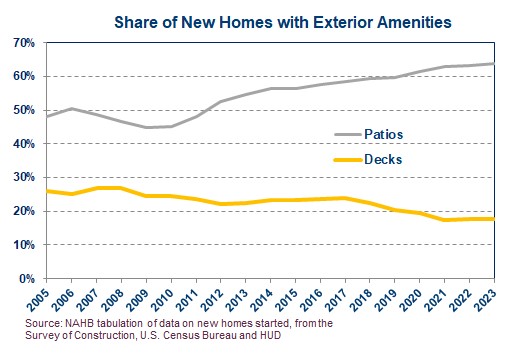

While the share of new homes with patios continues to climb, the share with decks has hovered at a historic low of under 18%, according to NAHB tabulation of data from the HUD/Census Bureau Survey of Construction (SOC).

Every year from the re-design of the SOC in 2005 through 2018, over 22% of single-family homes started featured decks. After that, however, the share dropped significantly, reaching a low of 17.5% in 2021. Since then, the percentage has remained near that trough, at 17.7% in 2022 and 17.6% in 2023. Moreover, this has been occurring at the same time the share of new homes with patios was climbing to a record high 67.7%. In fact, the tendency of deck and patio percentages to move in opposite directions is evident throughout the 2005-2023 period. The correlation between the percentages over that span is -0.84, suggesting that patios on new homes have been functioning as a substitute for decks. When more new homes have patios, fewer have decks.

New homes with both a deck and patio do occur but are comparatively rare. Among single-family homes started in 2023, fewer than 6% featured both a deck and a patio.

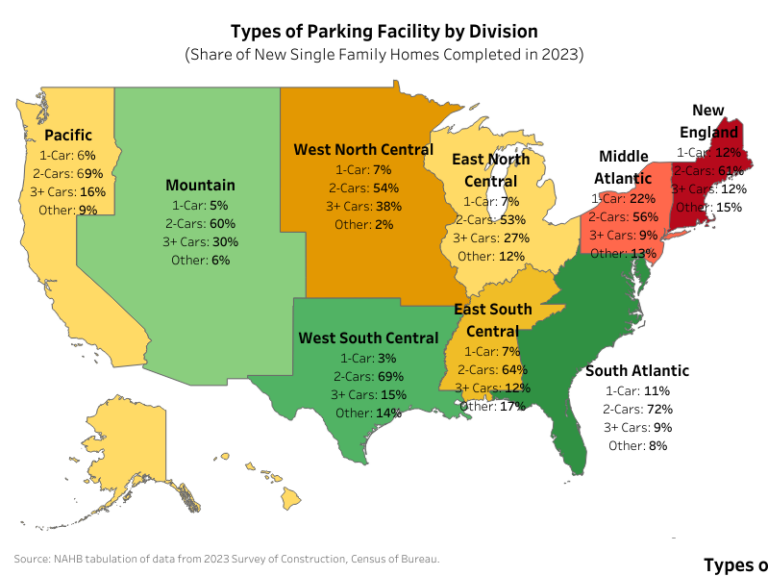

Decks have been more common not only when but where patios are less common. For example, among single-family homes started in 2023, patios were least common (featured ion only 17% of the homes) in the New England Census Division, the same division where a high of 76% of the homes featured decks. At the other extreme, in the West South Central a divisional high 81% of new homes featured patios in 2023, and a divisional low of 3% featured decks. Across all nine divisions in 2023, the correlation between the percentages of new homes with decks and patios was -0.82.

Nevertheless, decks remain relatively popular on new homes in some parts of the country. Following the 76% in New England at a distance, 42% of new homes featured decks in 2023 in both the Middle Atlantic and West North Central divisions.

More detail on new home deck construction is available from the Annual Builder Practices Survey (BPS) conducted by Home Innovation Research Labs.

Nationally, the 2024 BPS report (based on homes built in 2023) shows that the average size of a deck on a new single-family home is 284 square feet. Across Census divisions, the average size ranges from a low of 230 square feet in New England to a high of 382 square feet in the adjacent Middle Atlantic.

On a square foot basis, the BPS shows an evolving geographic split in the material builders use most often in deck construction. In the West North Central, South Atlantic, East South Central and West South Central divisions, treated wood remains the top choice. In the New England, Middle Atlantic, East North Central and Mountain divisions, composite material has moved ahead of treated wood; while in the Pacific Division, concrete edged out composite for the top spot. The Pacific is also the only division where redwood (a species that can be used outdoors without special pressure treatment) is relatively common in new home deck construction.

A previous post covered the characteristics of patios on single-family homes built in 2023.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .