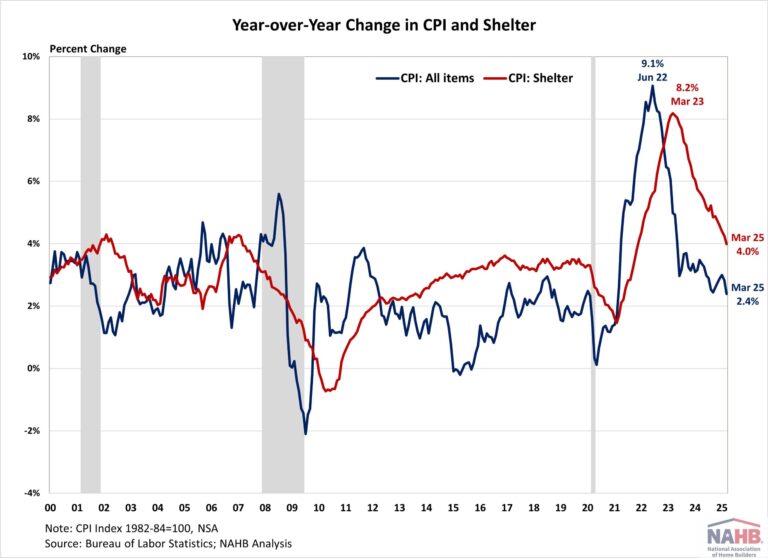

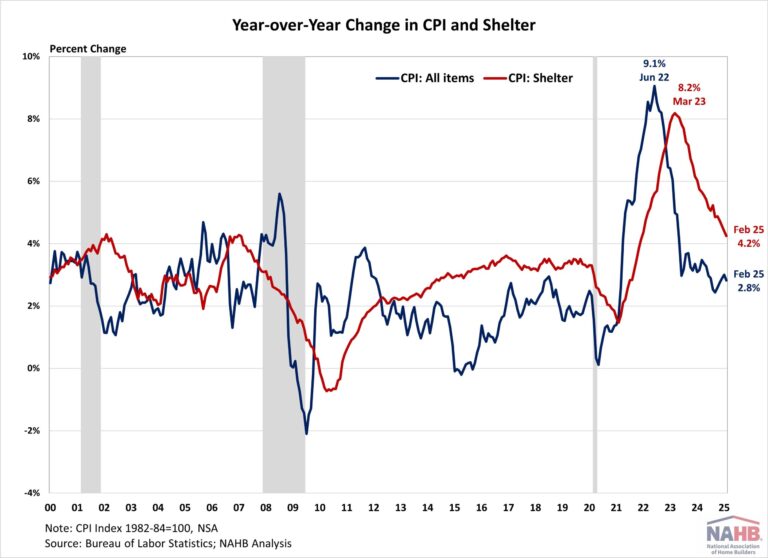

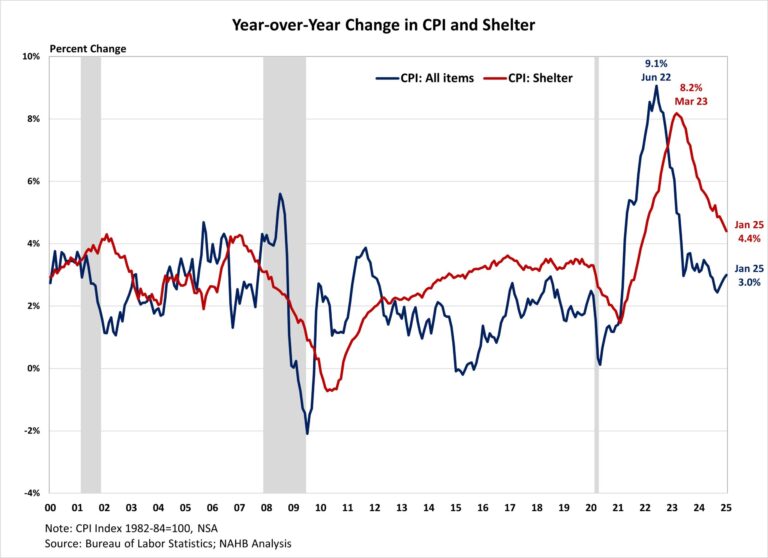

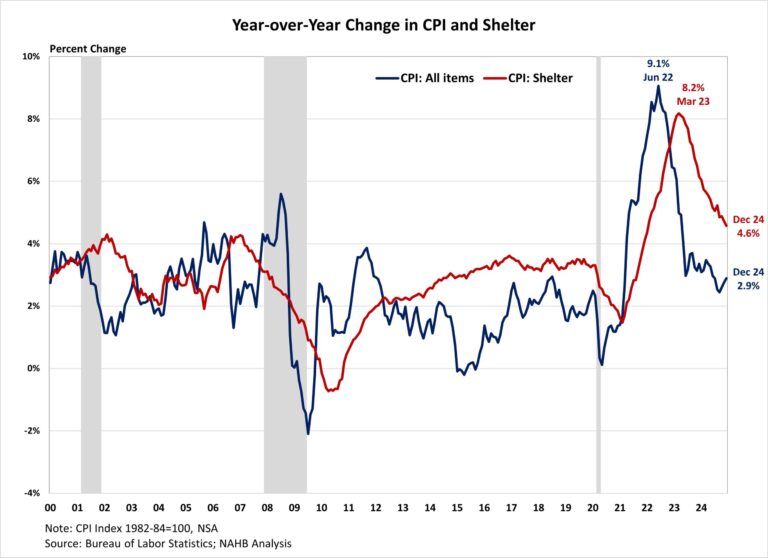

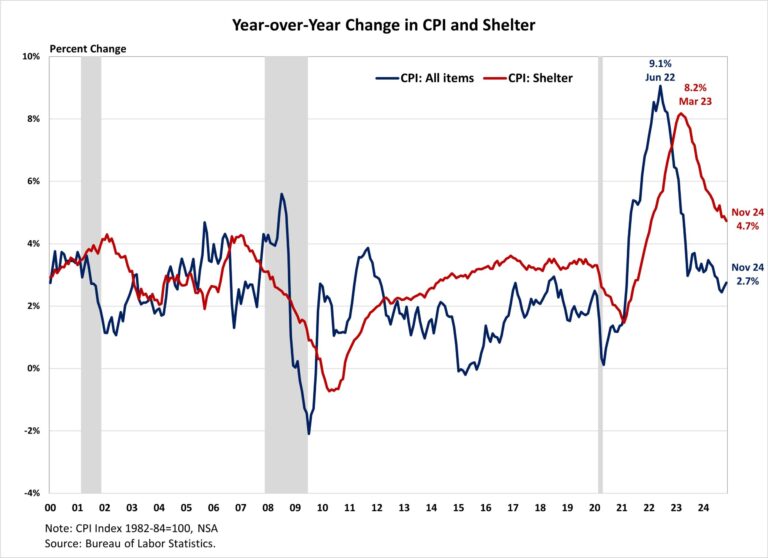

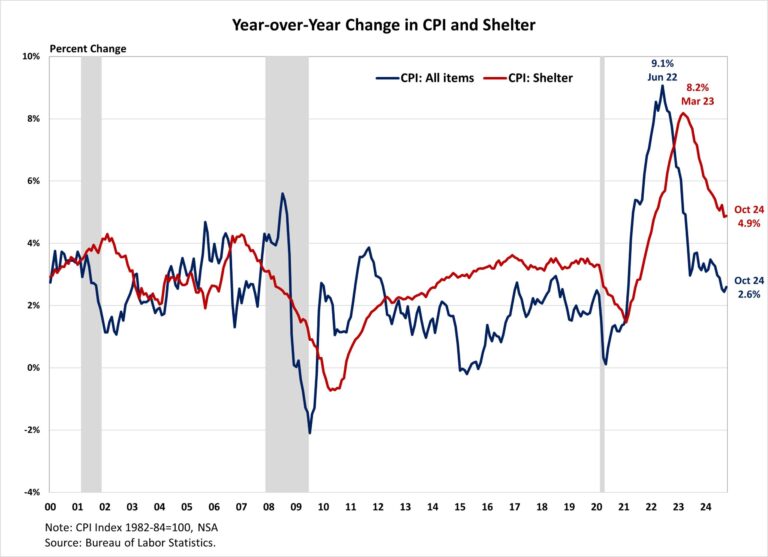

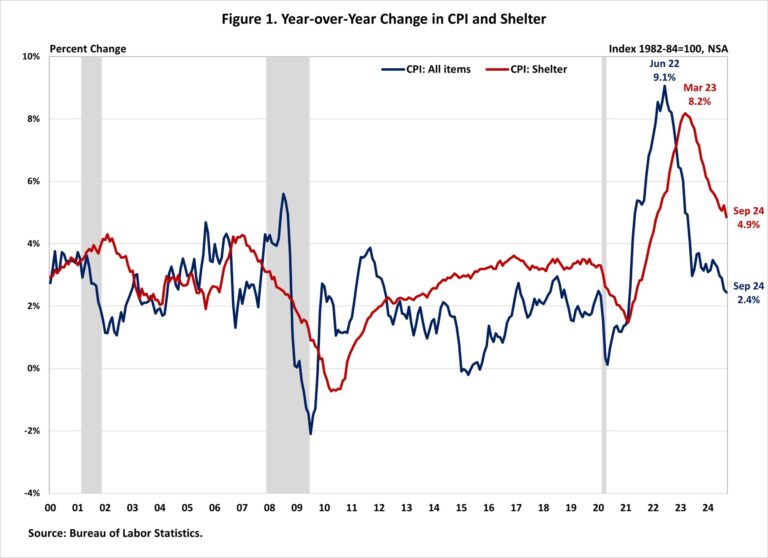

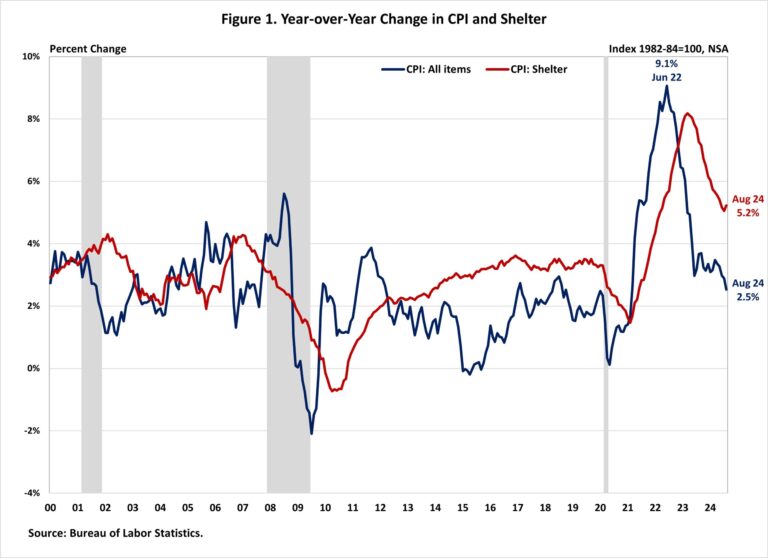

Inflation slowed to a 6-month low in March, largely driven by lower energy costs, especially in gasoline prices. Despite the easing, the report likely only captures part of the first wave of global tariffs announcement. The inflationary pressure from tariffs and escalating trade war continues to threaten the economic growth and complicate the Fed’s path to its 2% target. Meanwhile, while housing inflation remains elevated, it continues to show signs of cooling – the year-over-year change in the shelter index remained below 5% for a seven straight month and posted its lowest annual gain since November 2021.

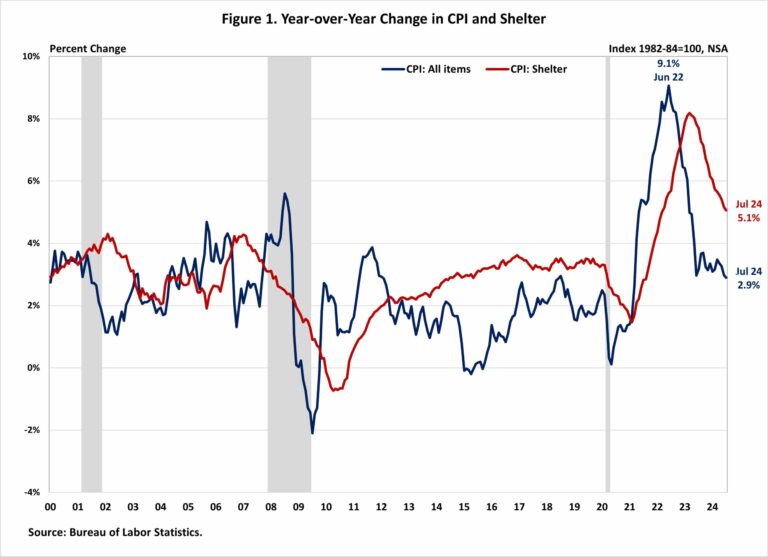

While the Fed’s interest rate cuts could help ease some pressure on the housing market, its ability to address rising housing costs is limited, as these increases are driven by a lack of affordable supply and increasing development costs. In fact, tight monetary policy hurts housing supply because it increases the cost of AD&C financing. This can be seen on the graph below, as shelter costs continue to rise at an elevated pace despite Fed policy tightening. Additional housing supply is the primary solution to tame housing inflation and with it, overall inflation. This emphasizes why the cost of construction, including the cost of building materials, matters not just for housing but also the inflation outlook and the path of future monetary policy.

Consequently, the election result has put inflation back in the spotlight and added additional upside and downside risks to the economic outlook. Proposed tax cuts and tariffs could increase inflationary pressures, suggesting a more gradual easing cycle with a slightly higher terminal federal funds rate. However, economic growth could also be higher with lower regulatory burdens. Given the housing market’s sensitivity to interest rates, a higher inflation path could extend the affordability crisis and constrain housing supply as builders continue to grapple with lingering supply chain challenges.

During the past twelve months, on a non-seasonally adjusted basis, the Consumer Price Index rose by 2.4% in March, according to the Bureau of Labor Statistics’ report. This followed a 2.8% year-over-year increase in February. Excluding the volatile food and energy components, the “core” CPI increased by 2.8% over the past twelve months, the smallest increase since March 2021. A large portion of the “core” CPI is the housing shelter index, which increased 4.0% over the year, the smallest year-over-year increase since November 2021. Meanwhile, the component index of food rose by 3.0%, and the energy component index fell by 3.3%.

On a monthly basis, the CPI fell by 0.1% in March (seasonally-adjusted), after a 0.2% increase in February. This was the first time the monthly CPI has fallen since May 2020. The “core” CPI increased by 0.1% in March.

The price index for a broad set of energy sources fell by 2.4% in March, with declines in gasoline (-6.3%) offset by increases in electricity (+0.9%) andnatural gas (+3.6%). Meanwhile, the food index rose 0.4%, after a 0.2% increase in February. The index for food away from home increased by 0.4% and the index for food at home rose by 0.5%.

Despite the overall monthly CPI decline, several indexes increased in March including personal care (+1.0%), medical care (+0.2%), education (+0.4%), apparel (+0.4%), as well as new vehicles (+0.1%). Meanwhile, the index for airline fares (-5.3%), used cars and trucks (-0.7%) and recreation (-0.3%) were among the major indexes that decreased over the month.

The index for shelter makes up more than 40% of the “core” CPI, rose by 0.2% in March, following an increase of 0.3% in February. The index for owners’ equivalent rent (OER) rose by 0.4% and index for rent of primary residence (RPR) increased by 0.3% over the month. Despite the moderation, shelter costs remained the largest contributors to headline inflation.

NAHB constructs a “real” rent index to indicate whether inflation in rents is faster or slower than core inflation. It provides insight into the supply and demand conditions for rental housing. When inflation in rents is rising faster than core inflation, the real rent index rises and vice versa. The real rent index is calculated by dividing the price index for rent by the core CPI (to exclude the volatile food and energy components).

In March, the Real Rent Index rose by 0.3%. Over the first three months of 2025, the monthly growth rate of the Real Rent Index averaged at 0.1%, higher than 0.0% from the same period in 2024.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .