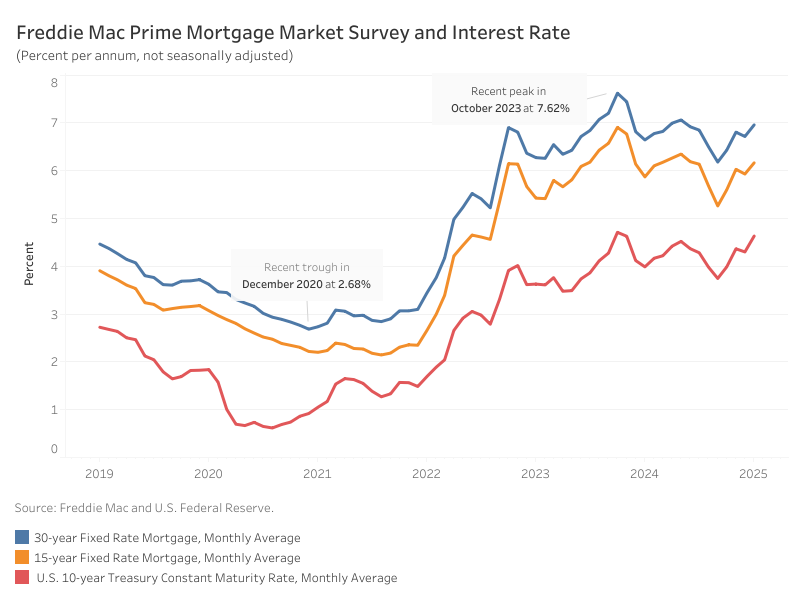

Mortgage rates edged higher in January, with the average 30-year fixed-rate mortgage reaching 6.96%. Rates had been climbing steadily since mid-December—even surpassing 7%—before easing in recent weeks as the bond market stabilized following news that President Donald Trump postponed tariffs plans to February 1.

According to Freddie Mac, the average rate for a 30-year fixed-rate mortgage rose 24 basis points (bps) from December, extending a two-year trend of fluctuations between 6% and 7%. Meanwhile, the 15-year fixed-rate mortgage increased 23 bps to land at 6.13%.

The 10-year Treasury yield, a key benchmark for mortgage rates, averaged 4.63% in November—33 basis points higher than December’s average. A strong economy, coupled with ongoing uncertainty over inflation due to tax cuts and tariffs, continues to put upward pressure on yields. This uncertainty is also reflected in the increased range for the projected 2025 core PCE inflation in the December FOMC economic projections, now estimated between 2.1% and 3.2%, compared to a narrower 2.1% to 2.5% range in September.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .