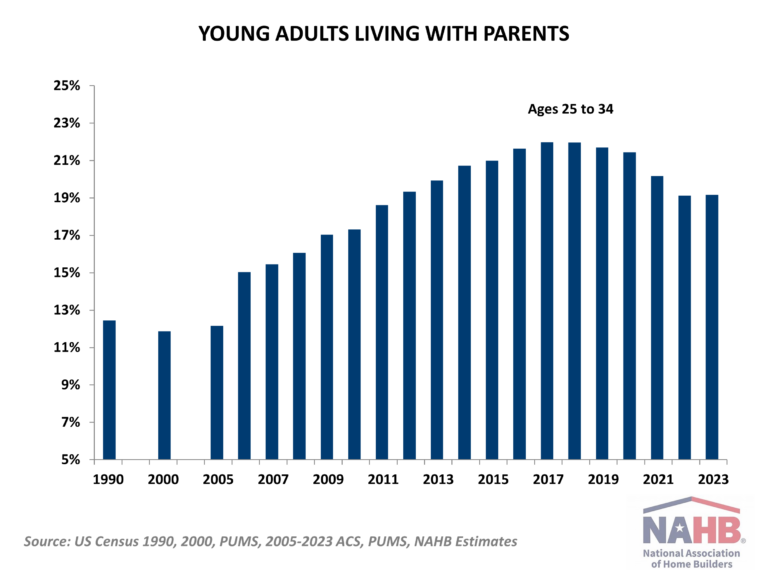

The worst on record rental affordability conditions, depleted “excess” savings of the pandemic era, and high mortgage rates halted the post-pandemic trend of young adults moving out of parental homes. The share of adults ages 25-34 living with parents or parents-in-law hovered just above 19% in 2023, stagnant from 2022, according to NAHB’s analysis of the 2023 American Community Survey (ACS) Public Use Microdata Sample (PUMS). While this percentage is the second lowest since 2011, the share remains elevated by historical standards. Regionally, Southern and Northeastern states register some of the highest shares of young adults remaining in parental homes.

Traditionally, young adults ages 25 to 34 make up around half of all first-time homebuyers. Consequently, the number and share of young adults in this age group that choose to stay with their parents, or parents-in-law, has profound implications for household formation, housing demand, and the housing market.

The current share of 19.2% translates into 8.5 million young adults living in homes of their parents or parents-in-law. In contrast, less than 12% of young adults ages 25 to 34, or 4.6 million, lived with parents in 2000. The share peaked in 2017-2018 at 22% when the ACS recorded over 9.7 million adults ages 25 to 34 living with parents.

While the national average share hovers around 19.2%, more than a quarter of young adults ages 25-34 remain in parental homes in California (26.5%), New Jersey (26.3%), and Hawaii (25.2%). Delaware (23.2%), Maryland (22.7%), Florida (22.4%) and New York (21.8%) are next on the list. At the opposite end of the spectrum are states with less than one in ten young adults living with parents. The fast-growing North Dakota records the nation’s lowest share of 5%, while the neighboring South Dakota registers 7%. In the District of Columbia, known for its relatively stable job market, less than 7.5% of young adults live with their parents. The cluster of central US states completes the nation’s list with the lowest percentages of young adults remaining in parental homes – Nebraska (8.4%), Iowa (8.5), and Wyoming (9.6%).

The elevated shares of young adults living with parents in high-cost coastal areas point to prohibitively expensive housing costs as one of the reasons for keeping young adults in parental homes. The statistical analysis confirms that states with higher shares of cost-burdened owners and renters living in unaffordable homes (i.e., paying 30 percent or more of income on housing) register higher shares of young adults living with parents. In particular, renters’ housing cost burdens explain half of the cross-state variation in the shares of young adults living in parental homes.

Multigeneration living, which is more prevalent among ethnic households, can also contribute to the elevated shares of young adults living with parents. This can be particularly relevant in the Southern states with higher shares of Hispanic households. However, the statistical analysis shows that while the correlation is positive, prevalence of Hispanic households does not carry any additional explanatory power once housing cost burdens are accounted for.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.