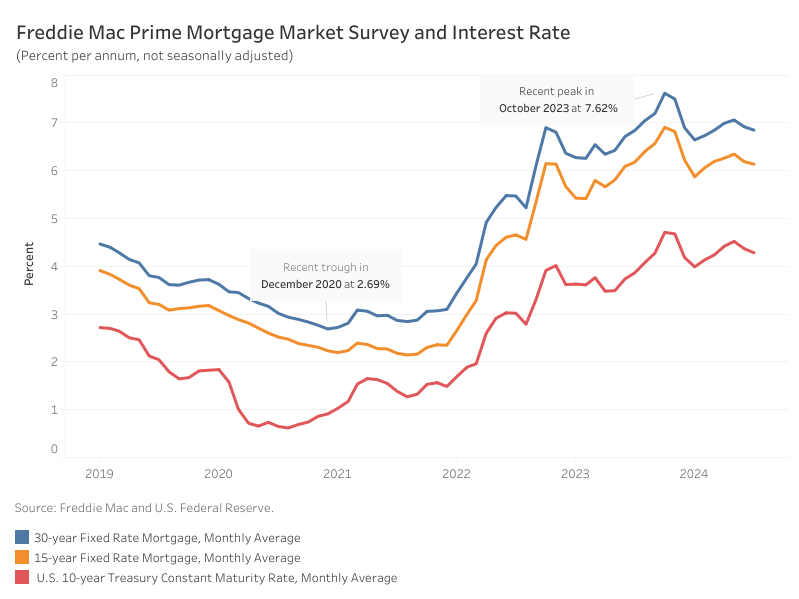

Mortgage rates continued to decrease in July, landing at an average rate of 6.85%. According to Freddie Mac, the average monthly rate fell by 7 basis points (bps) from June’s rate of 6.92%. This current rate is nearly identical to the rate from one year ago, which stood at 6.84%.

The 15-year fixed-rate mortgage also saw a decrease, dropping by 5 bps from June to 6.14%, and is now lower compared to last July by 4 bps. Additionally, the 10-year Treasury rate declined 9 bps from 4.37% in June to 4.28%.

Per the NAHB forecast, we expect 30-year mortgage rates to decline slightly to around 6.66% at the end of 2024 and eventually to decline to just under 6% by the end of 2025. The NAHB outlook anticipates the federal funds rate to be cut by 25 bps no later than the December Federal Reserve meeting and six more rate cuts in 2025 as inflation approaches the Fed’s policy target.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .