Stagflation: the combination of two of the worst economic conditions—inflation and slow/no growth. With stagflation, prices rise, asset growth shrinks, unemployment increases, consumer confidence drops, and economic pain spreads. This is the first time in almost fifty years that the US has had to deal with what is an extremely rare economic scare. And with the Fed already under immense pressure to lower rates, is the US economy out of escape routes?

Today, we’re talking about stagflation—a trend that has worried major economists for months. Economic “warning signs” are already flashing as recession and inflation risks grow. But if we get hit with stagflation, how bad will it be, how long will it last, and how will it affect real estate? I’m explaining it all today.

We’ll walk through what happened during the 1970s stagflation crisis, how home and rent prices were affected, what’s causing today’s stagflation risk, and whether the Fed has any power left to mitigate the worst consequences of it. This could affect every American and anyone investing in American real estate, but have my investing plans changed? I’ll tell you what I’m doing next.

Click here to listen on Apple Podcasts.

Listen to the Podcast Here

Read the Transcript Here

Dave:

The economy could be facing a one two punch of slowing growth and higher inflation in the coming months. And this particular dynamic is known as stagflation and it can put an economy into a really difficult spot. Today on the market, we’re diving into this important topic of stagflation, what it is, why there are new concerns about it, key warning signs to watch for, and what to do if it arrives. Hey everyone, it’s Dave head of Real Estate Investing at BiggerPockets. In addition to that job, I am also a housing market analyst. I’m an investor and a somewhat obsessive watcher of everything having to do with the economy. And as I’ve been doing that in recent weeks, I’ve seen a new trend develop. And this trend is really coming from people on both sides of the aisle and for many different backgrounds. And what I’m seeing is people talking about the prospects and risks of something called stagflation this term.

You may have heard it before, it’s been thrown around here and there, but fears of stagflation currently are on the rise. And although to be clear, we do not yet have evidence of stagflation. There are, in my opinion, enough warning signs going off that we should all be talking about this. Stagflation is one of those things that can be really, really detrimental to economy. It could set it back for years. And so if stagflation does actually arise, it’s going to impact the housing market and the day-to-day lives of almost all Americans. So I really encourage you all to pay a close attention here to this episode and this important issue. That said, let’s start off with the simple stuff. What is stagflation? Stagflation is the unfortunate combination of two negative economic conditions at the same time. High inflation and recession or slow growth, and you probably all know this, but either of those things, one of them on their own is bad enough, right?

No one wants inflation, no one wants slow economic growth. But those things sort of do happen in the normal course of business and economic cycles. But the combination of both things, both inflation and slow economic growth at the same time is particularly harmful to an economy in a couple of ways that may not be obvious, but in ways that we are about to discuss. So anyway, that is the definition, but let’s talk about why this actually matters. Typically in an economy, inflation and unemployment, which is one of the key markers of economic growth, are inversely correlated. That’s just a fancy term. That means that they move in opposite direction. So when inflation goes up, usually unemployment goes down. When inflation goes down, usually unemployment goes up. That is an inverse correlation. So normally, as part of the normal business and economic cycles that economies go through, there are periods where they have one of these things either high unemployment or high inflation from time to time.

But rarely do they have both. And this pattern that typically happens is called the Phillips Curve. If you want to do some of your own economic research after you listen to the episode or you want to be super uncool at your next party you go to, you can go check this out. But it is a real thing. It’s called the Phillips Curve, and it is not a rule. It does not always happen, but it describes a pattern that is very commonly, and this commonly seen relationship makes logical sense, at least to me. And it makes sense that it drives a lot of the business cycles of expansions, peaks, recessions, and troughs that we are all used to seeing. It goes a little bit like this when the economy is expanding, normal times things are growing, unemployment tends to go down, businesses are booming, they’re hiring more, so unemployment goes down.

Then when more people are working, wages start to go up because there is less labor available and businesses need to pay people more to retain them at their jobs. And this drives consumer demand. When people are earning more money, they tend to spend more money, and that ultimately leads eventually to higher inflation because when there’s more money flowing around the economy, there is more demand for the same amount of goods. That is one of several common ways that inflation starts, and this is a very common one. So in a nutshell, lower unemployment tends to lead to higher consumer demand, which can lead to higher inflation. Eventually in this cycle what happens is inflation gets bad and the Federal Reserve or the central bank of whatever government you’re talking about raises interest rates. This is one of the tools that they have to fight inflation, but unfortunately, the offshoot of fighting inflation is it pushes up unemployment.

As businesses scale back, people lose their jobs. That brings down demand and helps inflation get back under control. Then the Federal Reserve basically turns that knob back in the other direction. They lower interest rates to stimulate job growth and the cycle starts all over again. And this isn’t the most fun cycle. I wish that the economy could just grow forever without inflation or recessions, but this is just a common pattern observed in many or really all advanced capitalist economies. And frankly, up until the 1970s, the US basically worked in the cycle. This was pretty reliably how things worked. But then in the seventies, for the first time, at least that I have data for, it might’ve happened way back in the day before, we had good record keeping. Between 1973 and 1975, the US economy posted six consecutive of declining GDP. So there’s different definitions of recessions to me that is very clearly a recession.

And at the same time, during that long year and a half long recession, which is a long one, inflation tripled. So that was a really big dramatic period of stagflation. Exactly what we’re talking about. And remember, this is different from that cycle that I was just talking about. Normally you would see either these GDP declines or inflation, not at the same time. It usually takes some unusual set of geopolitical or economic circumstances for stagflation to arise. And I will spare you all the full economics lecture here, but a lot of things were happening in the 1970s that contributed to this. Some of them were oil shocks. There was loose monetary policy that arguably shouldn’t have existed, and that worsened inflation. We saw a lot of changes to fiscal policy like Nixon’s wage price controls. We went off the gold standard. The Vietnam spending was getting really dramatic.

And so all these unusual things combined to create this stagflationary environment, and I’m sure you probably all intuitively know this by now by the very fact that we’re talking about it, but this is a really bad situation because inflation eats away at your spending power as a consumer while slowing growth and rising unemployment decreases household incomes, it reduces business incomes and it just causes general economic pain. So the long and short of it is stagflation is bad for normal people and businesses alike. The big challenge here is not that it’s just bad, it’s that it’s hard to fix. There really aren’t many great ways to fix stagflation. Normally when something goes wrong in the economy, we turn to the Federal Reserve as one of several levers that we can pull to manage economic cycles. Congress controls fiscal policy while the Federal Reserve controls monetary policy, and they both tend to work together to try and sort out these economic issues.

The Fed is particularly relied on here because they’re the ones, their task, their job from Congress is to balance the seesaw of rising unemployment and rising inflation. Remember I said that works in a cycle. When unemployment goes up, inflation tends to go down. When unemployment goes down, inflation tends to go up. And so there’s this sort of natural balancing act that is required. And in the United States, the Federal Reserve is tasked with creating that balance. But stagflation in particular, you’re probably seeing, I think the challenge here is that stagflation puts the Federal Reserve in a really tough spot and it eliminates one of their tools, one of their only tools to try and fix the economy. Normally when inflation gets high, they raise interest because that will reduce overall demand, and yes, it will damage employment rates, but it will get inflation under control. But with stagflation, they may not want to do that.

They may not want to raise rates because they don’t want to make unemployment even worse or slow economic growth even further, which can happen with higher rates. Conversely, when unemployment is high, the Fed usually lowers rates to spur job growth, but they may not want to do that either for fears of increasing inflation even beyond where it is. So not only is stagflation sort of outside the normal economic cycle, it takes away one of our only tools for dealing with economic challenges. Just candidly speaking, the Fed, it doesn’t have that many tools for managing the economy in a lot of ways. It’s just this blunt instrument and stagflation makes it hard for them to use the few effective tools that they do have. And this issue, by the way, if you’ve been paying attention to what’s been going on in the news, this issue about putting the Fed in a tough spot is greatly contributing to the very public showdown that is going on between President Trump and the Fed Chairman Jerome Powell. We’ll get into that a little more later, but you may have seen Powell has publicly been saying that he thinks the Fed is getting boxed in right now, and he has fears of a Stagflationary environment and how that might limit his and the Fed’s ability to positively impact the economy. Alright, so that is our economics lesson and our history lesson for today. Let’s turn now to current day events and why the prospect of stagflation is rising right now. We’re going to get into that right after this quick break.

Welcome back to On the Market. Today we’re talking about stagflation and we’re going to turn the conversation now to current market conditions and why some prominent economists are raising the alarm about stagflationary risks. Remember we said stagflation is somewhat unusual, so it takes some non-normal economic conditions to create. And if you’re asking yourself what could be creating them today, you can probably guess it’s tariffs. And to be clear, no one knows what’s going to happen with tariffs and where they’re going to wind up. As of right now, we have 10% baseline tariffs, some huge tariffs on China. We have tariffs on steel and aluminum, but we don’t know exactly what’s going to happen from here with many of the countries that are negotiating trade deals with Trump, with automobiles. We don’t know exactly what’s going to happen and just remember that everything can change. But my best guess, at least as of now, because as investors we sort of need to make hypotheses and plan ahead, otherwise we’ll just be stuck doing nothing.

My best guess is that at least some level of tariffs will stay in place. Trump has been very clear that he believes in tariffs and he believes that any short-term economic pain that is endured by the implementation of his tariff regimen will be worth it in the long run. And I am going to take him at his word there and assume that at least some level of tariffs are going to stay in place even if they get lessened a little bit from that initial rollout. And the historical record basically shows that tariffs often lead to higher inflation and lower growth. Those, as you probably remember, are the exact two ingredients that get us to stagflation and even Trump, remember, even Trump and his team have acknowledged there could be this short-term economic pain as part of his plan to reconfigure global trade. And from the research I’ve done that economic pain will probably come in the form of slower growth and higher inflation, at least in the short run.

We don’t know if that will last forever, but at least in the short run, that’s what the data shows us. Now, there is only some limited data from the United States on tariffs since we haven’t had them in a very long time. But the best comparison we have is something called the Smoot Holly Tariffs. Those were enacted in 1930, and so this is a super long time ago. It’s a super different economy that looked very different than it was today. So you can’t take all that many conclusions from it, but it’s generally important to know that a very strong consensus among economists is that the tariffs really hurt. GDP hurt economic growth, unemployment shot up from lower export jobs and banking crises got worse due to a lot of trade instability. In addition to that, I was looking for more data to try and understand what happens after tariffs.

I looked at this one study, it’s called a meta-analysis. You may have heard of these things where they basically look at tons of different studies, try and draw big conclusions, and this one in particular looked at 151 countries from 1963 to 2014 that implemented tariffs and generally showed that they led to decreased output, basically lower GDP growth, lower economic growth. But it wasn’t some huge amount. It was a modest decline in GDP that they were able to measure. So if the tariffs stay, I think at least in the short term, medium term, I really can’t guess what’s going to happen in the long term, but at least in the short term, medium term, we’re likely to see lower growth. And just frankly, I don’t think tariffs are the only thing that could lead to slower growth. I think recession risk was high even at the end of last year.

We’re seeing things like lower consumer confidence. We’re seeing business spending start to decline. We’re seeing a lot of red flags start to signal. So all these things combined make me think that the prospect of a recession are relatively high. Now, let’s look at the other side, which is inflation. The logic here is that because of tariffs, US companies are going to be paying higher taxes. That’s what tariffs are, right? When US companies import goods from China or from any country that has a tariff on it, that company that’s importing the goods actually pays the tariff. That’s essentially just another form of taxes. And you got to believe that at least some, if not all of those costs are going to be passed on to consumers. And if that is what happens, then inflation is going to go up. That means consumer prices are going up.

That’s basically the definition of inflation, the consensus forecasts that I’ve seen. And when I say consensus forecast, it means I try and look at data from all sides of the aisle, from all kinds of different organizations, public organizations, private organizations. I look at all of them and I try and form a consensus of generally where people think things are going to go. And there is a pretty strong signal here that almost everyone, every study that I’ve looked at thinks inflation is going to go up, but it’s not that crazy. So Goldman Sachs, for example, predicted at the beginning of the year they were saying inflation would be about 2.1% this year. So essentially getting down to the fed’s target, they’ve revised that now and think it’s going to be 3%. So going up a little bit, Deloitte has gone from two to 2.8%. Fannie Mae has gone from 2.5 to 2.8%.

So generally, almost every study I saw, I think literally every study I saw, inflation expectations have gone up. But I haven’t seen a single forecast that thinks we’re going to see inflation in that 2021 or 2022 level or anything like that. It’s not saying we’re going to get to 5%. I haven’t seen that. I don’t think seven 9%, which is what we peaked at in 2021. So keep this all in perspective, but this combination of likelihood of recession and likelihood of inflation, both of them going up, is why stagflation is in the news right now. Tariffs have historically driven up inflation and they hurt growth. That doesn’t mean this is definitely going to happen. I want to make that clear. We need more time to get that data, but there is a logical reason why people are talking about stagflation, and I personally think it’s important to talk about as evidenced by the fact that you’re listening to this podcast right now, and I am talking about it now, if you want to try to quantify the risk of stagflation, which I do because I’m an analyst and I can’t help myself, most forecasters still think that stagflation is not the most probable outcome, at least in the next year.

Comerica projects a 35 to 40% chance of stagflation, assuming partial tariff, rollbacks, and fed rate cuts. So again, they’re saying those risks are less than 50%, assuming some partial tariff rollback and fed rate cuts, both of which are uncertain. And so we’ll see that happens. The University of Michigan model shows just a 25 to 30% probability while UBS raised their stagflation risk up to 20%, but they warn of basically unquote what they call a mini stagflation, not something that’s as dramatic as the 1970s. And in fact, I haven’t seen anything that suggests that stagflation could, if it does occur at all, could get to that 1970s level. Actually, what was kind of interesting to me was the most pessimistic group seems to be coming from Wall Street, actually, according to business insiders, 71% of fund managers expect global stagflation within 12 months, which is much more pessimistic than everything else that I’ve seen.

But if I had to sort of summarize what I’ve learned from some pretty extensive research into what experts think are going to happen here, it’s that stagflation risk is high. It’s probably the highest it’s been since the 1980s, but most still think that we’ll avoid those risks, right? That combination of things that I just said, although it may seem contradictory, both things can happen, right? We may have gone up from a 5% risk of stagflation to a 40% risk of stagflation, but since it’s 40%, it’s still not the most likely outcome that’s going to happen. And the other consensus I think I gained here is that even if it does happen, I again haven’t seen anything that suggests this big protracted 1970s style stagflation situation is likely it’s more likely to be short-term than what happened in the past. But again, I want to caveat that most of these assumptions are based on somewhat of the status quo.

And so if the Federal Reserve doesn’t cut interest rates, if Trump actually goes through with firing Jerome Powell, if he, instead of striking more deals with trade partners to lower tariffs, increases tariffs in the future, I don’t know if those things are going to happen, but if any of those things happen, at least to me, the risk of stagflation is going to go up a lot and may actually become the more probable outcome. But I think we have to wait and see if any of those things actually materialize over the next couple of months before updating what I think might happen next. But so far, we’ve mostly been talking about stagflation. In theory, we should be also talking about what this means for real estate and for real estate investors. And I’ll give you my take right after this quick break.

Welcome back to On the Market. We’re here talking about stagflationary risks in the economy, and I want to just share some thoughts about what this all could mean for real estate investors if stagflation occurs. And again, that is a big if right now. I’m not saying that’s going to happen. I just am here trying to educate everyone that there are risks that this can happen, what it is and how it could play out. So you’re prepared stagflation for everyone what it means. It means that it’s rough for almost everyone in terms of day-to-day living. As I said before, inflation takes away spending power while higher unemployment and slower growth bring down total economic output. It basically just squeezes consumers from both sides. And it’s not good. Hopefully it doesn’t happen, but if it does, hopefully it will be short-lived. Now, in terms of just going beyond just ordinary Americans, what does this mean for real estate investors?

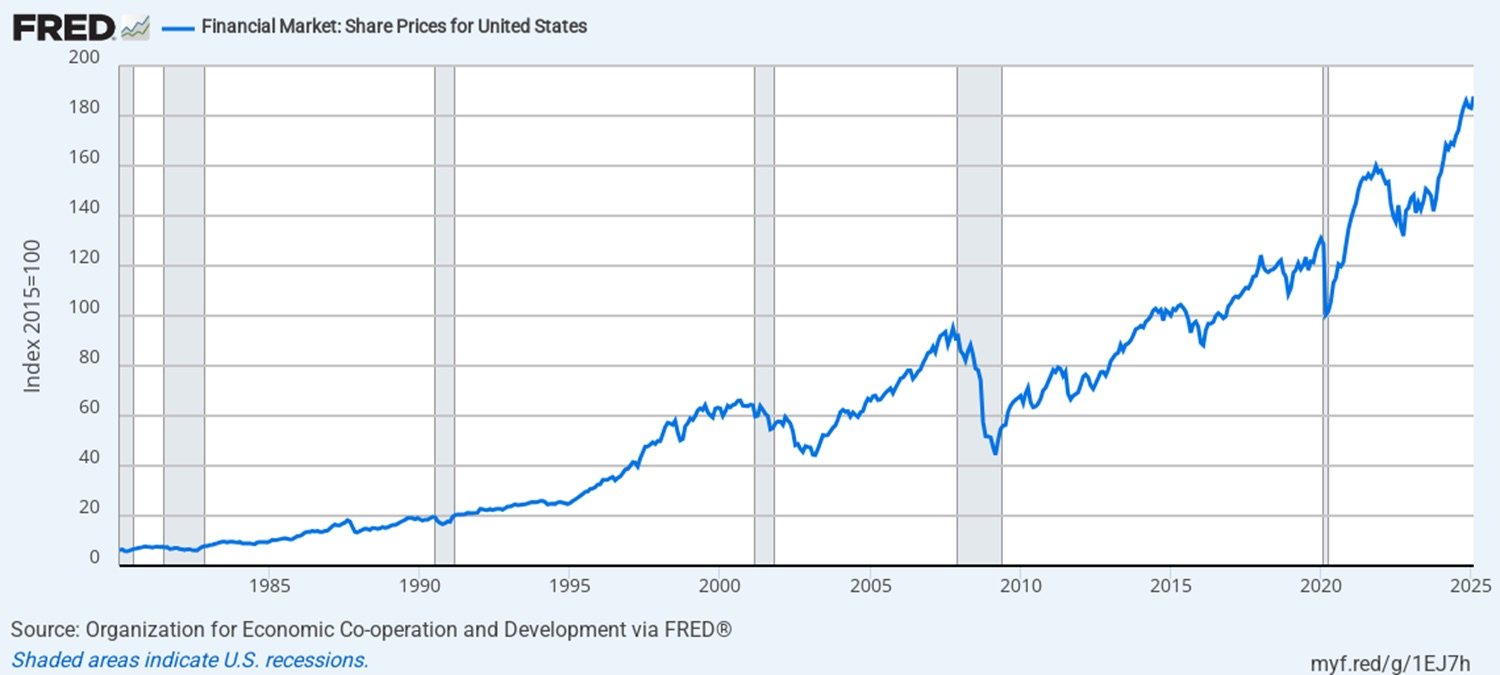

I did a bit of research into what happened to real estate and real estate investors in the 1970s during the last period of stagflation, and it’s pretty interesting. The general trend is that prices kept up with inflation in nominal terms. Now, remember we’ve talked about this before, but nominal means not inflation adjusted terms. So prices on paper kept up, which is good, but in inflation adjusted, which is also called real terms. So in real terms, it was uneven and there were often periods, extended periods of declines for housing prices as compared to inflation. And as investors, I think it’s kind of both good and bad. So during stagflation, a lot of assets performed badly. So in some ways you’re kind of looking for what performs the best out of a bad situation and seeing that real estate prices often keep pace with inflation means real estate served as a good hedge in a really challenging time.

And we’ve talked about this before on the show, that real estate tends to be a very good hedge, and that’s good news because even if things are bad, generally real estate can help you get through it. But on the bad side, we’ve gotten used to in the real estate market, seeing real positive returns, again, inflation adjusted positive returns. And during stagflationary periods, I think there’s a very high chance that that declines, which is obviously never an ideal situation and can impact your returns as an investor. So that’s mostly what happened just with housing prices. Again, that doesn’t have anything to say about what happens when you do value add or you do owner occupied strategies. That’s just looking at housing prices. The next thing that I looked at is rents, and it was actually much of the same thing. Rents grew a lot nominally, again, not inflation adjusted, meaning that they kept pace close to inflation, but real rent growth when adjusted for inflation was modest at best, and I wish I could tell you more than that, but rent data before the two thousands honestly is pretty scattered.

It’s not great and consistent, so it’s hard to get a super clear picture, and I don’t want to form conclusions that I don’t feel confident about, but this idea that rents grew a lot nominally, but real rent growth was modest, is kind of the best that I could come up with, but I feel pretty confident that is directionally what happened. All this to say is that stagflation didn’t prove to be some disaster for the housing market or for rental property owners in the 1970s. The returns were probably not as great as they were during other periods in the housing market for real estate investors. But real estate actually showed to be a good hedge against inflation and stagflationary pressures. And although there are many ways to measure it, it probably, at least according to my research, outperformed equities, the stock market as an asset class during that difficult time in the economy.

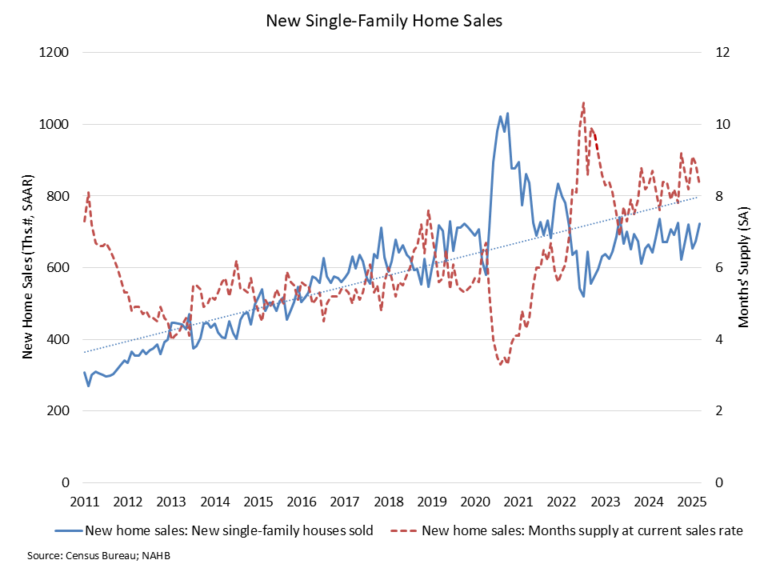

If stagflation comes again, we don’t know if real estate will behave in the same way, but understanding these historical trends does help. Some things that I was just thinking about that could make this potentially new stagflationary period different is just how housing prices, how unaffordable they have gotten relative to incomes. And the same thing with rent. We are in a period with just low affordability for housing prices and for rents. And since stagflation could make that worse, that could shift how the economy, how consumers, how the housing market reacts if stagflation does rear its ugly head. Now, all this to say, personally, I don’t think that this risk as of right now is going to change my strategy very much. I have been saying all year that I’m going to keep investing and I’m going to do that, but I’m going to do so very cautiously.

I am looking for really great standout long-term assets, things that I think are going to stand the test of time. I am not looking for anything that relies on short-term price gains, that relies on short-term rent growth. I’m not going to stretch myself or reach for any thin or risky deals because it’s just not worth it to me, given the uncertainty in the economy right now. I’m instead going to remain patient and opportunistic, and I think that deals will come along, this type of uncertainty. It does raise risk, absolutely do not get me wrong, but typically the way these things work is when there is more risk, there is more opportunity. And for investors who are willing to be patient and to really focus on finding those great long-term assets that will perform over several years, not over the next six to 12 months, you might be able to really set yourself up with some great assets to add to your portfolio.

So that’s my take. Just as a recap, I see why stagflation concerns are rising and I am concerned myself. I will be keeping a close eye on the data trends, and we’ll obviously keep you all posted too, but as of right now, I think it’s too early to say if stagflation will actually occur, and if so, how bad it might get for now. Instead, I encourage everyone to first and foremost stay informed. That is the most important thing you can do in these environment is to keep an eye on key economic data to learn about things like stagflation and what contributes to them. Secondly, I will encourage you to stay patient during this uncertainty and only go for strong obvious deals. And the third thing is just to continue to think long-term. Real estate has always been a long-term game, and right now there is a lot of short-term uncertainty, but investing for the long-term, at least to me, always makes sense. Thank you all so much for listening to this episode of On The Market. I’ll see you next time.

Watch the Episode Here

Help Us Out!

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

In This Episode We Cover

- Stagflation explained and why it’s becoming a greater risk in 2025

- Why the Fed may be out of options to fight stagflation and what’s causing it

- Reviewing the 1970s stagflation crisis and what happened to real estate prices then

- Inflation forecasts for 2025 and how much more prices could rise

- My current investing plan and how I’m looking at real estate if stagflation strikes

- And So Much More!

Links from the Show

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email [email protected].