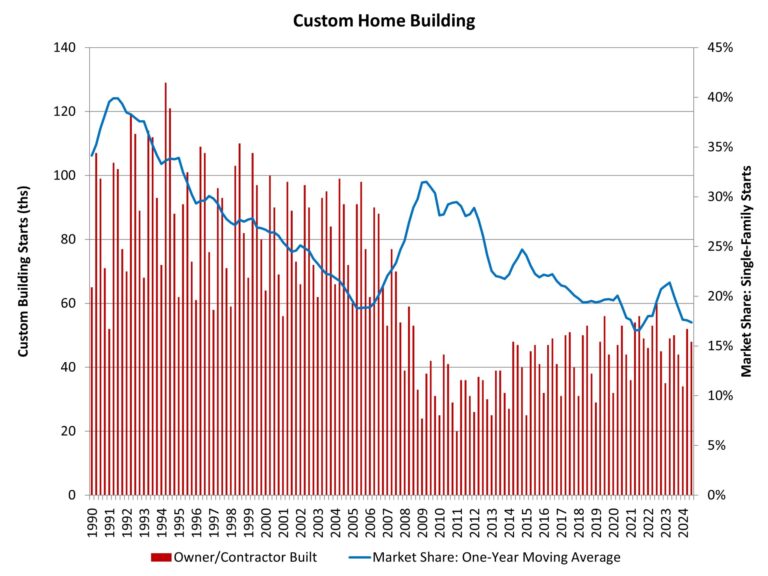

NAHB’s analysis of Census Data from the Quarterly Starts and Completions by Purpose and Design survey indicates relatively flat conditions for custom home builders after a period slight softening of market share due to declining mortgage interest rates. However, post-election stock market gains should support custom building at the end of 2024 and going into 2025.

There were 48,000 total custom building starts during the third quarter of 2024. This marks a 4% decline compared to the third quarter of 2023. Over the last four quarters, custom housing starts totaled 178,000 homes, just below a 1% decline compared to the prior four quarter total (179,000).

After share declines due to a rise in spec building in the wake of the pandemic, the market share for custom homes increased until 2023 and then entered a period of retrenchment. As measured on a one-year moving average, the market share of custom home building, in terms of total single-family starts, has fallen back to 17%. This is down from a prior cycle peak of 31.5% set during the second quarter of 2009 and a 21% local peak rate at the beginning of 2023.

Note that this definition of custom home building does not include homes intended for sale, so the analysis in this post uses a narrow definition of the sector. It represents home construction undertaken on a contract basis for which the builder does not hold tax basis in the structure during construction.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .