Constrained housing affordability conditions due to elevated interest rates, rising construction costs and labor shortages led to a reduction in housing production in March.

Overall housing starts decreased 11.4% in March to a seasonally adjusted annual rate of 1.32 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

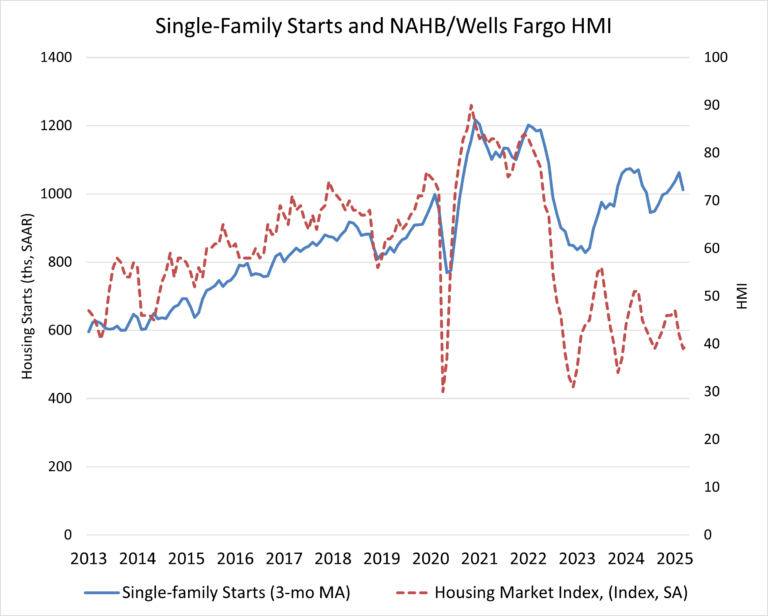

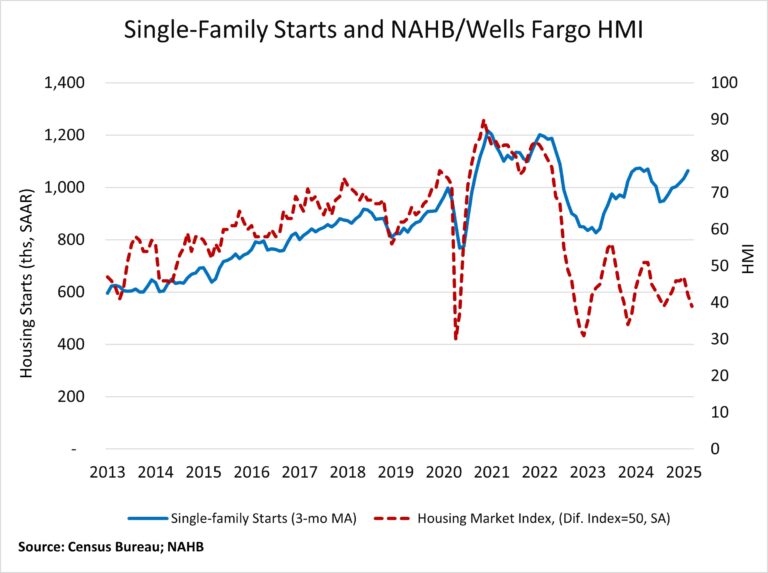

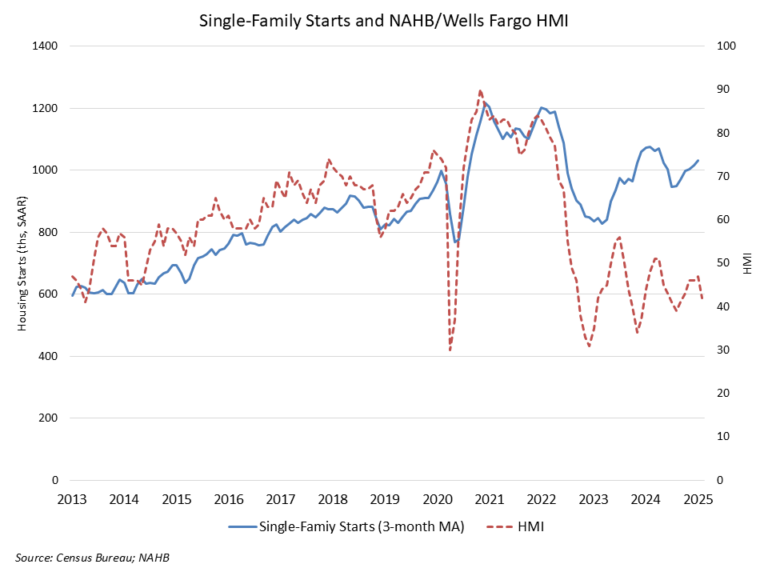

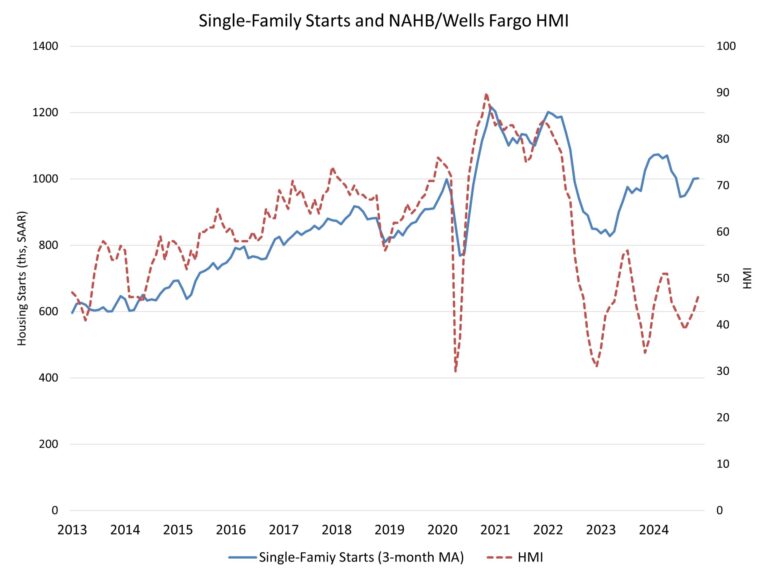

The March reading of 1.32 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts decreased 14.2% to a 940,000 seasonally adjusted annual rate over the month and are down 9.7% compared to March 2024. On a year-to-date basis, single-family starts are down 5.6%. The three-month moving average (a useful gauge given recent volatility) is down to 1.01 million units, as charted below.

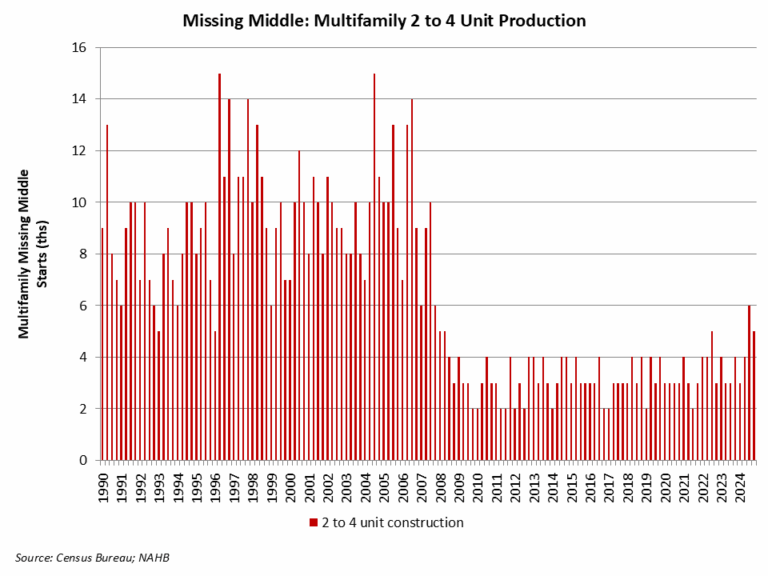

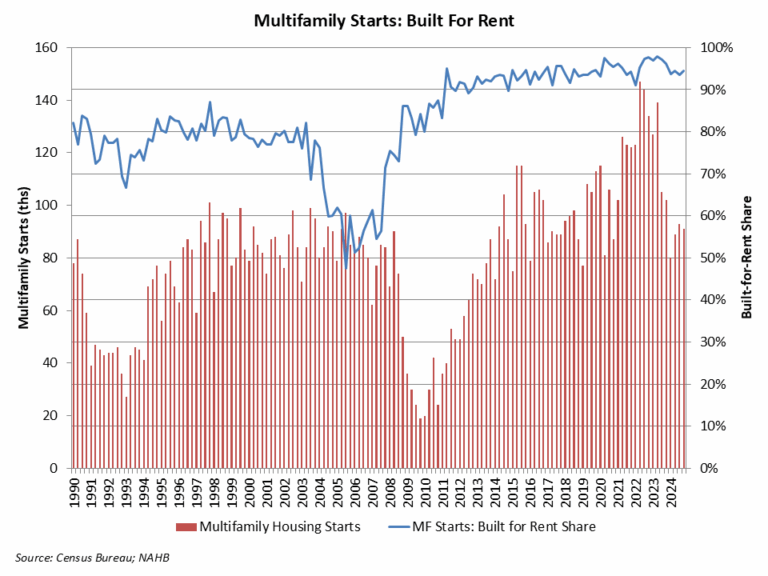

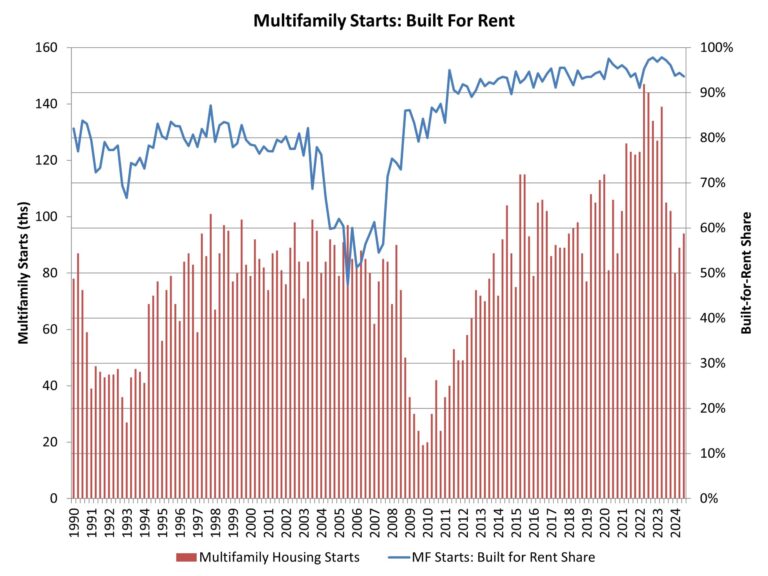

The multifamily sector, which includes apartment buildings and condos, decreased 3.5% to an annualized 384,000 pace. The three-month moving average for multifamily construction has trended upward to a 381,000-unit annual rate. On a year-over-year basis, multifamily construction is up 48.8%.

On a regional and year-to-date basis, combined single-family and multifamily starts were 10.6% higher in the West, 8.6% higher in the Northeast, 3.3% higher in the Midwest, and 8.5% lower in the South.

The total number of single-family homes and apartments under construction was 1.4 million in March. This is the lowest total since July 2021. Total housing units now under construction are 15.2% lower than a year ago. Single-family units under construction fell to a count of 632,000—down 8.7% compared to a year ago. The number of multifamily units under construction has fallen to 759,000 units. This is down 20.0% compared to a year ago.

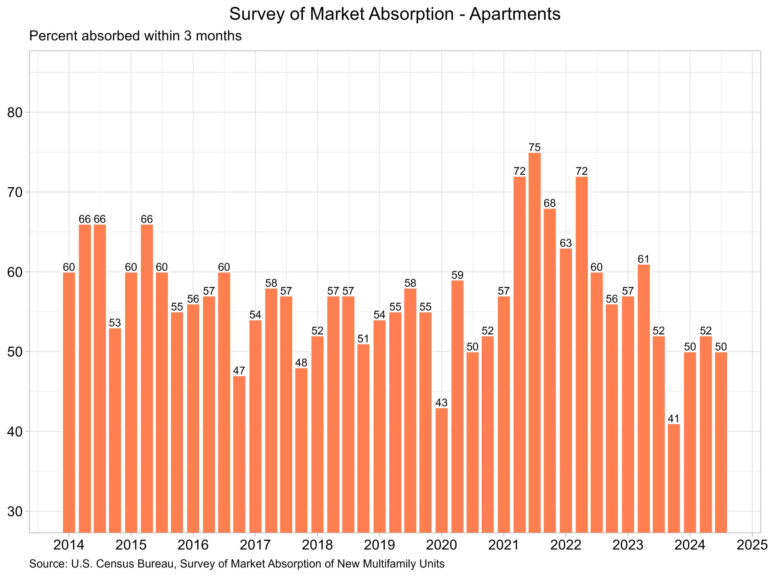

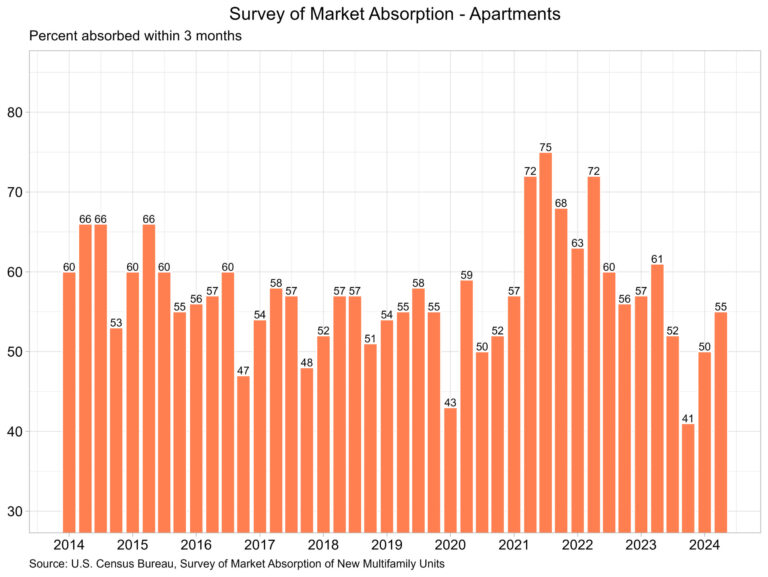

On a 3-month moving average basis, there are currently 1.5 apartments completing construction for every one that is beginning construction. While apartment construction starts are down, the number of completed units entering the market is rising due to prior elevated construction levels. Year-to-date, the pace of completions for apartments in buildings with five or more units is down 3.5% in 2025 compared to 2024. An elevated pace of completions in 2025 for multifamily construction will place some downward pressure on rent growth.

Overall permits increased 1.6% to a 1.48-million-unit annualized rate in March. Single-family permits decreased 2.0% to a 978,000-unit rate. Multifamily permits increased 9.3% to a 504,000 pace.

Looking at regional permit data on a year-to-date basis, permits were 4.7% higher in the Midwest, 0.4% higher in the South, 8.8% lower in the West and 24.7% lower in the Northeast.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .