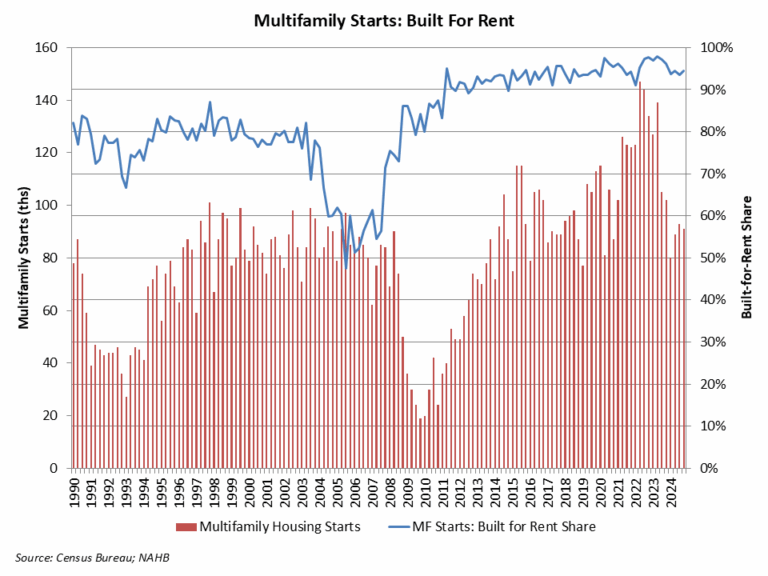

According to NAHB analysis of quarterly Census data, the count of multifamily, for-rent housing starts declined during the fourth quarter of 2024. For the quarter, 91,000 multifamily residences started construction. Of this total, 86,000 were built-for-rent. This was almost 12% lower than the fourth quarter of 2023.

The market share of rental units of multifamily construction starts ticked higher to 95% for the fourth quarter. A historical low market share of 47% for bult-for-rent multifamily construction was set during the third quarter of 2005, during the condo building boom. An average share of 80% was registered during the 1980-2002 period.

For the fourth quarter, there were 5,000 multifamily condo unit construction starts, up from 4,000 a year ago.

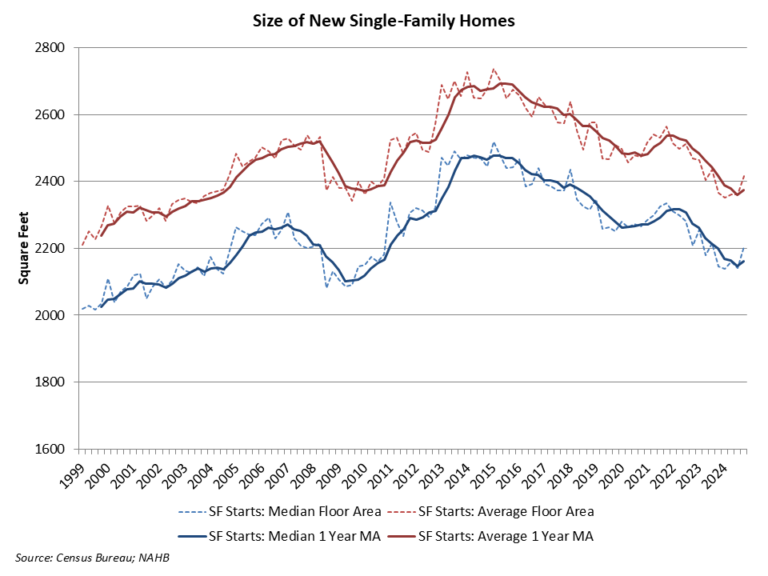

An elevated rental share of multifamily construction is holding typical apartment size below levels seen during the pre-Great Recession period. However, according to the fourth quarter 2024 data, the average square footage of multifamily construction starts moved higher to 1,129 square feet. The median edged up to 1,039 square feet. These are notable moves higher off of multidecade lows.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .

Make it clear that you place great emphasis on quality and that quality has its price. After all, you want to work with clients who appreciate good work and are willing to pay for it. This willingness on the part of your client may (or may not) become apparent early on.

Luisa Haase-Kiewning of Lu Interior Berlin, for example, started charging an extra fee several years ago. She charges for her time spent on the initial meeting as well as for travel time. This is justified as she arrives prepared and with good ideas after completing a certain amount of preparatory work prior to meeting with her clients.

And remember, if your client is not willing to pay for quality, it could be a warning sign that working together may not be smooth — or possible.

Lara Theel, managing director of Stand Out Design, recommends a similar approach. Explain to your clients, from the smallest to the largest items, how rising prices have affected the elements and materials in their project. Point out how companies that don’t pass along some of the current price increases are cutting back in other places.

Theel and her team focus on “longevity, quality and sustainability” and customers appreciate that.

Tip: Positive reviews on your Houzz profile and a visible Best of Houzz award help build trust and distinguish your excellent work from competitors.