Home price growth continued to slow in September, growing at a rate just below 4% year-over-year. The S&P CoreLogic Case-Shiller Home Price Index (seasonally adjusted – SA) posted a 3.89% annual gain, down from a 4.28% increase in August. The S&P CoreLogic Case-Shiller HPI year-over-year rate has decelerated for the seventh consecutive month, peaking at 6.54% in February 2024. Meanwhile, the Federal Housing Finance Agency Home Price Index (SA) grew at a rate of 4.36%, stagnant from the previous month.

By Metro Area

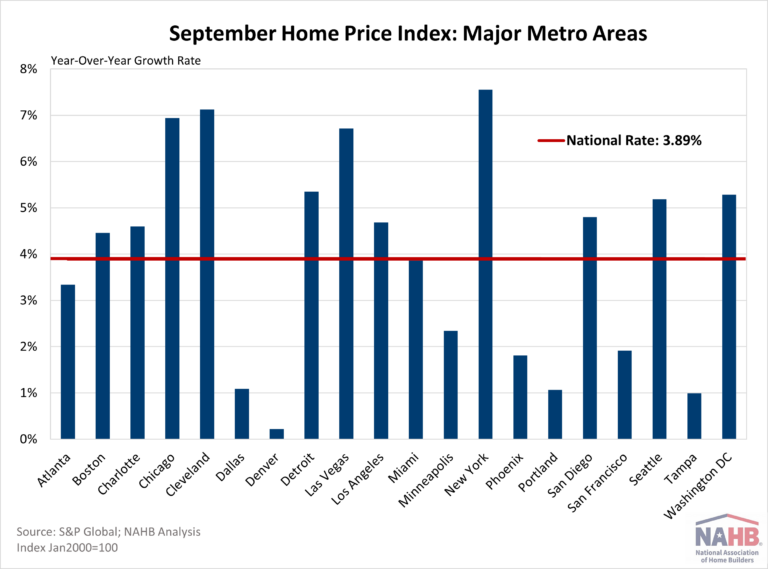

In addition to tracking national home price changes, the S&P CoreLogic Index (SA) also reports home price indexes across 20 metro areas. Compared to last year, all 20 metro areas reported a home price increase. There were 11 metro areas that grew more than the national rate of 3.89%. The highest annual rate was New York at 7.55%, followed by Cleveland at 7.13% and Chicago at 6.94%. The smallest home price growth over the year was seen by Denver at 0.22%, followed by Tampa at 0.99%, and Portland at 1.07%.

By Census Division

Monthly, the FHFA Home Price Index (SA) publishes not only national data but also data by census division. The highest year-over-year rate for September was 7.10% in the Middle Atlantic division, while the lowest was 1.16% in the West South Central division. Most divisions saw an increase from last month as shown in the chart below except for the West South Central and East North Central divisions. The FHFA Home Price Index releases their metro and state data on a quarterly basis, which NAHB analyzed in a previous post.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .