Following two straight quarters of deceleration, house price appreciation accelerated slightly in the fourth quarter of 2024 due to the persistent high mortgage rates and low inventory. Although inventories of existing homes have improved from a year ago, the current 3.5-month supply remains below the 4.5- to 6-month supply that considered a balanced housing market.

Nationally, according to the quarterly all-transactions House Price Index (HPI) released by the Federal Housing Finance Agency (FHFA), U.S. house prices rose 5.4% in the fourth quarter of 2024, compared to the fourth quarter of 2023. The year-over-year rate has decreased from a high of 20.6% in the second quarter of 2022, but is higher than the previous quarter’s rate of 5.2%.

The quarterly FHFA HPI not only reports house prices at the national level but also provides insights about house price fluctuations at the state and metro area levels. The FHFA HPI used in this article is the all-transactions index, measuring average price changes in repeat sales or refinancings on the same single-family properties.

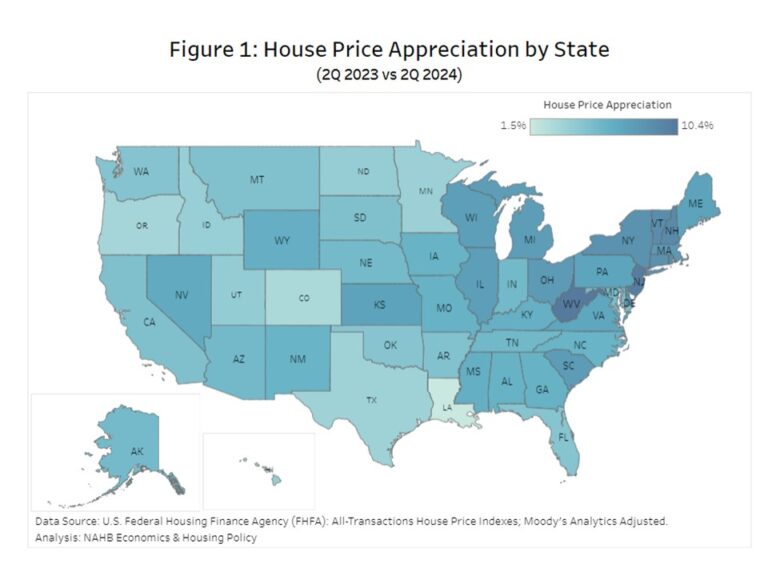

Between the fourth quarter of 2023 and the fourth quarter of 2024, 49 states and the District of Columbia had positive house price appreciation. Vermont topped the house price appreciation list with an 8.9% gain, followed by New Jersey and Connecticut both with 8.3% gains. At the other end, Louisiana had the lowest house price appreciation (+2.1%), while Hawaii was the only state to experience a price decline (-4.3%). Among all 50 states and the District of Columbia, 31 states reached or exceeded the national growth rate of 5.4%. Compared to the third quarter of 2024, 32 out of the 50 states had an acceleration in house price appreciation in the fourth quarter.

House price growth widely varied across U.S. metro areas year-over-year, ranging from -4.9% to +24.7%. In the fourth quarter of 2024, 18 metro areas, in reddish color on the map above, had negative house price appreciation, while the remaining 366 metro areas experienced positive price appreciation. Punta Gorda, FL had the largest decline in house prices, while Cumberland, MD-WV saw the highest increase over the previous four quarters.

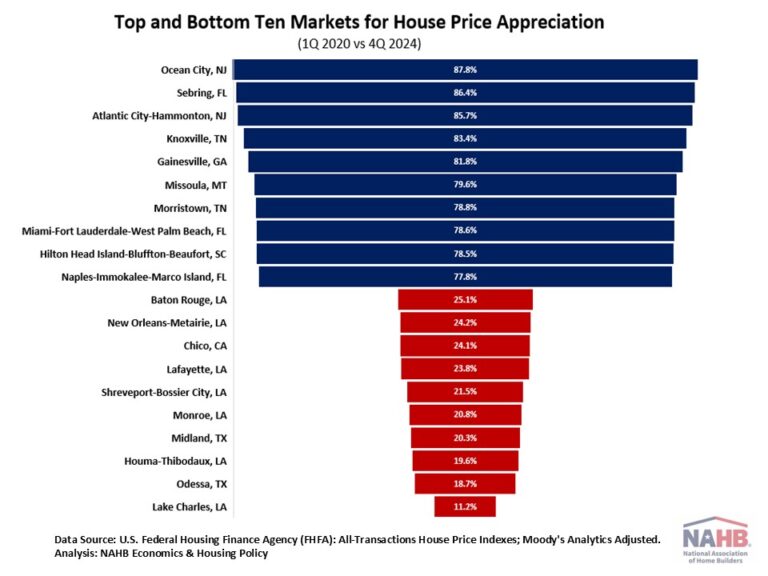

Additionally, house prices have increased dramatically since the COVID-19 pandemic. Nationally, house prices rose 53% between the first quarter of 2020 and the fourth quarter of 2024. More than half of metro areas saw house prices rise by more than the national price growth rate of 53%.

The table below shows the top and bottom ten markets for house price appreciation between the first quarter of 2020 and the fourth quarter of 2024. Among all the metro areas, house price appreciation ranged from 11.2% to 87.8%. Ocean City, NJ experienced the highest house price appreciation. Lake Charles, LA had the lowest appreciation for the third quarter in a row.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .