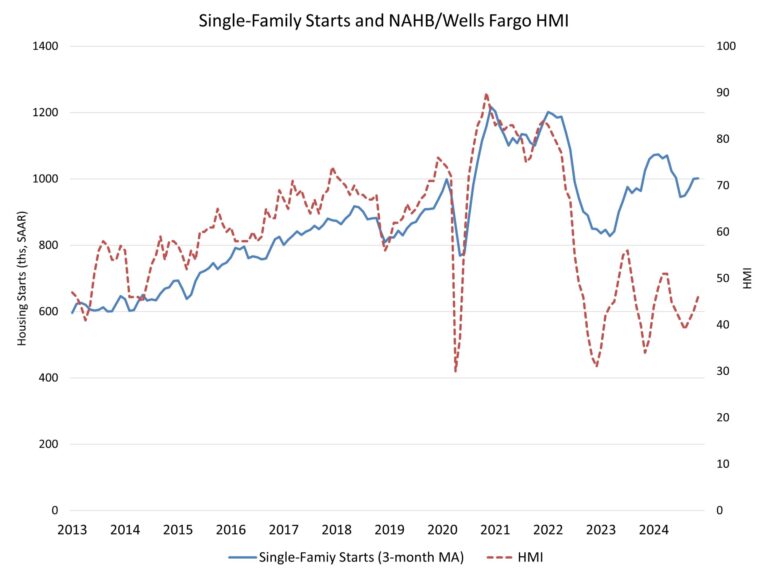

Ongoing lean levels of single-family existing home inventory helped to boost single-family production in November, while overall housing production fell because of a double-digit percentage drop in multifamily construction.

Overall housing starts decreased 1.8% in November to a seasonally adjusted annual rate of 1.29 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

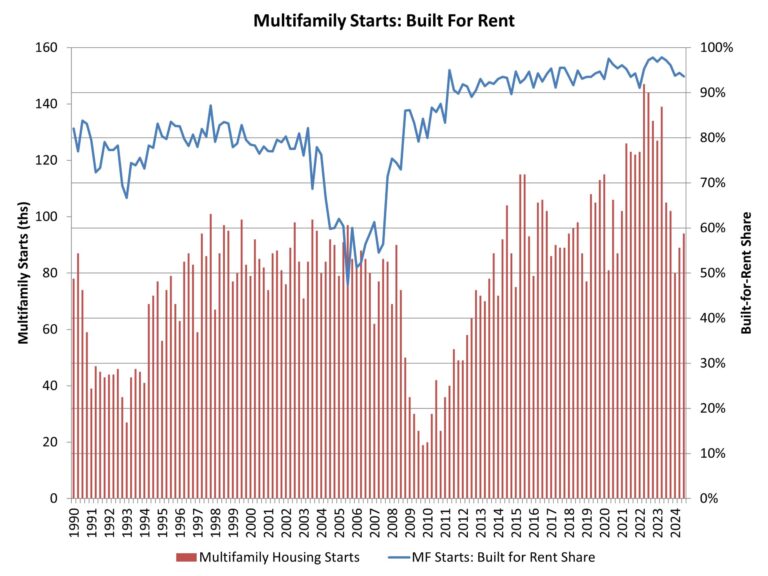

The November reading of 1.29 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts increased 6.4% to a 1.01 million seasonally adjusted annual rate. On a year-to-date basis, single-family construction is up 7.2%. The multifamily sector, which includes apartment buildings and condos, decreased 23.2% to an annualized 278,000 pace.

While the pace of single-family starts increased in November, single-family permitting was flat as builders face mixed market conditions that include an election result that promises a focus on regulatory relief, but ongoing elevated mortgage rates.

NAHB is forecasting single-family starts to post a slight increase in 2025 as the financing conditions for builders improve modestly. The significant decline for apartment construction is forecasted to end next year, with that market stabilizing during the second half of 2025.

On a regional and year-to-date basis, combined single-family and multifamily starts are 7.3% higher in the Northeast, 2.4% lower in the Midwest, 5.8% lower in the South and 5.9% lower in the West.

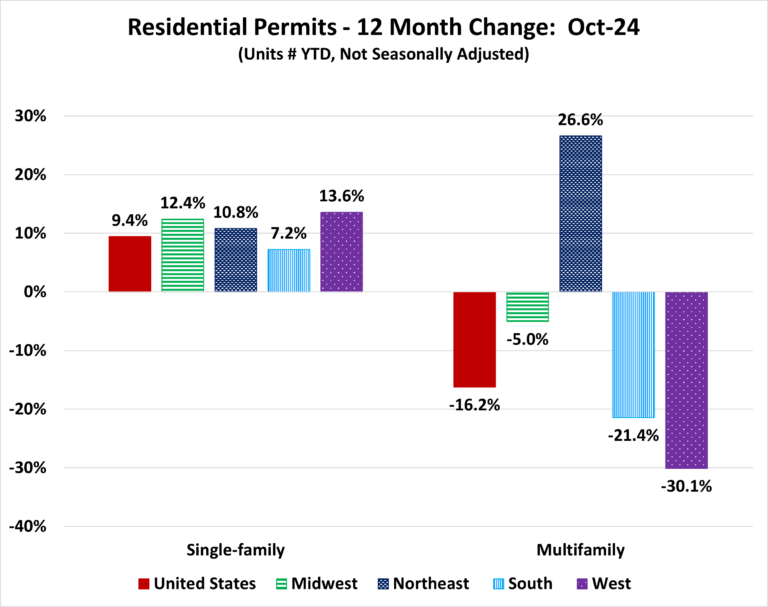

Overall permits increased 6.1% to a 1.51 million unit annualized rate in November. Single-family permits increased 0.1% to a 972,000 unit rate and are up 8.0% on a year-to-date basis. Multifamily permits increased 19.0% to an annualized 533,000 pace.

Looking at regional data on a year-to-date basis, permits are 3.2% higher in the Northeast, 4.8% higher in the Midwest, 2.5% lower in the South and 7.0% lower in the West.

The number of single-family units under construction is down 6.3% from a year ago, declining to 637,000 homes. The number of multifamily units under construction is down 20.5% from a year ago, to 797,000 units.

In November, there were two multifamily units completed for every one unit starting construction. Two years ago, there were just 0.7 multifamily units being completed for every 1 unit starting construction.

The count of multifamily units in 5-plus unit properties units completing construction of is up 36.1% on a year-to-date basis for 2024. In contrast, single-family completions are up 3.6% on a year-to-date basis.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .