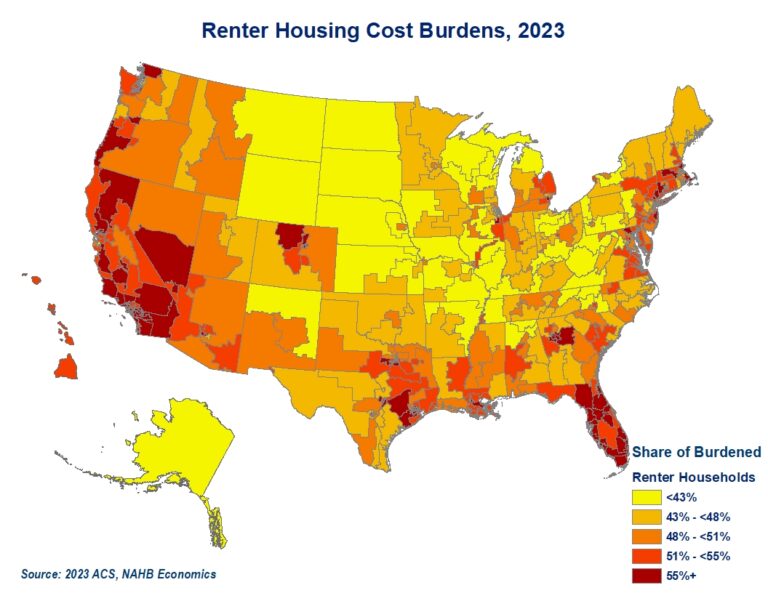

With elevated interest rates and rising home prices, 103.5 million households in the United States cannot afford a $495,750 median-priced new home. The growing affordability crisis makes housing a top issue for voters in the 2024 presidential election. Both presidential candidates have offered housing policy proposals to address our nation’s housing supply and affordability challenges.

Homeownership has been a crucial part of the American Dream for over a century as owning a home not only provides households with a stable place to live, but also offers an opportunity for households to accumulate assets and build wealth over time through equity.

A recent NAHB study on home buyer preferences revealed that a single-family detached home remained the top purchase preference for two out of every three buyers. In reality, only 54% of the total housing units in 2023 were owner-occupied single-family detached homes, according to NAHB analysis of American Community Survey (ACS) data. This equates to around 70 million homes of the total 131 million housing units.

In addition, a recent article in the Washington Post stated that “the new American Dream should be a townhouse (using the term of single-family attached homes in this post).” The article argues that townhouses are more affordable, need less maintenance, and foster a sense of community. Additionally, townhomes in medium-density residential neighborhoods can be a good option for younger home buyers. However, owner-occupied single-family attached homes only accounted for 4% of the total occupied housing units in 2023.

Single-Family Detached Homes Across Congressional Districts

Across congressional districts, the share of single-family detached homes among all owner-occupied housing units varies substantially, ranging from 3% to 95%.

Texas has a high share of owner-occupied single-family homes. Texas’s 20th congressional district has the highest share of single-family detached homes. All congressional districts in Texas have at least an 83% share of single-family detached homes. Four districts in Texas, two in Indiana and Nebraska, one in Iowa, and one in California report the top ten highest share of single-family detached homes.

At the bottom of the ranking, congressional districts in New York and Pennsylvania are on the list of the ten lowest shares of single-family detached homes. New York’s 12th, 13th, and 10th, where renter-occupied housing units exceed owner-occupied ones, have the lowest share with 3%, 4%, and 5%, respectively. In addition to a lower share of single-family detached homes, New York’s 12th and 13th have a low share of single-family attached homes, with 2% for both districts. In the District of Columbia, at-large, 22% of owner-occupied single-family housing units are detached, ranked as the 12th lowest share.

Despite the geographic variation, single-family detached homes dominate most of the owner-occupied housing markets. Out of all 436 congressional districts, only 18 congressional districts have a lower share of single-family detached homes than the national level of 54%.

Single-Family Attached Homes Across Congressional Districts

Although single-family attached homes are not as popular as single-family detached homes in the owner-occupied housing market, the share of single-family attached homes shows substantial variation across congressional districts, ranging from 0% to 78%.

Pennsylvania’s 3rd congressional district has about 78% single-family attached homes, followed by Pennsylvania’s 2nd district with 75% single-family attached homes, and Maryland’s 7th district with 57%. The District of Columbia, at-large, with only 22% single-family detached homes, was ranked as the fourth highest share of single-family attached homes (43%).

Single-family attached homes have become popular as more home buyers are looking for “medium-density residential neighborhoods, such as urban villages that offer walkable environments and other amenities”, as mentioned in an NAHB blog post.

Median Home Value

The median value of owner-occupied housing units in the United States is $340,200, though it varies significantly across congressional districts depending on local housing supply and demand, property size, neighborhood, and overall economic factors. Coastal areas often have significantly higher median home values than rural regions.

Analysis of the 2023 ACS data shows that of the 14 congressional districts where median house value exceeds one million, 12 of them are in California. California’s 16th congressional district has the highest median home value of $1,820,400 among all congressional districts, with 81% of 159,895 owner-occupied housing units valuing more than one million dollars.

New York’s 12th and 10th congressional districts, with only 3% and 5% single-family detached homes, are the other two districts where median home value is over one million.

Additional housing data for your congressional district are provided by the US Census Bureau here.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.