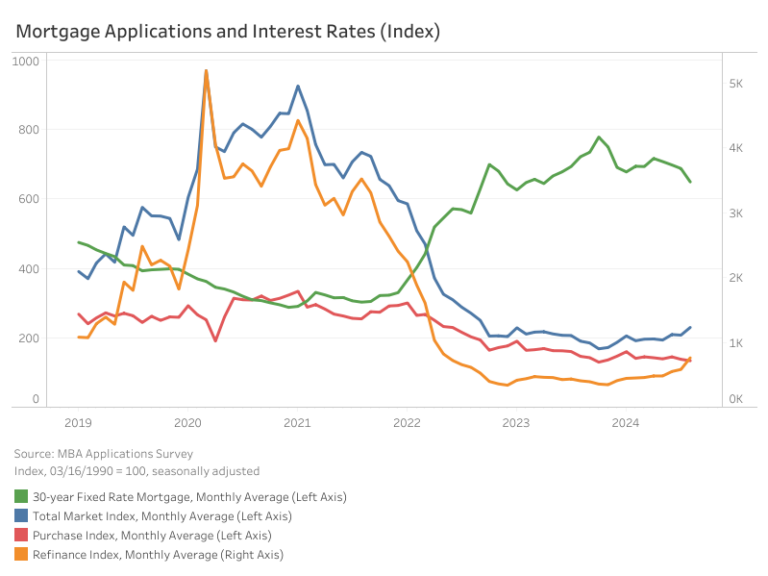

The Market Composite Index, a measure of mortgage loan application volume by the Mortgage Bankers Association’s (MBA) weekly survey, saw a month-over-month increase of 10.7% on a seasonally adjusted (SA) basis. Compared to last August, the index increased by 20.8%. While the Purchase Index declined by 2.9%, month-over-month, the Refinance Index jumped 30.8% as borrowers took advantage of the declining mortgage rates to refinance higher-rate loans. On a yearly basis, the Purchase Index is down by 8.6%, while the Refinance Index increased by 87.2%.

The average monthly 30-year fixed mortgage rate has fallen for four straight months with August seeing the largest decrease of 40 basis points (bps), bringing the rate to 6.49%. The current rate is 73 bps lower than last August.

The average loan size for the total market (including purchases and refinances) is up 3.6% from July to $380,800 on a non-seasonally adjusted (NSA) basis. Similarly, the month-over-month change for purchase loans increased 0.6% to an average size of $426,600, while refinance loans rose by 18.5% to an average of $325,800. The average loan size for an adjustable-rate mortgage (ARM) also saw a steep increase of 9.5% for the same period, from $1.01 million to $1.1 million.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .