The percentage of new apartment units that were absorbed within three months of completion rose from a decade low 42% to 53% in the first quarter of 2024, according to the Census Bureau’s latest release of the Survey of Market Absorption of New Multifamily Units (SOMA). The SOMA survey covers new units in multifamily residential buildings with five or more units. The absorption rate within three months for condominiums and cooperative units also rose over the quarter, up from 63% to 69%.

Apartments

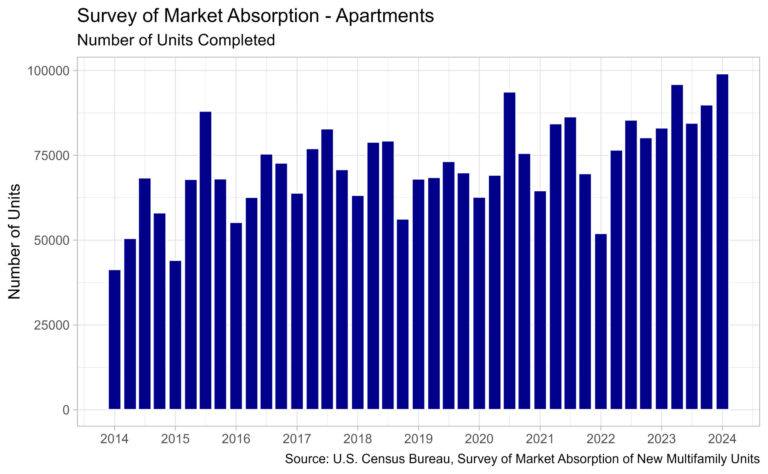

The percentage of apartments absorbed within three months has fallen significantly from its peak of 75% in the third quarter of 2021, as shown in the graph above. Currently, the rate stands at 53% which is coupled with an uptick in completions, as SOMA estimates show a historically high level of completions at 99,120 units in the first quarter of 2024. This is well above the level of completions a year ago, which stood at 83,140. The pace of multifamily units being completed has picked up, as many units under construction over the past year are reaching the market. Since the first quarter of 2022, completions have been above 75,000 for eight consecutive quarters, as seen in the graph below.

Additionally, SOMA reports absorption rates within six-months, nine-months, and 12-months of completion. The absorption rates for all time periods follow similar downward trends as the number of apartments has ticked upwards over the past two years. For apartments completed in the 4th quarter of 2023, the absorption rate within six months of completion was 71%, down from a peak of 88% in the third quarter of 2021.

For the nine-month period, the absorption rate of apartments completed in the third quarter of 2023 fell to 84% down from the previous quarter’s completions of 88%. This rate also peaked at 96% in the same quarter as the other periods, the third quarter of 2021.

Finally, apartment units completed in the second quarter of 2023 were 94% absorbed within a year following completion. The trend remains the same for the 12-month period as the other time periods, as it peaked in the third quarter of 2021 at 98%.

Condominiums and Cooperative Units

The absorption rate for new condominiums and cooperative units rose to 69% for the quarter. However, this was 10 percentage points lower than absorption rate of the same quarter last year.

Total completions of new condominiums and cooperative units, according to SOMA, fell to the lowest level since the first quarter of 2022 marking 3,312 completed units. Quarterly completions of these units peaked in the second quarter of 2018, at 7,996 completions.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .