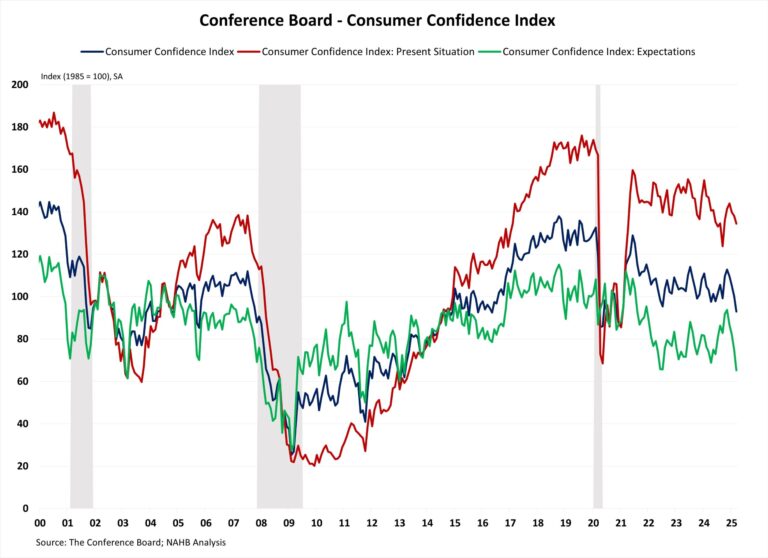

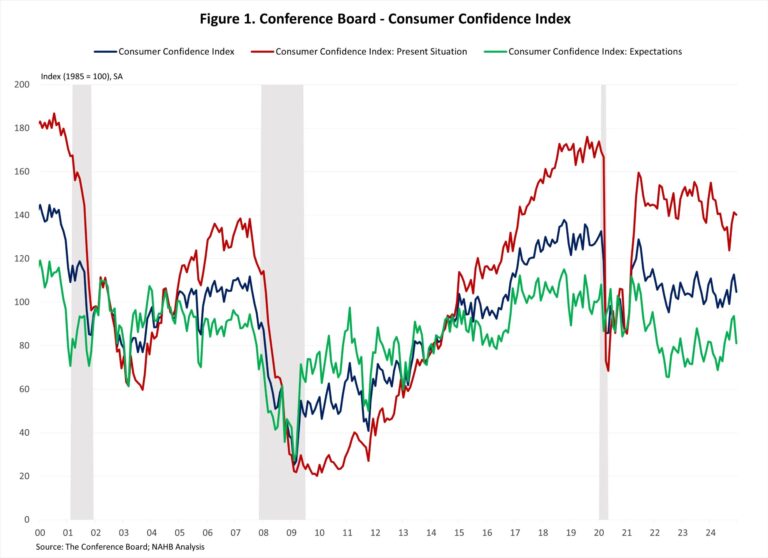

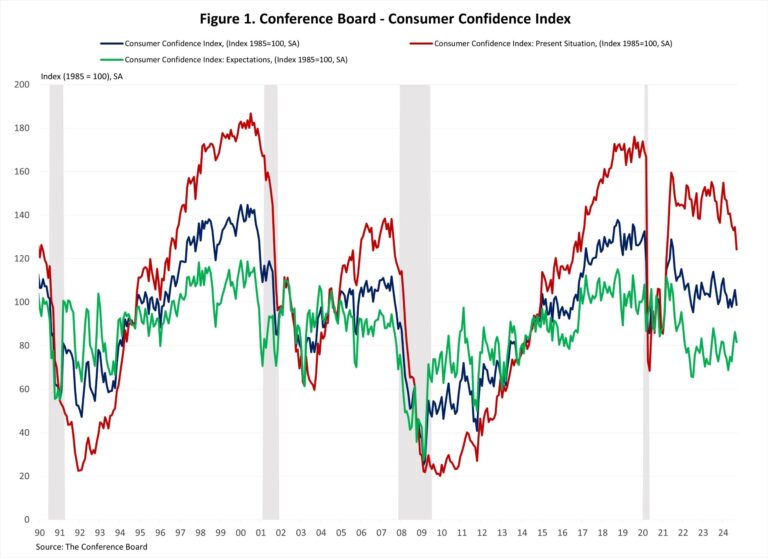

Consumer confidence fell for the fourth straight month amid growing concerns about the economic outlook and policy uncertainties, especially potential tariffs. Uncertainties continue to weigh on consumer sentiment as consumer confidence dropped to a 4-year low and expectations for the future economy fell to a 12-year low. The persistent decline in sentiment has raised recession concerns as consumers have grown pessimistic about economic conditions.

The Consumer Confidence Index, reported by the Conference Board, is a survey measuring how optimistic or pessimistic consumers feel about their financial situation. This index fell from 100 to 92.9 in March, the largest monthly decline since August 2021 and the lowest level since February 2021. The Consumer Confidence Index consists of two components: how consumers feel about their present situation and about their expected situation. The Present Situation Index decreased 3.6 points from 138.1 to 134.5, and the Expectation Situation Index dropped 9.6 points from 74.8 to 65.2, the lowest level since February 2013. This is the second consecutive month that the Expectation Index has been below 80, a threshold that often signals a recession within a year.

Consumers’ assessment of current business conditions turned negative in March. The share of respondents rating business conditions “good” decreased by 1.4 percentage points to 17.7%, while those claiming business conditions as “bad” rose by 1.8 percentage points to 16.7%. However, consumers’ assessments of the labor market improved slightly. The share of respondents reporting that jobs were “plentiful” remained unchanged at 33.6%, and those who saw jobs as “hard to get” decreased by 0.3 percentage points to 15.7%.

Consumers were pessimistic about the short-term outlook. The share of respondents expecting business conditions to improve fell from 20.8% to 17.1%, while those expecting business conditions to deteriorate rose from 25.5% to 27.3%. Similarly, expectations of employment over the next six months were less positive. The share of respondents expecting “more jobs” decreased by 2.1 percentage points to 16.7%, and those anticipating “fewer jobs” climbed by 1.9 percentage points to 28.5%.

The Conference Board also reported the share of respondents planning to buy a home within six months. The share of respondents planning to buy a home rose slightly to 5.4% in March. Of those, respondents planning to buy a newly constructed home increased to 0.5%, and those planning to buy an existing home dropped to 2.3%. The remaining 2.6% were planning to buy a home but undecided between new or existing homes.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .