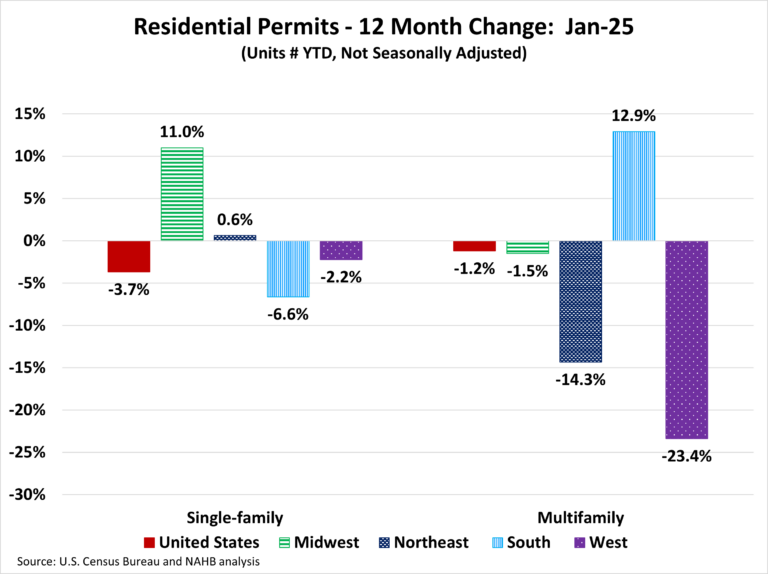

Permits are off to a lower level to start the new year. Over the first month of 2025, the total number of single-family permits issued year-to-date (YTD) nationwide reached 73,115. On a year-over-year (YoY) basis, this is a decline of 3.7% over the January 2024 level of 75,906. For multifamily, the total number of permits issued nationwide reached 38,402. This is 1.2% below the January 2024 level of 38,870.

Year-to-date ending in January, single-family permits were up in the Midwest (+11.0%) and the Northeast (+0.6%) but down in the two remaining regions. The West was down by 2.2% and the South was down by 6.6% in single-family permits during this time. For multifamily permits, three out of the four regions posted declines. The South was up by 12.9% but the West posted a decline of 23.4%, the Northeast declined by 14.3%, and the Midwest declined by 1.5%.

Between January 2025 YTD and January 2024 YTD, 26 states and the District of Columbia posted an increase in single-family permits. The range of increases spanned 525.0% in the District of Columbia to 0.1% in Utah. The remaining 24 states reported declines in single-family permits with Alaska reporting the steepest decline of 23.1% .

The ten states issuing the highest number of single-family permits combined accounted for 65.4% of the total single-family permits issued. Texas, the state with the highest number of single-family permits, issued 12,179 permits over the first month 2025, which is a decline of 4.2% compared to the same period last year. The second highest state, Florida, was down by 13.9%, while the third highest, North Carolina, posted a decline of 11.4%.

Between January 2025 YTD and January 2024 YTD, 22 states recorded growth in multifamily permits, while 27 states and the District of Columbia recorded a decline. In January 2024, Alaska issued zero permits and issued 9 multifamily permits in January 2025. Therefore, the growth rate for Alaska is undefined. The District of Columbia (+1,282.4%) led the way with a sharp rise in multifamily permits from 17 to 235, while Delaware had the biggest decline of 90.9% from 176 to 16.

The ten states issuing the highest number of multifamily permits combined accounted for 67.6% of the multifamily permits issued. Over the first month of 2025, Florida, the state with the highest number of multifamily permits issued, experienced an increase of 48.0%. Texas, the second-highest state in multifamily permits, saw a decline of 23.1%. New York, the third largest multifamily issuing state, decreased by 19.4%.

At the local level, below are the top ten metro areas that issued the highest number of single-family permits.

For multifamily permits, below are the top ten local areas that issued the highest number of permits.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .