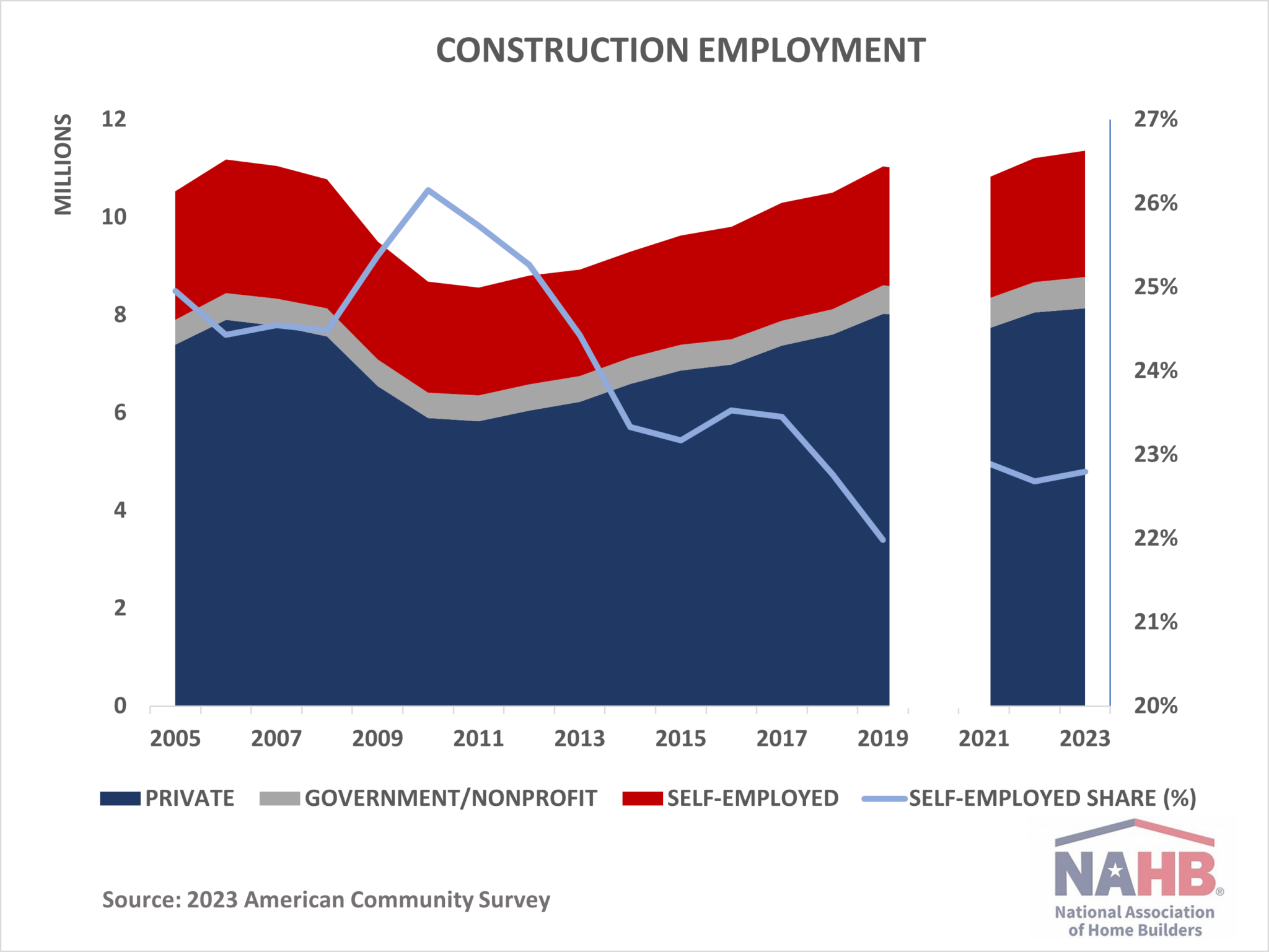

The share of self-employed in construction remains just under 23%, a new post-pandemic norm. While this is significantly higher than an economy-wide average of 10% of the employed labor force, for construction, these rates are historically low. Across the nation, construction self-employment rates range from 38% in Maine to 13% in Nevada.

As of 2023, close to 2.6 million of workers employed in construction are self-employed, according to the latest American Community Survey (ACS). While the industry’s payroll employment surpassed the historic highs of the home building boom of the mid-2000s, the number of self-employed remains below the peak of 2006 when over a quarter of the construction labor force was self-employed.

Declining self-employment rates in construction coincide with the declining share of tradesmen in construction and potentially reflect structural changes in the construction labor force, such as a shift towards larger construction firms that are better equipped to invest into new technologies and absorb higher overhead costs.

Partially, the downward trend in construction self-employment rates since the Housing Bust reflects the counter-cyclical nature of self-employment. Under normal circumstances, self-employment rates rise during an economic downturn and fall during an expansion. This presumably reflects a common practice among builders to downsize payrolls when construction activity is declining. In contrast, builders and trade contractors offer better terms for employment and attract a larger pool of laborers to be employees rather than self-employed when workflow is steady and rising. Potentially reflecting the counter-cyclical nature of construction self-employment, the current self-employment rates are 3.4 percentage points lower compared to the peak rate of the Great Recession.

For similar reasons, persistent labor shortages that plagued the industry during the last decade likely have contributed to the decline in self-employment rates. Ostensibly, to minimize construction delays, builders and trade contractors would be willing to offer better payroll terms to secure employees when finding experienced craftsmen is a challenge.

Since the 2020 ACS data are not reliable due to the data collection issues experienced during the early lockdown stages of the pandemic, we can only compare the pre-pandemic 2019 and post-pandemic 2021-2022 data (hence the omitted 2020 data in the charts above). As a result, it is not clear what accounted for the post-pandemic bump in self-employment. One answer is that self-employed workers in construction managed to remain employed during the short COVID-19 recession or recovered their jobs faster afterwards, compared to private payroll workers. Another possibility is that the booming residential construction sector attracted self-employed workers from other more vulnerable or slow recovering industries, including commercial construction.

Examining cross-state variation provides additional insights into construction self-employment rates. The New England states and Montana register some of the highest self-employment shares. In Maine, 38% of construction workers are self-employed. The share is similarly high in Vermont where more than a third of workers are self-employed, 36%. In Connecticut and Rhode Island, 28% of workers are self-employed. In Montana, the share is 30%.

The New England states are where it takes longer to build a house. Because of the short construction season and longer times to complete a project, specialty trade contractors in these states have fewer workers on their payrolls. The 2022 Economic Census data show that specialty trade contractors in Vermont and Maine have some of the smallest payrolls in the nation with five workers on average. Only contractors in Montana have smaller payrolls, averaging less than 5 workers. At the same time, the national average is over nine workers. As a result, independent entrepreneurs in New England and Montana tend to complete a greater share of work, which helps explain the high self-employment shares in these states.

The Mountain division has states with the highest and lowest self-employment rates simultaneously. Montana and Colorado, where more than a quarter of workers are self-employed, round up the list of states with the highest self-employment rates. At the same time, Nevada registers one of the lowest (13%) self-employment rates in construction and takes the place at the opposite end of the list. Only Washington, DC has a lower share of self-employed, 9%. The substantial differences likely reflect a predominance of home building in Montana and Colorado and a higher prevalence of commercial construction, that has larger payroll employment and, presumably, relies less heavily on self-employed.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .