Before she put her Westford home on the market, Vicky Phillips did some math. With the four-bedroom home priced at $808,000, Phillips estimated it would cost her about $48,000 in commissions for a real estate agent to handle the sale.

Phillips decided to keep that money and sell the home herself. In May, she posted it on Picket Fence Preview, a website featuring homes that are for sale by the owner. She also paid a real estate agent $499 to offer the house on the multiple listing service, a system that shows all the properties for sale through brokers.

“It isn’t complicated,” said Phillips, who owns a business and noted that she has signed much more detailed contracts than the one she’ll use in selling her home.

She’s shown her home five times, a process that usually takes her about two hours, including tidying up. If she contracted with a real estate agent to handle the sale, that person would expect the standard 2 or 3 percent commission, as much as $24,000. If a buyer’s agent were involved, as is often the case, that person would take another 2 or 3 percent of the sale price.

“Real estate agents are great, but what are you paying for?” Phillips asked.

Questions like Phillips’ have roiled the real estate profession for years, and recently a rebellion of home sellers succeeded. In March, the National Association of Realtors agreed to pay $418 million in damages to settle a 2019 federal lawsuit that accused the organization of violating antitrust laws by adopting rules that created an industry-wide standard commission.

The settlement specifies that the NAR must drop rules that require the agent for the home seller to offer payment to the agent for the buyer. Those rules have resulted in the standard 5 to 6 percent commission being incorporated into the price of most homes for sale. Under the settlement, it will be easier for buyers and sellers to negotiate commissions with their real estate agents.

The settlement made national headlines, with some analysts predicting that the price of buying a home would drop significantly as a result of the decline in commissions.

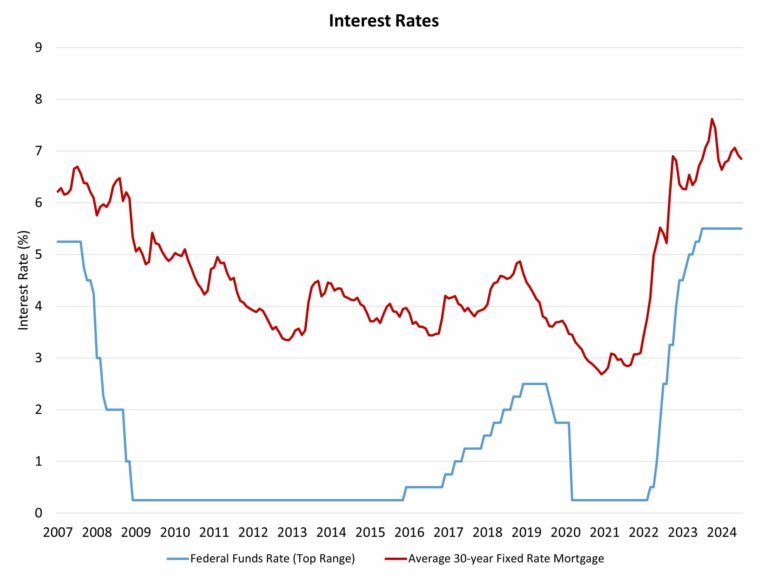

Smaller commissions would be good news for Vermont home sellers, but local experts say the soaring cost of buying a house is mainly the result of the spike in home values. The median price of a house sold in Chittenden County climbed by more than $100,000 between 2020 and last year, to $460,500. With the typical commission of 5 or 6 percent, someone selling that home would pay the agents involved as much as $27,000.

Many real estate agents insist the national settlement won’t change anything in Vermont. Local agents have always been up front with homebuyers and sellers about how much commissions would cost — and have always been open to negotiation, said Kathy Sweeten, CEO of the Vermont Association of Realtors.

“It’s not going to have a huge effect, because we already do this,” Sweeten said in an interview. That’s the position many of Vermont’s real estate agencies are taking, too.

“We’ve been doing business this way for many years now with our agency disclosures,” Four Seasons Sotheby’s International Realty CEO Laurie Mecier-Brochu said.

But home industry analysts say the settlement will likely free up consumers to bargain with agents for their services. The Consumer Federation of America, an advocate for nonprofit consumer groups, said that while negotiating has always been an option in theory, contracts are usually written by lawyers for local real estate associations. Under the existing system, many homebuyers are unaware they’re paying a commission of 2 or 3 percent to their agent, because it’s incorporated into the home seller’s fees and therefore into the price of the home.

Starting next month, buyers who hire an agent to show them homes will be asked to sign a contract spelling out what they will pay the agent if there is a sale, so the cost will not be hidden in the sale price of the home. The advocacy group said the settlement will create more freedom and transparency for agents and consumers.

Change won’t happen overnight.

“The residential real estate marketplace will take some time, perhaps several years, to fully process the implications of this settlement,” the Consumer Federation said in a statement after the NAR settlement was announced.

Not all agents are paid by commission. Some charge a flat fee — $3,500 is common — instead of a commission, using that transparency as a selling point. And there have always been homeowners such as Phillips who avoid commissions altogether by tackling home sales on their own.

Changes in technology are making that easier. Nowadays, websites such as Zillow and Redfin display the homes that are listed on the MLS, making them available online to anyone who knows how to look for them. When she was shopping for a house two decades ago, Phillips noted, the real estate agent would print off MLS listings and mail them to her, a cumbersome process that gave the agent control over which properties Phillips could consider.

Online listing services also help would-be home sellers see what similar properties are going for — and provide valuable information to buyers, such as how much the home sold for in the past.

“Before, you couldn’t really go on Zillow and find comparables and past histories and what the taxes were” for houses on the MLS, Phillips added.

Demand for homes is high in Vermont, making it a good time for sellers to try their hand at going it alone.

Before she put her Montpelier modular home on the market in May, Tammy Parish asked for advice on Front Porch Forum about selling without an agent. She got a flurry of responses from sellers who had done that — as well as several pleas from people who wanted to tour her home.

“My phone blew up. It was people giving me advice saying, ‘Yes, you can do it’ or ‘No, it’s more detailed than you think,'” said Parish, who added that she sold her home for $240,000 the following weekend to one of the people who had responded to her query.

Parish hired a lawyer to help with a contract, paying around $2,000, she said. A 5 percent commission would have set her back around $12,000.

“That’s a lot of money to give to someone else for putting pictures out there and marketing it,” she said.

Phillips said more than 25 agents have gotten in touch since she posted an ad for her Westford home on Front Porch Forum in May.

“They all want to represent me,” said Phillips, who thinks a lack of inventory and high interest rates may have created a very slow market for agents. She added that there are times when using an agent is essential. She’s looking for property in Asheville, N.C., where she’ll build her next home, and she said the agent alerted her that land prices were lower in a neighboring town because of a local paper mill.

“She said, ‘On the right day you don’t smell it, but on a bad day, not only do you smell it everywhere, the fumes are toxic,'” Phillips said. “Good advice.”

If more negotiations lead to lower commissions, as expected, some agents might leave the profession. The number of real estate agents licensed in Vermont jumped during the pandemic, reaching 3,072 last year — the most since the Secretary of State’s Office started keeping records in 2008. Right now, 2,843 people are licensed to sell real estate, according to the office.

It’s a tough way to make a living, according to Mikail Stein of RE/MAX North Professionals, who sells about 40 homes a year. Stein said his overhead is high and his hours are long. Income is unpredictable.

“Only in the last two years of my career have I had a winter where I wasn’t freaking out about where things were financially,” Stein said. “And hourly-wise, most people do way better than me.”

Stein thinks career professionals such as him will stay in the business, and if commissions drop, part-time, new or unskilled agents will be most likely to leave.

“I hope what it ends up doing is providing the public with better service,” he said of the NAR settlement. “For those of us who do bring high service, the compensation will be just. And for those who don’t, the market will say, ‘You’re not providing enough.'”

A Game-Changing Federal Case

The lawsuit

A group of Missourians who had used real estate agents to sell their homes filed a 2019 class-action lawsuit against the 1.5 million member National Association of Realtors and several multistate real estate brokerages. The suit alleged that the defendants had conspired to inflate real estate commissions paid by the homeowners.

The details

The lawsuit took aim at the NAR’s “cooperative compensation” rule, which requires the home seller’s agent to offer compensation to the agent for the buyer in order to add the home to a multiple listing service. The suit charged that the NAR, by controlling almost all the multiple listing services in the U.S., was wielding monopoly power to keep commissions artificially high.

The verdict

A federal jury in Missouri ruled for the homeowners in October 2023, awarding them $1.8 billion in damages. The NAR said it would appeal.

The settlement

Instead, in March, the NAR settled the case for $418 million in damages and an agreement to change some of its practices.

What will change?

Sellers’ agents won’t set the commission earned by the buyer’s agent. Instead, homebuyers will negotiate directly with those agents for their services. The changes are due to take effect in August.

What’s next?

In Vermont, analysts say it is too soon to predict what, if any, impact the settlement will have in the state. Prices are high, driven by a critical shortage of inventory and high demand.

“If I had to guess, I would say Realtors will become less powerful, and maybe there will be more fee-for-service” real estate transactions, said Jeff Lubell, a Norwich resident who works as a principal associate in housing policy for Abt Global, a consulting firm in Rockville, Md. “We’ll see different patterns in different places.”

An unintended consequence?

Some real estate companies and analysts say the settlement will hurt low-income homebuyers. Those buyers may not be able to afford to pay an out-of-pocket commission to their agent. Previously that commission was incorporated into the price of the home, and thus into the mortgage paid over time.

This article was originally published by a www.sevendaysvt.com . Read the Original article here. .