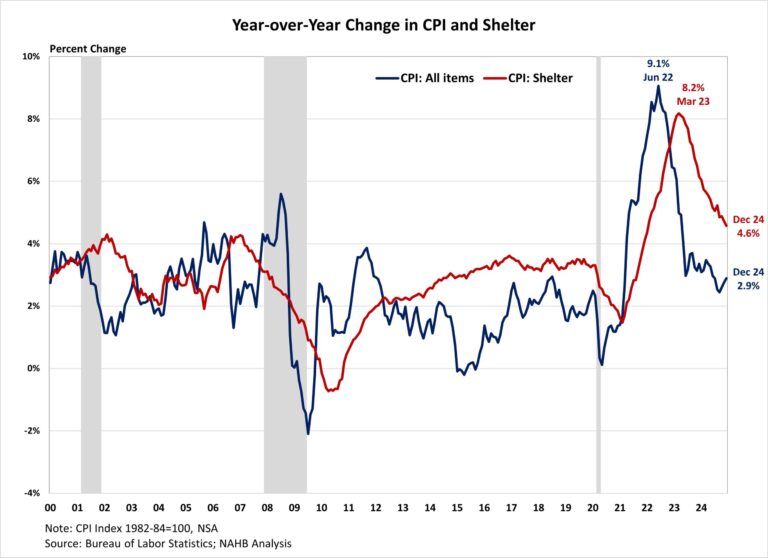

Inflation edged up to a five-month high in December as energy prices surged, accounting for more than 40% of the monthly headline increase. Inflation ended 2024 at a 2.9% rate, down from 3.4% a year ago, although the last mile to the Fed’s 2% target continues to be challenging. While core inflation remained stubborn due to elevated shelter and other service costs, housing costs showed signs of cooling – the year-over-year change in the shelter index remained below 5% for a fourth straight month and posted its lowest annual gain since January 2022, suggesting a continued moderation in housing inflation.

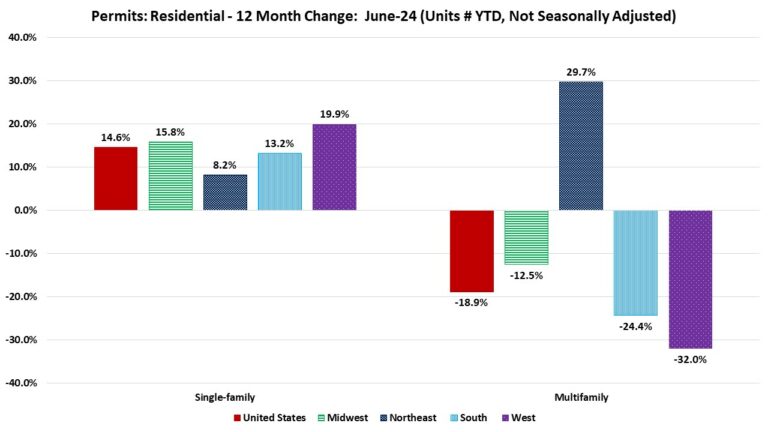

While the Fed’s interest rate cuts could help ease some pressure on the housing market, its ability to address rising housing costs is limited, as these increases are driven by a lack of affordable supply and increasing development costs. In fact, tight monetary policy hurts housing supply because it increases the cost of AD&C financing. This can be seen on the graph below, as shelter costs continue to rise at an elevated pace despite Fed policy tightening. Additional housing supply is the primary solution to tame housing inflation.

Furthermore, the election result has put inflation back in the spotlight and added additional risks to the economic outlook. Proposed tax cuts and tariffs could increase inflationary pressures, suggesting a more gradual easing cycle with a slightly higher terminal federal funds rate. However, economic growth could also be higher with lower regulatory burdens. Given the housing market’s sensitivity to interest rates, a higher inflation path could extend the affordability crisis and constrain housing supply as builders continue to grapple with lingering supply chain challenges. During the past twelve months, on a non-seasonally adjusted basis, the Consumer Price Index rose by 2.9% in December, according to the Bureau of Labor Statistics’ report. This followed a 2.7% year-over-year increase in November. Excluding the volatile food and energy components, the “core” CPI increased by 3.2% over the past twelve months, after holding steady at 3.3% for three months. The component index of food rose by 2.5%, while the energy component index fell by 0.5%.

On a monthly basis, the CPI rose by 0.4% in December on a seasonally adjusted basis, after a 0.3% increase in November. The “core” CPI increased by 0.2% in December, after rising 0.3% for three consecutive months.

The price index for a broad set of energy sources rose by 2.6% in December, with increases across all categories including gasoline (+4.4%), fuel oil (+4.4%), natural gas (+2.4%) and electricity (+0.3%). Meanwhile, the food index rose 0.3%, after a 0.4% increase in November. Both indexes for food away from home and food at home increased by 0.3%.

The index for shelter (+0.3%) was the largest contributor to the monthly increase in all items index, accounting for nearly 37% of the total increase. Other top contributors that rose in December include indexes for airline fares (+3.9%), used cars and trucks, (+1.2%) and new vehicles (+0.5%). Meanwhile, the index for personal care (-0.2%) was among the few major indexes that decreased over the month. The index for shelter makes up more than 40% of the “core” CPI, rose by 0.3% in December, the same increase last month. Both indexes for owners’ equivalent rent (OER) and rent of primary residence (RPR) increased by 0.3% over the month. Despite the moderation, shelter costs remained the largest contributors to headline inflation.

NAHB constructs a “real” rent index to indicate whether inflation in rents is faster or slower than overall inflation. It provides insight into the supply and demand conditions for rental housing. When inflation in rents is rising faster than overall inflation, the real rent index rises and vice versa. The real rent index is calculated by dividing the price index for rent by the core CPI (to exclude the volatile food and energy components). In December, the Real Rent Index rose by 0.1%. Over the twelve months of 2024, the monthly growth rate of the Real Rent Index averaged 0.1%, slower than the average of 0.2% in 2023.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .