Food, shelter, and healthcare are traditionally some of the most stable sources of employment and investment worldwide. While office spaces have undergone a fire sale in the wake of remote work, owners of large residential multifamily buildings have mostly been impervious to the same volatility. After all, rents have risen faster over the last few years than they have in decades.

With many single-family homes now out of reach due to increasing home prices and high interest rates, multifamily housing seemed like a safe bet. But according to new data, all that could soon change.

Rising Rates and Waning Demand

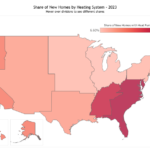

Can there be too much of a good thing? Apparently, yes. Developers and lenders were so bullish about multifamily housing, buoyed by migration from the Northeast and California to the Sunbelt and Midwest, that they embarked on an unprecedented building boom.

Half a million new apartments were added in the U.S. in 2023, the most in 40 years, with a similar amount slated for completion in 2024. According to the New York Times, analysts fear that up to 20% of all loans on apartment properties could be at risk of default. High rates and oversupply have seen rental rates fall in former Sunbelt hot spots.

Lenders Fear Defaults

Lenders have seen the storm clouds brewing and become skittish about lending money to projects—even when developers have already purchased the land—for fear of not getting them rented. Those who have already loaned are worried about what the future might bring.

The end result has been an increase in the time that developers take from buying and receiving permit approvals to starting construction to about 500 days, a 45% increase from 2019, according to property data firm Yardi Matrix.

According to the U.S. Census Bureau, multifamily building starts fell to an annual rate of 322,000 units in April, the lowest April rate since 2020. When buildings fail to get off the ground once the land has been purchased, developers are left holding the bag, eating up holding costs and investor patience, as has happened recently with an intended 104-unit development in Boise, Idaho.

Past-due multifamily loans have been on the increase. Loans at least 30 days past due or in nonaccrual status in the fourth quarter (2023) have risen to $3.46 billion, up 43.1% from the previous quarter and an 81.2% increase year over year, according to S&P Global Market Intelligence.

Despite this, multifamily lending is still quite far from a full-blown crisis. According to the Commercial Real Estate Finance Council, an industry association with members including lenders and investors, 1.7% of multifamily loans are at least 30 days delinquent, compared with roughly 7% of office loans and around 6% of hotel and retail loans.

A Perfect Storm of Increasing Costs

It would be easy to blame the problems facing multifamily housing on high interest rates alone, but that wouldn’t be entirely accurate. While some loans have defaulted when interest rates reset and some syndicated deals purchased with floating-rate mortgages have imploded, the overlying issues tend to be a combination of several factors. These include low occupancy, decreasing rents, and high expenses, including insurance costs, which have soared with extreme weather.

The aforementioned New York Times article mentions defaulted loans at the Reserve, a 982-unit complex in Brandon, Florida, near Tampa, as well as at Oaks of Westchase in Houston, a 182-unit garden-style apartment property, where, according to Mike Haas, the chief executive of data provider CRED iQ, “The spike in rates is causing the debt service costs on these properties to surge.”

However, lack of demand is also part of the equation. In 2019, 120,000 new apartment units became available across 19 major Sunbelt cities, absorbing 110,000 renters. Last year, there were only 95,000 renters for 216,000 new units.

“The developers just got so far out of hand,” said Jay Lybik, national director of multifamily analytics at CoStar Group, in the New York Times article. “Everybody thought the demand we saw in 2021 was going to be the way it was going forward.”

Smaller Banks at Greater Risk

The difference between residential assets and other types of commercial buildings is that multifamily units can be financed by lending from government-backed mortgage giants Fannie Mae and Freddie Mac, which Congress created to make housing more affordable. By the end of 2023, there were 49 banks with at least 5% of multifamily loans past due on their payments, Reuters reported. Most of these consisted of regional and community banks.

“Multifamily loans facing pressure include those that are rent stabilized, reliant on overly optimistic rental income increase projections, or in submarkets with elevated rental vacancy rates and/or excess supply, many of which are in Sunbelt states, particularly Texas, Florida, Tennessee, and the Carolinas,” Fitch Ratings said in its report earlier this year, upon which the Reuters article was based.

So far, smaller community banks with average assets of $1.3 billion face the greatest exposure. According to Fitch, nearly 40% of total multifamily loans in the U.S. banking system are held by 10 banks with many other assets. By comparison, the failed Silicon Valley Bank had $209 billion in assets, and JPMorgan, the country’s largest bank, has $3.3 trillion in assets.

Stated Fitch: “We expect any deterioration to play out for the banking sector over an extended period. During the Global Financial Crisis, losses did not peak until almost two years after a peak in delinquencies, and problem loans have yet to peak for the sector.”

Multifamily also has another built-in defensive shield: “If regional banks and large investment banks decide they’re not going to be making multifamily loans, then Fannie and Freddie will simply get more of the business,” Lonnie Hendry, chief product officer for Trepp, a commercial real estate data firm, told the New York Times. “It’s a fail-safe that the other asset classes simply do not have.”

Final Thoughts

Oversupply always leads to falling demand and lower prices. However, the results can be catastrophic when the compounding effect of increasing costs and high interest rates are added.

That doesn’t mean all rental housing is a bad investment because, as the evidence shows, rental real estate is one of the most proven forms of wealth building. However, the headwinds facing large-scale multifamily housing mean you should probably think twice about investing in REITs or syndications unless they have been purchased at a deep discount in a distress sale.

Depending on where you are on your investing journey, the safer play is probably smaller multifamily properties—at the right price or in an all-cash deal to be refinanced later—which would mean less financial exposure.

Ready to succeed in real estate investing? Create a free BiggerPockets account to learn about investment strategies; ask questions and get answers from our community of +2 million members; connect with investor-friendly agents; and so much more.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.