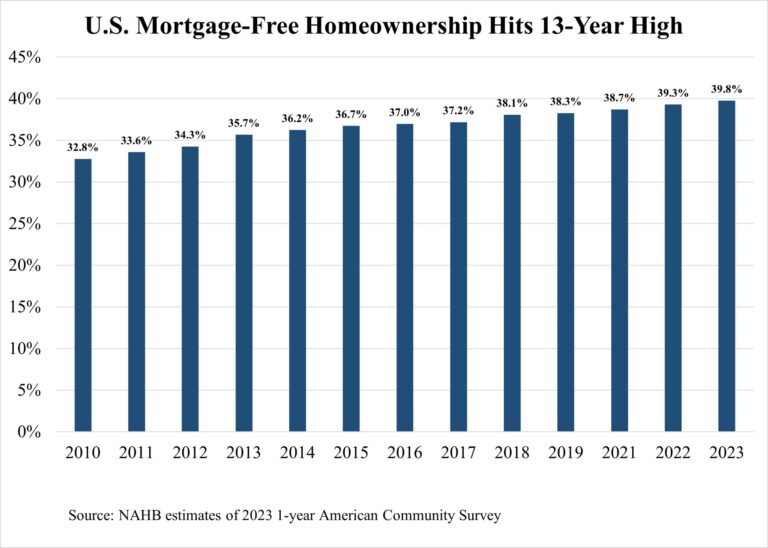

As of 2023, nearly 40% of homeowners in the United States are mortgage-free, the highest level seen in the past 13 years. With elections approaching, it is valuable to analyze the share of mortgage-free homeowners across congressional districts, as these patterns often provide insights into the local housing market as well as demographic shifts.

Both the number and the share of homeowners without mortgages have steadily increased since 2010, according to the 2023 American Community Survey. In 2010, around 32.8% of homeowners, or 24.5 million households, were mortgage-free. By 2023, this number had increased to 39.8% of homeowners, with 34.1 million homeowners having fully paid off their mortgages. Over the past 13 years, the share of mortgage-free homeowners has reached a record high level.

Older homeowners are more likely to have fully paid off their mortgages. In 2023, two-thirds of the mortgage-free homeowners are baby boomers aged 60 years and over. In contrast, only 5% of mortgage-free homeowners are under 35 years old, 8% are between 35 and 44 years old, 11.9% are aged 45 to 55, and 8.9% are between 55 and 59.

The share of mortgage-free homeowners varies substantially across the congressional districts. Districts with more affordable housing or a higher proportion of older populations tend to have a higher percentage of mortgage-free homeowners. The top 5 congressional districts for mortgage-free homeownership are primarily located in Southern states such as Texas, West Virginia, Kentucky, Mississippi, where lower housing costs or favorable weather attract older residents. As of 2023, Texas’s 34th district had the highest share of mortgage-free homeowners in the nation. Following closely, West Virginia’s 1st district had 61.2% of homeowners living mortgage-free, while Kentucky’s 5th district had a mortgage-free rate of 60.2%, Mississippi’s 2nd district had 58.7%, and Texas’s 29th district had 56.7%.

In contrast, districts with younger populations, higher levels of urbanization and less affordable housing tend to have lower shares of mortgage-free homeowners. The five congressional districts that struggle the most with low rates of mortgage-free homeowners include Maryland’s 5th district (20.8%), Virginia’s 10th district (22.6%), the District of Columbia’s Delegate District at Large (22.7%), Virginia’s 7th district (22.6%) and California’s 37th district (20.8%).

Additional housing data for your congressional district are provided by the US Census Bureau here.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .

The majority of renovating homeowners (57%) still opt for a

custom or semicustom vanity, though the share has decreased

5 percentage points year over year. Stock vanities, which are typically less expensive than custom options, are on the rise, selected by 31% of homeowners (up 5 points), while 7% opt for a ready-to-assemble option.

The most popular features of upgraded vanities are soft-close

drawers (78%) and soft-close doors (75%), followed by built-in

electrical outlets (29%) and built-in drawer organizers (22%).

When it comes to vanity width, a majority of homeowners (51%) choose a vanity that’s 48 inches or less, a notable jump of 10 percentage points year over year. The share of homeowners choosing a vanity wider than 72 inches dropped 6 points, to 12%, during the same period. Again, this aligns with homeowners likely making budget-conscious choices. Smaller stock vanities are often less expensive than larger custom vanities.