Today’s jobs report and the newly released preliminary estimate of the benchmark revision indicate that the U.S. labor market is slowing from its overheated state in 2021 and 2022 but remains stable. Among all sectors, construction led the August job gains, adding 34,000 jobs to payrolls.

Additionally, wage growth accelerated in August. Wages grew at a 3.8% year-over-year (YOY) growth rate, down 0.7 percentage points from a year ago. Wage growth is outpacing inflation, which typically occurs as productivity increases.

National Employment

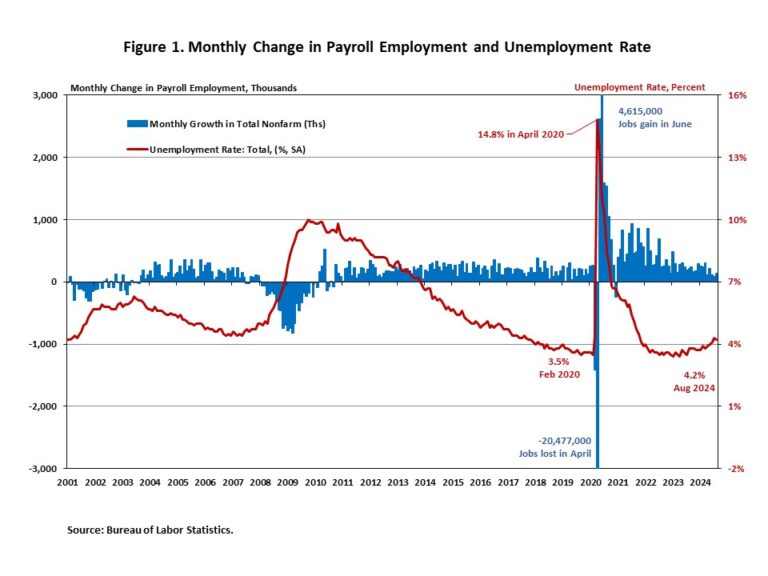

Total nonfarm payroll employment increased by 142,000 in August, following a downwardly revised increase of 89,000 jobs in July, as reported in the Employment Situation Summary. The estimates for the previous two months were revised lower. The monthly change in total nonfarm payroll employment for June was revised down by 61,000, from +179,000 to +118,000, while the change for July was revised down by 25,000 from +114,000 to +89,000. Combined, the revisions were 86,000 lower than the original estimates.

Despite restrictive monetary policy, about 7.9 million jobs have been created since March 2022, when the Fed enacted the first interest rate hike of this cycle. In the first eight months of 2024, 1,475,000 jobs were created. Additionally, monthly employment growth averaged 184,000 per month, compared with the 251,000 monthly average gain for 2023.

In August, the unemployment rate eased slightly to 4.2%, from 4.3% in July. The August decrease in the unemployment rate reflected the decrease in the number of persons unemployed (-48,000) and the increase in the number of persons employed (+168,000).

Meanwhile, the labor force participation rate—the proportion of the population either looking for a job or already holding a job—remained at 62.7%. However, for people aged between 25 and 54, the participation rate dipped slightly to 83.9%. This rate exceeds the pre-pandemic level of 83.1%. Meanwhile, the overall labor force participation rate is still below its pre-pandemic levels when it stood at 63.3% at the beginning of 2020.

For industry sectors, construction (+34,000), health care (+31,000), and social assistance (+13,000) had job gains in August, while manufacturing lost 24,000 jobs. Employment in other major industries showed little change over the month.

Construction Employment

Employment in the overall construction sector in August (+34,000) experienced an increase, from the 13,000 job gains in July. While residential construction gained 5,600 jobs, non-residential construction employment added 28,300 jobs for the month.

Residential construction employment now stands at 3.4 million in August, broken down as 951,000 builders and 2.4 million residential specialty trade contractors. The 6-month moving average of job gains for residential construction was 5,667 a month. Over the last 12 months, home builders and remodelers added 63,100 jobs on a net basis. Since the low point following the Great Recession, residential construction has gained 1,385,000 positions.

In August, the unemployment rate for construction workers declined to 3.9% on a seasonally adjusted basis. The unemployment rate for construction workers has remained at a relatively lower level, after reaching 15.3% in April 2020, due to the housing demand impact of the COVID-19 pandemic.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.