Single-family starts posted a solid gain in August on robust demand and moderating mortgage rates even as builders continue to grapple with challenges related to lot and labor shortages and elevated prices for many building materials.

Overall housing starts increased 9.6% in August to a seasonally adjusted annual rate of 1.36 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

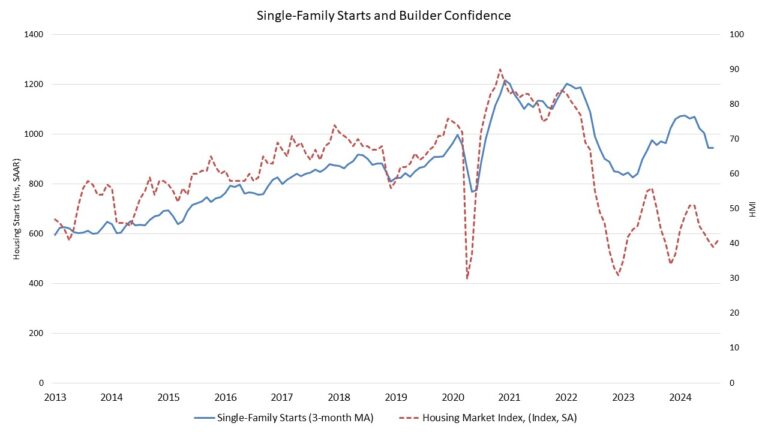

The August reading of 1.36 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts increased 15.8% to a 992,000 seasonally adjusted annual rate. On a year-over-year basis, single-family starts are up 5.2% compared to August 2023. On a year-to-date basis, single-family starts are up 10.4%. The three-month moving average (a useful gauge given recent volatility) is down to 944,000 units, as charted below.

The multifamily sector, which includes apartment buildings and condos, decreased 4.2% to an annualized 364,000 pace. The three-month moving average for multifamily construction has trended upward to a 363,000-unit annual rate. On a year-over-year basis, multifamily construction is up 0.6%.

On a regional and year-to-date basis, combined single-family and multifamily starts are 1.9% lower in the Midwest, 2.1% lower in the Northeast, 4.4% lower in the West and 4.6% lower in the South.

The total number of single-family homes and apartments under construction was 1.5 million in August. This is the lowest total since November 2021. Total housing units now under construction are 11.1% lower than a year ago. Single-family units under construction fell to a count of 642,000—down 5.2% compared to a year ago. The number of multifamily units under construction has fallen to 867,000 units. This is down 15.0% compared to a year ago.

On a 3-month moving average basis, there are currently 1.8 apartments completing construction for every one that is beginning construction. While apartment construction starts are down, the number of completed units entering the market is rising due to prior elevated construction levels. Year-to-date, the pace of completions for apartments in buildings with five or more units is up 36.7% in 2024 compared to 2023. A higher pace of completions in 2024 for multifamily construction will place some downward pressure on rent growth.

Overall permits increased 4.9% to a 1.48-million-unit annualized rate in August. Single-family permits increased 2.8% to a 967,000 unit rate. Multifamily permits increased 9.2% to an annualized 508,000 pace.

Looking at regional data on a year-to-date basis, permits are 2.1% higher in the Midwest, 0.7% higher in the Northeast, 1.1% lower in the South and 6.2% lower in the West.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .