Nearly 1.3 million tax returns filed for tax year 2023 utilized the Residential Clean Energy Credit (25D tax credit), according to the latest IRS clean energy tax credit statistics. Through May 23rd of the 2024 tax filing season for 2023 returns, almost 138 million tax returns had been filed with the IRS, which indicates that 0.9% of returns filed utilized the 25D credit. Both 25C (Energy Efficient Home Improvement Credit) and 25D are claimed on Form 5695, as both are residential energy tax credits. A previous blog discussed the 25C credit, while this one focuses on the 25D credit. The two credits main difference is that 25C relates to improvements that make homes more energy efficient, while 25D is focused on investments associated with renewable energy in the home. The 25D credit is an annual credit that taxpayers may claim for investing in renewable energy for their residence, such as solar, wind, geothermal, fuel cells or battery storage technology.

The 25D tax credit allows home owners to claim qualifying residential clean energy expenditures made to their primary or secondary residence. Renters can also claim the credit for certain residential clean energy expenditures made to their residence while landlords cannot. Additionally, 25D can be applied to newly constructed homes as well as existing homes. The 25D credit amount is based on 30% of the clean energy expenditure and, unlike 25C, has no credit limit with one exception— the credit for fuel cell property expenditures is 30% up to $500 for each half kilowatt of capacity for the qualified fuel cell property. The 30% credit amount will fall to 26% in 2033 and 22% in 2034. Taxpayers can also include installation costs in the calculation of their credit amount. While the credit is non-refundable, taxpayers can carryforward the credit to reduce their tax liability in future years. Clean energy property must meet certain standards to qualify for the credit. For example, geothermal heat pumps must meet Energy Star requirements at the time of purchase.

Cost of Energy Property and Usage

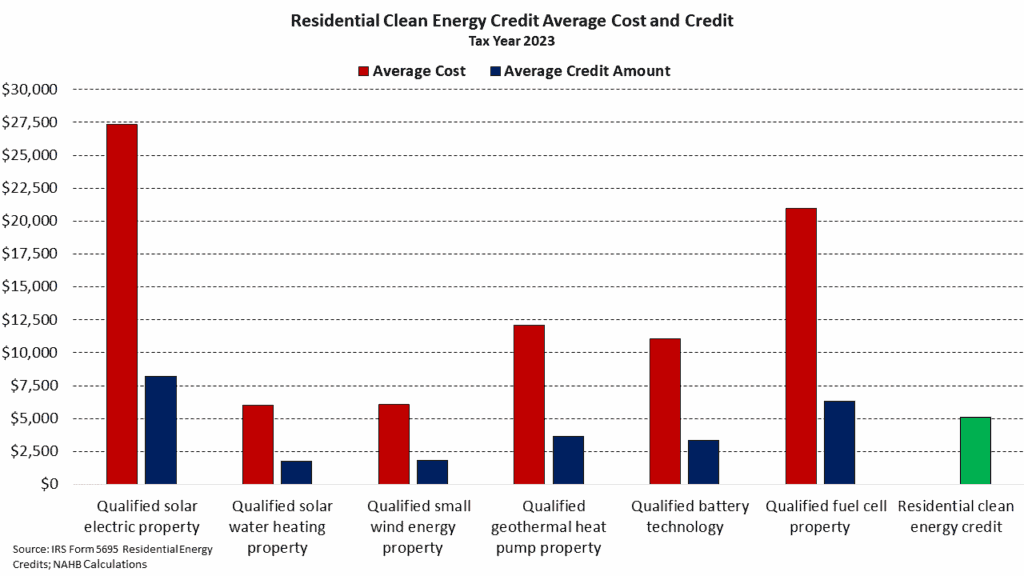

The recent IRS data indicates that the most expensive clean energy investment claimed in tax year 2023 was the purchase and installation of qualified solar electric property at an average cost of $27,355. Shown below are the average cost and average credit (30% of cost) across each investment, while the average credit amount across all returns that claimed 25D is shown in green at $5,084. While not shown below, the average credit claimed in 2023 that was carryforward from a previous year was $7,019 and the average credit carryforward to next year was $7,464. Both carryforward credits were higher than the average credit amount claimed in 2023.

Solar electric property was also by far the most frequently claimed investment at 752,300 returns. The next highest claimed investment was qualified solar water heating property, with 139,130 returns. No other improvement appeared on over 100,000 returns. The qualified improvement that was least claimed on tax returns was fuel cell property, with only 35,850 returns. Fuel cell property is the only expenditure subject to a cap.

Income and Geographic Differences

The Residential Clean Energy Credit is not subject to income limitations, meaning any taxpayer regardless of income can claim the credit on their tax return. The income level that most frequently claimed the credit was between $500,000 and $1,000,000 at 1.99%. Given the average cost of each improvement, it comes as little surprise that lower incomes claim the credit less frequently.

Geographically, the highest claim rate of the 25D tax credit was in Nevada, with 2.0% of returns claiming the credit. Florida had the second highest claim rate at 1.8%. The lowest claim rate was in North Dakota, at just 0.2%. Of note, higher usage rates of the 25D tax credit are found in states in the southwest, with Nevada (2.0%), Arizona (1.6%), Texas (1.6%), California (1.6%), and New Mexico (1.5%) all ranking in the top ten. This may be due to their significantly higher exposure to the sun, leading to higher potential benefits from installing solar electric property.

New Hampshire had the highest average credit amount at $7,581. This was $500 more than the second highest state which was Hawaii at $7,055. The lowest average credit amount was in Mississippi, at $2,248.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .