Shares of new single-family homes built with private wells and individual septic systems decreased in 2023, compared with the previous year. NAHB tabulation of data from the Survey of Construction (SOC) indicates approximately 9% of new single-family homes started in 2023 were served by individual wells and 17% had private septic systems. There are large variations for these shares across the nine Census divisions with the corresponding shares reaching 26% and 38% in New England – the highest occurrence rates in the nation.

Nationally, 9% of new single-family homes started in 2023 were served by individual wells, with the majority relying on public water systems, which include community or shared supplies. In New England, where the median lot size is almost 3 times larger than the national average, 26% of new homes used private wells. Private wells were also common in the East North Central division, where nearly 22% of new homes had them. The Middle Atlantic division had the third-highest share at 14%. These divisions, along with the South Atlantic division (13%), surpassed the national average of 9%. Conversely, individual wells were rare in the East South Central and West South Central divisions, accounting for only a 1% share.

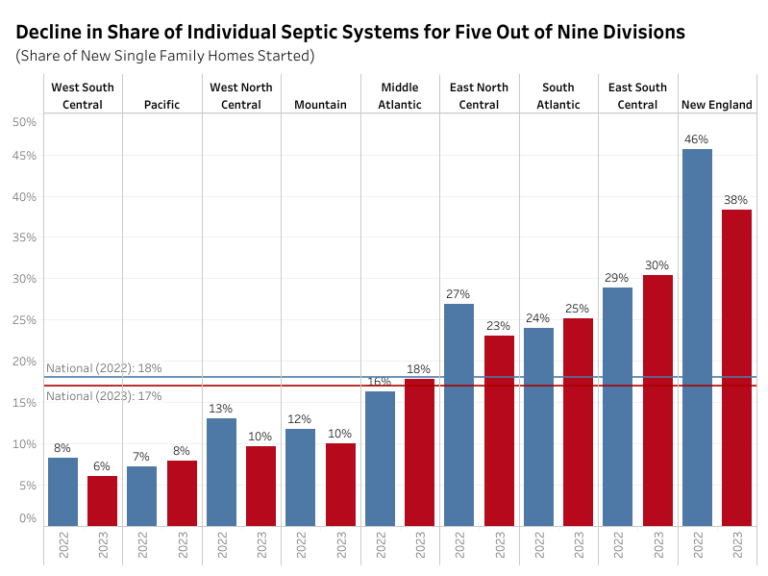

For sewage disposal, 82% of new homes were connected to public sewers (including community or shared sewage/septic systems) in 2023, and 17% utilized individual septic systems. The share of individual septic system decreased from 18% in 2022 to 17% in 2023.

The use of individual septic systems varied by division. In New England, 38% of new homes had private septic systems, while the East South Central, South Atlantic, and East North Central divisions reported 30%, 25%, and 23% shares, respectively. These shares, including the Middle Atlantic (18%), were above the national average of 17%. Shares were below average in the Mountain (10%), West North Central (10%), Pacific (8%), and West South Central (6%) divisions.

Compared to the previous year, the proportion of new single-family homes with individual septic systems fell in five out of nine divisions. Notably, New England saw a decrease from 46% in 2022 to 38% in 2023. Meanwhile, the Pacific, Middle Atlantic, South Atlantic, and East South Central divisions experienced slight increases, ranging from 1% to 2%.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .