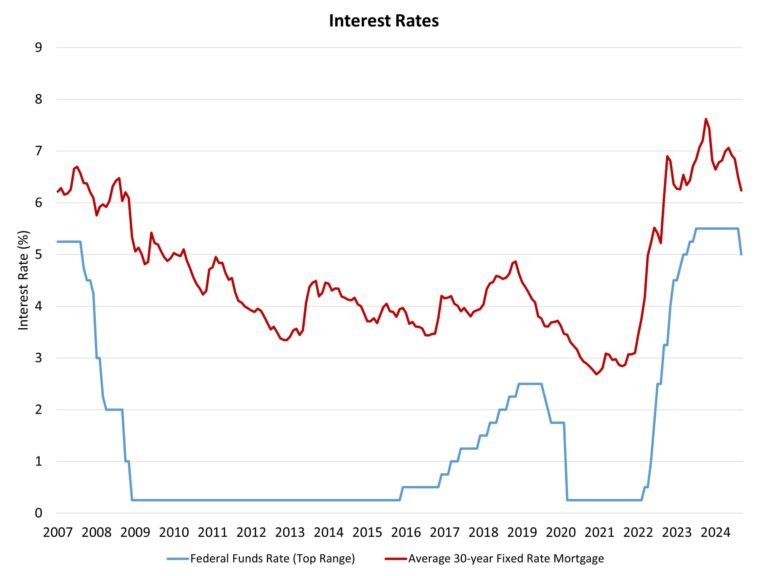

In a widely anticipated move, the Federal Reserve’s Federal Open Market Committee (FOMC) reduced the short-term federal funds rate by an additional 25 basis points at the conclusion of its December meeting. This policy move reduces the top target rate to 4.5%. However, the Fed’s newly published forward-looking projections also noted a reduction in the number of federal funds rate cuts expected in 2025, from four in its last projection to just two 25 basis point reductions as detailed today.

The new Fed projection envisions the federal funds top target rate falling to 4% by the end of 2025, with two more rate cuts in 2026, placing the federal funds top target rate to 3.5% at the end of 2026. One final rate is seen occurring in 2027. Furthermore, the Fed also increased its estimate of the neutral, long-run rate (sometimes referred to as the terminal rate) from 2.9% to 3%, which is reflective of stronger expectations for economic growth and productivity gains.

For home builders and other residential construction market stakeholders, the new projections suggest an improved economic growth environment, one in which there is a smaller amount of monetary policy easing, leading to higher than previously expected interest rates for acquisition, development and construction (AD&C) loans. Thus, more economic growth but higher interest rates.

The statement from the December FOMC summarized current market conditions as:

Recent indicators suggest that economic activity has continued to expand at a solid pace. Since earlier in the year, labor market conditions have generally eased, and the unemployment rate has moved up but remains low. Inflation has made progress toward the Committee’s 2 percent objective but remains somewhat elevated.

The Fed’s broader economic projections generally experienced positive revisions. The central bank lifted its forecast for GDP growth in 2025 to 2.1%. It sees the unemployment rate at 4.3% at the end of 2025, down from 4.4%.

However, the Fed also increased its inflation expectations. The central bank now sees 2.5% core PCE inflation at the end of 2025, up from its prior projection of 2.1%. While long-run expectations of the FOMC remained anchored at the 2% inflation target, the increase for the 2025 expectation for inflation is the reason for taking two rate cuts off the table for 2025, leaving just two remaining in the forecast.

Despite 100 basis points of easing for the short-term federal funds rate since September, long-term interest rates (which are set by markets and investors), including mortgage rates, have increased. This reflects market expectations of firmer inflation and a slower path for monetary policy easing. Policy concerns over government deficits and perhaps tariffs are also affecting investor outlooks. The size of the government deficit will be key for future inflation and long-term interest rates, particularly given a significant debate on taxes and government spending set for the start of 2025. And the slower path of monetary policy easing pushed the 10-year Treasury rate to 4.5%.

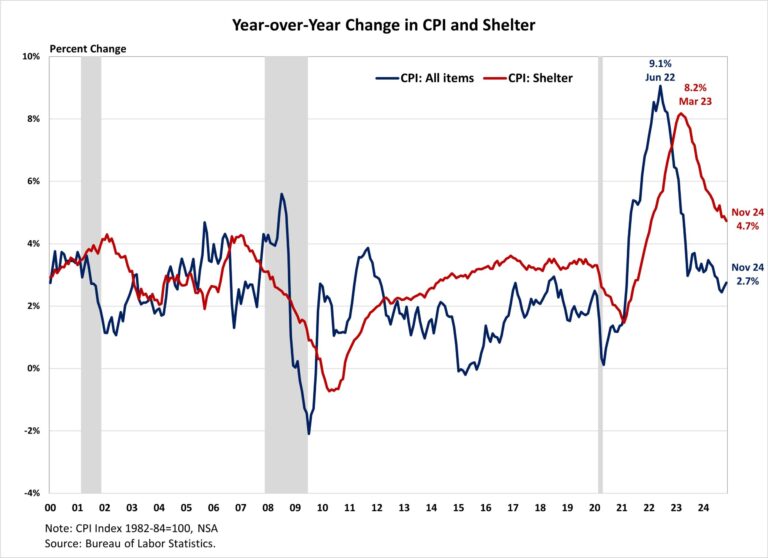

The pace of overall inflation is moving lower albeit slowly. Shelter inflation continues to be a driver of overall inflation, with gains for housing costs responsible for 65% of overall inflation over the last year. This kind of inflation can only be tamed in the long-run by increases in housing supply. Fed Chair Powell has previously noted it will take some time for rent cost growth to slow although it is moving lower. Given recent tight financing conditions, however, the Fed noted that while consumer spending is resilient, “…activity in the housing sector has been weak.” A slower path of Fed rate cuts for 2025 will keep builder and developer construction loan interest rates higher than previously expected and act as an additional headwind for gains in housing supply.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .