Like you, I have definitely considered the following question: stocks or bonds? Which option is best for diversification?

Investing can be the best way to grow wealth, secure your financial future, and plan your retirement. But with numerous investment options available, it can be very hard to navigate the markets to determine which wealth-building engine is the right fit for you.

I will explore the pros and cons of investing in stocks or bonds, which are among the most common ways to diversify your real estate portfolio. However, I recommend you consult with your financial advisor before making any of these investments.

Stocks

Stocks, or equities, are securities that represent ownership of a fraction of the issuing company. Shares represent units of ownership in a corporation or financial asset owned by investors who exchange capital in return for these units. When you buy a stock, you become a shareholder and own a small piece of the company.

Stocks, like bonds and real estate, can provide great returns over the long term, but they can also be extremely volatile short term. Here are some pros and cons to consider:

Pros of stocks

- Higher returns

- The S&P 500’s average return over the past decade has been around 10.2%, just under the long-term historic average of 10.7% since the benchmark index was introduced 65 years ago.

- According to a study done at NYU, the historical returns for stocks have been between 8% and 10% since 1928. The historical returns for bonds have been lower, between 4% to 6% since 1928.

- Dividend-paying stocks

- Dividends represent a payment by a company, typically made on a quarterly basis, to its shareholders from income generated by the business.

- Dividends, when reinvested, can significantly boost total returns over time, making dividend-paying stocks an attractive option for older investors close to retirement and younger investors just starting out building their financial foundation.

Cons of stocks

- Higher Risk

- You guessed it: Higher return potential = higher risk.

- Stocks are riskier than bonds, generally speaking, simply due to the fact that they offer no guaranteed returns to the investor, unlike bonds, which offer fairly reliable returns through coupon payments.

- Dividends aren’t guaranteed, unlike the interest payments from Treasuries. Companies can trim or slash their dividends at any time, a risk that came true in 2020 after 68 of the roughly 380 dividend-paying companies in the S&P 500 suspended or reduced their payouts.

Bonds

Bonds are issued by governments and corporations when they want to raise money. By buying a bond, you’re giving the issuer a loan, and they agree to pay you back the face value of the loan on a specific date, paying you periodic interest payments along the way, usually twice a year.

Once the bond reaches maturity, the bond issuer returns the investor’s money. Fixed income is a term often used to describe bonds, since your investment earns fixed payments over the life of the bond.

Pros of bonds

- Low risk

- Bonds are backed by the U.S. Treasury, which has never defaulted on its debt, meaning you’ll almost certainly get your interest payments on time and receive back your principal at the end of your ownership. The regular income can be helpful for investors who need the money for day-to-day expenses. Or, you can reinvest the earnings if you don’t need the money right now.

- Regular income that’s sometimes tax-free

- If you purchase municipal bonds from a local, city or state government, you often won’t have to pay federal income taxes on the earnings. Depending on where you live, you also might be able to avoid local and state income taxes. Income from federal bonds is often exempt from local and state income taxes, but still taxed at the federal level.

Cons of bonds

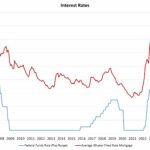

- Values drop when interest rates rise

- The value will drop if interest rates increase. Someone won’t want to pay you $1,000 for a bond that pays 4% when they can get a new bond that pays 5% instead. Conversely, if interest rates drop, your bond’s value might increase. The effect of interest rate changes on a bond’s value is also called interest rate or market risk.

- Yields might not keep up with inflation

- The risk is that rising prices will decrease the value of the fixed income you receive from the bond. Even if inflation rates don’t drastically climb, the compounding effect of inflation on prices can be significant over a period of 20 to 30 years.

- Some bonds can be called early

- You might not think of getting paid back early as a risk, but that’s exactly what “call risk” describes. Often, this happens when interest rates fall. Although lower rates might increase your bond’s value, the issuer isn’t buying the bond from you; it’s simply paying off the debt early. The bond issuer might turn around and issue a new bond for a lower rate to save money. But now you’re stuck with the cash and likely can’t find an equally safe way to earn the same amount of interest.

Diversifying Your Portfolio With Bonds and Stocks

The short answer to the “stocks or bonds” question is to have both in your portfolio. Both stocks and bonds are far more passive in nature than any real estate venture you will pursue. Having a healthy share of each investment engine will only positively impact your ability to weather a storm in a certain market and mitigate a lot of risk through diversification.

Personally, I do not have any holdings in bonds and have always had less than 5% of my investments in bonds. I certainly hold a greater equity position compared to real estate and stocks, but it wasn’t always this way! Right now, I have close to 95% of my investments in real estate and only about 5% in stocks. Before I was a real estate investor, my splits were closer to 90% stocks and 10% bonds.

These splits will continue to fluctuate as I save up for my next down payment using the stock market to grow my capital, and I have a more recent uptick in my stock holdings due to the end goal of converting it into capital for real estate. As time passes, I will certainly reevaluate my risk tolerance and would likely favor a more passive, safe revenue stream like the offerings of high-dividend stocks and bonds.

Reach Your Financial Goals, Faster

Connect with a real estate friendly financial planner who can help you get started and build for the future.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.