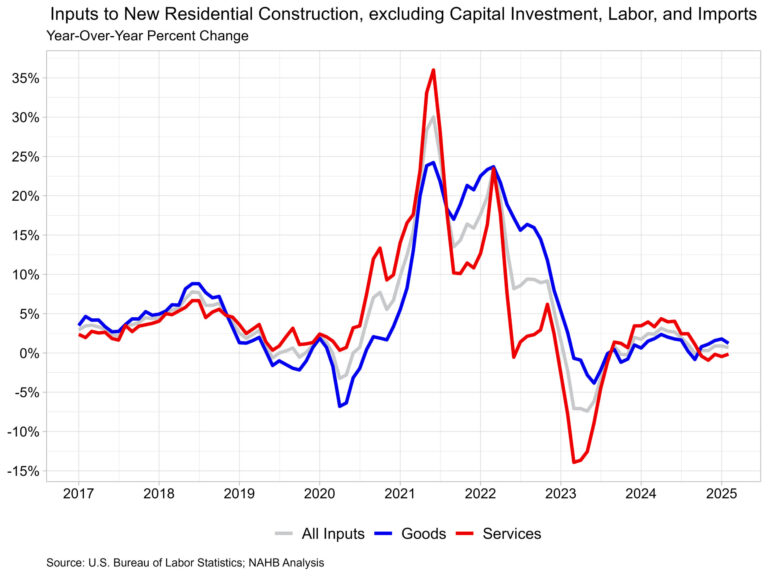

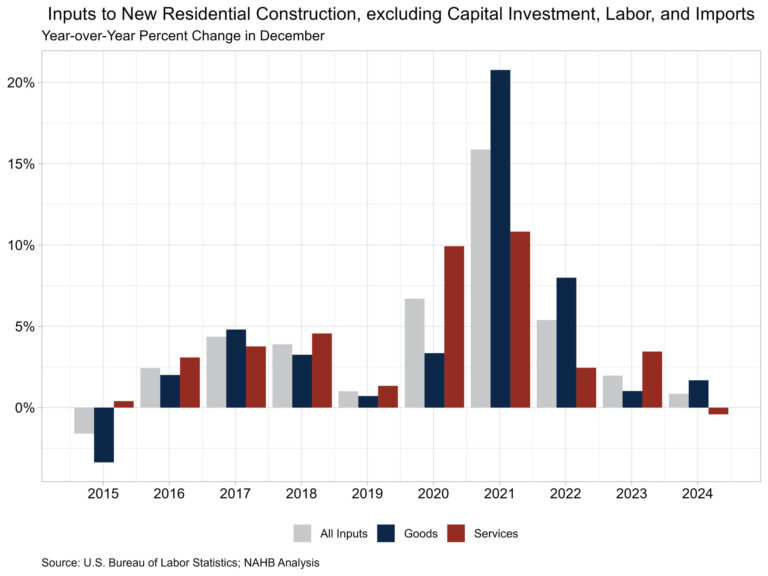

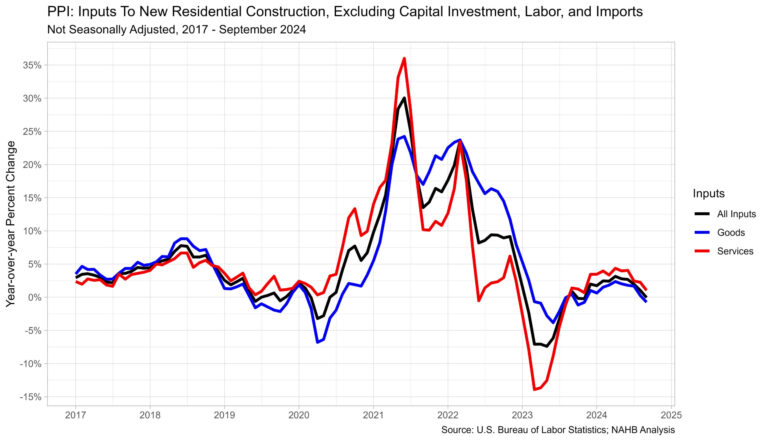

Prices for inputs to new residential construction—excluding capital investment, labor, and imports—were up 0.5% in February according to the most recent Producer Price Index (PPI) report published by the U.S. Bureau of Labor Statistics. The increase in January was revised downward to 1.1%. The Producer Price Index measures prices that domestic producers receive for their goods and services, this differs from the Consumer Price Index which measures what consumers pay and includes both domestic products as well as imports.

The inputs to the New Residential Construction Price Index grew 0.7% from February of last year. The index can be broken into two components—the goods component increased 1.2% over the year, while services decreased 0.1%. For comparison, the total final demand index, which measures all goods and services across the economy, increased 3.2% over the year, with final demand with respect to goods up 1.7% and final demand for services up 3.9% over the year.

Input Goods

The goods component has a larger importance to the total residential construction inputs price index, representing around 60%. For the month, the price of input goods to new residential construction was up 0.6% in February.

The input goods to residential construction index can be further broken down into two separate components, one measuring energy inputs with the other measuring goods less energy inputs. The latter of these two components simply represents building materials used in residential construction, which makes up around 93% of the goods index.

Energy input prices grew 2.6% between January and February but remained 8.5% lower compared to one year ago. Building material prices were up 0.5% between January and February while they were up 2.0% compared to one year ago.

Among materials used in residential construction, lumber and wood products ranks 3rd in terms of importance for the Inputs to New Residential Construction Index. Nonmetallic mineral products and metal products rank 1st and 2nd, respectively. The top lumber and wood products include general millwork, prefabricated structural members, not-edge worked softwood lumber, softwood veneer/plywood and hardwood veneer/plywood. Prices for these wood commodities experienced little growth for most of 2024. Currently, softwood lumber prices were 11.7% higher compared to one year ago while on a monthly basis, prices rose 3.0%. This marks the fourth straight month where yearly price growth was above 10% for softwood lumber.

Input Services

While prices of inputs to residential construction for services were down 0.1% over the year, they were up 0.4% in February from January. The price index for service inputs to residential construction can be broken out into three separate components: a trade services component, a transportation and warehousing services component, and a services excluding trade, transportation and warehousing component. The most significant component is trade services (around 60%), followed by services less trade, transportation and warehousing (around 29%), and finally transportation and warehousing services (around 11%). The largest component, trade services, was down 1.5% from a year ago. The services less trade, transportation and warehousing component was up 1.6% over the year. Lastly, prices for transportation and warehousing services advanced 2.2% compared to February last year.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .

Make it clear that you place great emphasis on quality and that quality has its price. After all, you want to work with clients who appreciate good work and are willing to pay for it. This willingness on the part of your client may (or may not) become apparent early on.

Luisa Haase-Kiewning of Lu Interior Berlin, for example, started charging an extra fee several years ago. She charges for her time spent on the initial meeting as well as for travel time. This is justified as she arrives prepared and with good ideas after completing a certain amount of preparatory work prior to meeting with her clients.

And remember, if your client is not willing to pay for quality, it could be a warning sign that working together may not be smooth — or possible.

Lara Theel, managing director of Stand Out Design, recommends a similar approach. Explain to your clients, from the smallest to the largest items, how rising prices have affected the elements and materials in their project. Point out how companies that don’t pass along some of the current price increases are cutting back in other places.

Theel and her team focus on “longevity, quality and sustainability” and customers appreciate that.

Tip: Positive reviews on your Houzz profile and a visible Best of Houzz award help build trust and distinguish your excellent work from competitors.