Builder sentiment held steady to end the year as high home prices and mortgage rates offset renewed hope about a better regulatory business climate in 2025. Along those lines, builders expressed increased optimism for higher sales expectations in the next months.

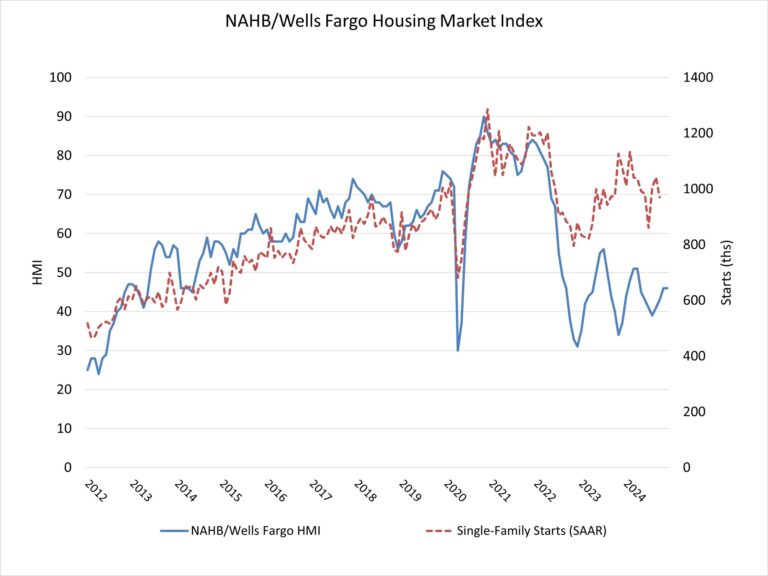

Builder confidence in the market for newly built single-family homes was 46 in December, the same reading as last month, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI).

While builders are expressing concerns that high interest rates, elevated construction costs and a lack of buildable lots continue to act as headwinds, they are also anticipating future regulatory relief in the aftermath of the election. This is reflected in the fact that future sales expectations have increased to a nearly three-year high.

NAHB is forecasting additional interest rate cuts from the Federal Reserve in 2025, but with inflation pressures still present, we have reduced that forecast from 100 basis points to 75 basis points for the federal funds rate. Concerns over inflation risks in 2025 will keep long-term interest rates, like mortgage rates, near current levels with mortgage rates remaining above 6%.

The latest HMI survey also revealed that 31% of builders cut home prices in December, unchanged from November. Meanwhile, the average price reduction was 5% in December, the same rate as in November. The use of sales incentives was 60% in December, also unchanged from November.

Derived from a monthly survey that NAHB has been conducting for more than 35 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The HMI index gauging current sales conditions held steady at 48 while the gauge charting traffic of prospective buyers posted a one-point decline to 31. The component measuring sales expectations in the next six months rose three points to 66, the highest level since April 2022.

Looking at the three-month moving averages for regional HMI scores, the Northeast increased two points to 57, the Midwest moved two points higher to 46, the South posted a two-point gain to 44 and the West fell one point to 40. The HMI tables can be found at nahb.org/hmi.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.